go.bsky.app/TZKw6S2

go.bsky.app/TZKw6S2

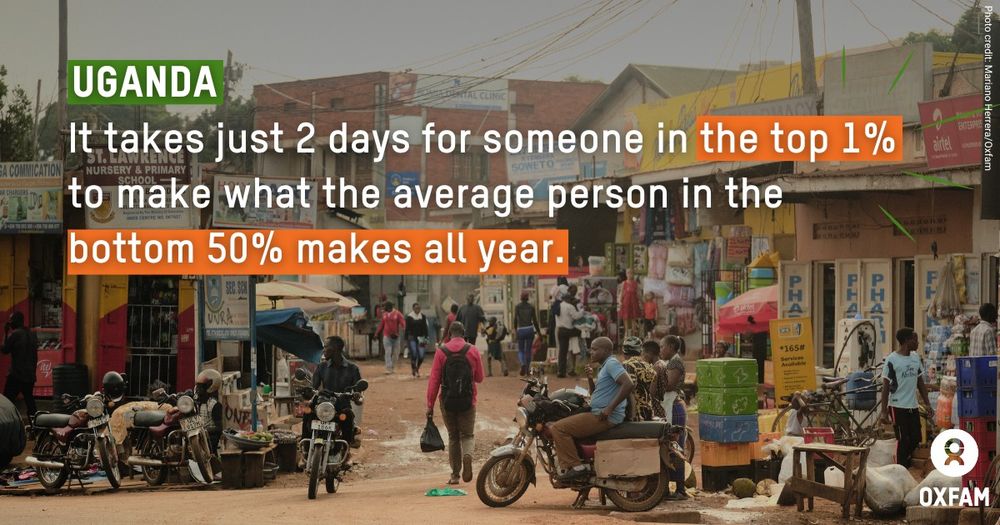

Countries that support this reform are up against scandalous tactics from OECD countries.

This post from our partner organisation explains it very well:

taxjustice.net/press/world-...

Countries that support this reform are up against scandalous tactics from OECD countries.

This post from our partner organisation explains it very well:

taxjustice.net/press/world-...