FTSE listed companies are most likely to headquarter in London, and much less likely to headquarter in Birmingham, for example.

FTSE listed companies are most likely to headquarter in London, and much less likely to headquarter in Birmingham, for example.

One explanation is agglomeration - i.e. larger labour markets pay more. But we find that doubling a labour market’s size lifts pay by only 3.9 per cent, explaining just 24 per cent of the place premium.

One explanation is agglomeration - i.e. larger labour markets pay more. But we find that doubling a labour market’s size lifts pay by only 3.9 per cent, explaining just 24 per cent of the place premium.

Move an average worker from Dudley to Harrogate and they pocket an extra £1,300 a year (~5 per cent).

Move an average worker from Dudley to Harrogate and they pocket an extra £1,300 a year (~5 per cent).

Is this because high‑earning areas attract inherently higher‑earning people, or because the jobs located there pay more to any worker?

Our new @resfoundation.bsky.social report finds out.

Is this because high‑earning areas attract inherently higher‑earning people, or because the jobs located there pay more to any worker?

Our new @resfoundation.bsky.social report finds out.

Exports of non-ferrous metals to the US (aluminium, copper, and *precious metals*) are up 1,358% since Feb 2024.

This isn't a global trend: exports to the RoW fell 50% since Feb 2024.

Exports of non-ferrous metals to the US (aluminium, copper, and *precious metals*) are up 1,358% since Feb 2024.

This isn't a global trend: exports to the RoW fell 50% since Feb 2024.

In 2019, $24bn worth of UK motor vehicle value added ended up in the US via supply chains.

That’s 22% of ALL Britain’s motor vehicle output.

In 2019, $24bn worth of UK motor vehicle value added ended up in the US via supply chains.

That’s 22% of ALL Britain’s motor vehicle output.

obr.uk/efo/economic...

obr.uk/efo/economic...

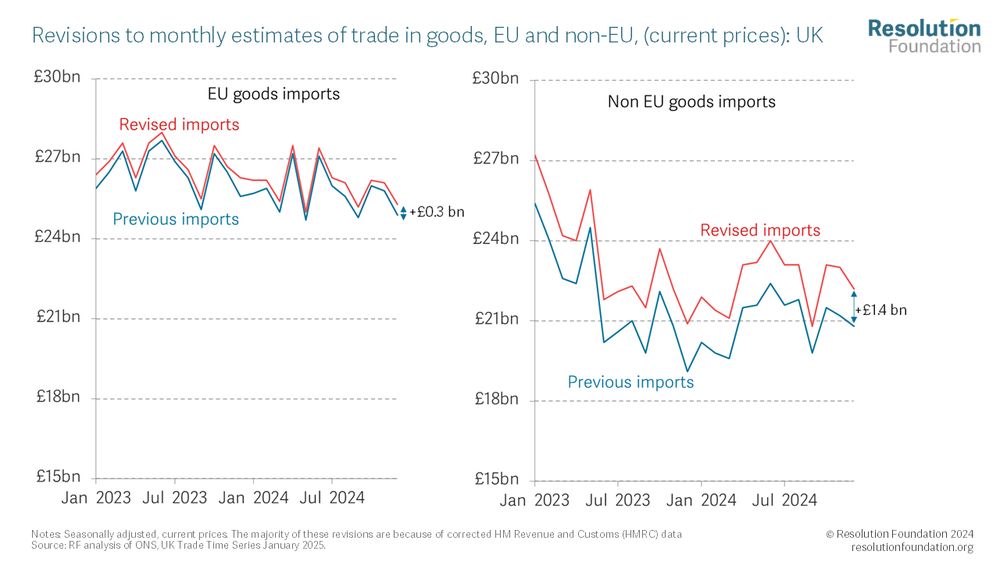

Services imports were also revised upwards (up 2.7% in 2023 & 5.7% in 2024, worth £17.1 bn in 2024)

Services imports were also revised upwards (up 2.7% in 2023 & 5.7% in 2024, worth £17.1 bn in 2024)

Goods imports were unchanged overall, although imports from the EU fell by 2.6%, while imports from Non-EU rose by 2.9%.

Goods imports were unchanged overall, although imports from the EU fell by 2.6%, while imports from Non-EU rose by 2.9%.

1) Despite it being billed as a spending consolidation, real terms spending will be +£1.1 billion higher over the years of the 2025 Spending Review than it was expected to be in the Autumn Budget.

1) Despite it being billed as a spending consolidation, real terms spending will be +£1.1 billion higher over the years of the 2025 Spending Review than it was expected to be in the Autumn Budget.