Also, nonresidential construction, such as factory construction, is growing, but not excessively fast. We won't be replacing world manufacturing here this month.

Also, nonresidential construction, such as factory construction, is growing, but not excessively fast. We won't be replacing world manufacturing here this month.

Constitutional power to enact tariffs lies with Congress for a reason - they shouldn’t be executed as one would a bodily function.

Constitutional power to enact tariffs lies with Congress for a reason - they shouldn’t be executed as one would a bodily function.

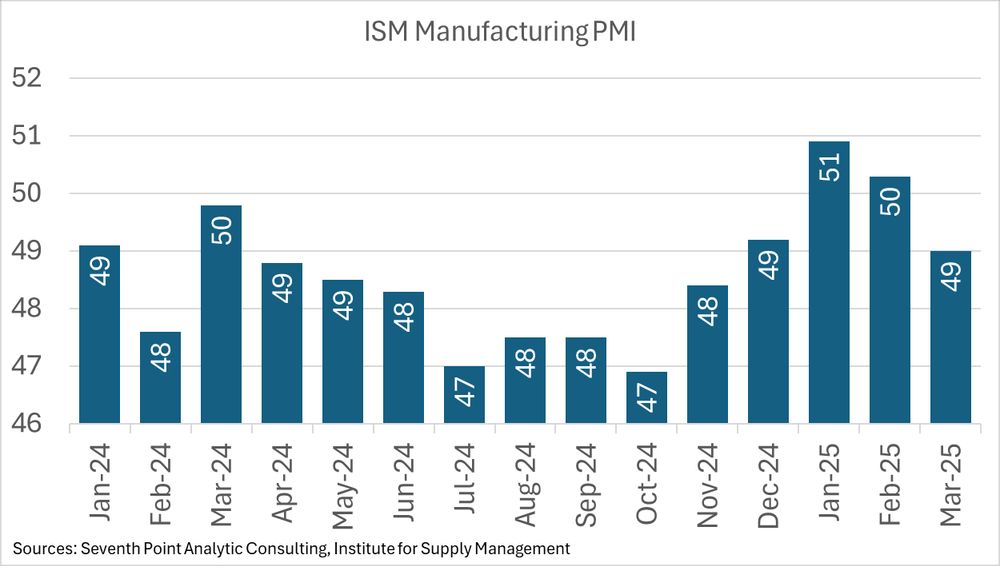

Full report here: www.ismworld.org/supply-manag...

Full report here: www.ismworld.org/supply-manag...

Tue: Consumer Confidence, JOLTS, Adv. Trade Balance

Wed: ADP Employment, Q1 GDP, PCE Inflation, NAR Pending Home Sales

Thu: Census Construction & ISM Mfg.

Fri: BLS Employment, Census Mfg.

Tue: Consumer Confidence, JOLTS, Adv. Trade Balance

Wed: ADP Employment, Q1 GDP, PCE Inflation, NAR Pending Home Sales

Thu: Census Construction & ISM Mfg.

Fri: BLS Employment, Census Mfg.

*Under the std Taylor Rule

*Under the std Taylor Rule