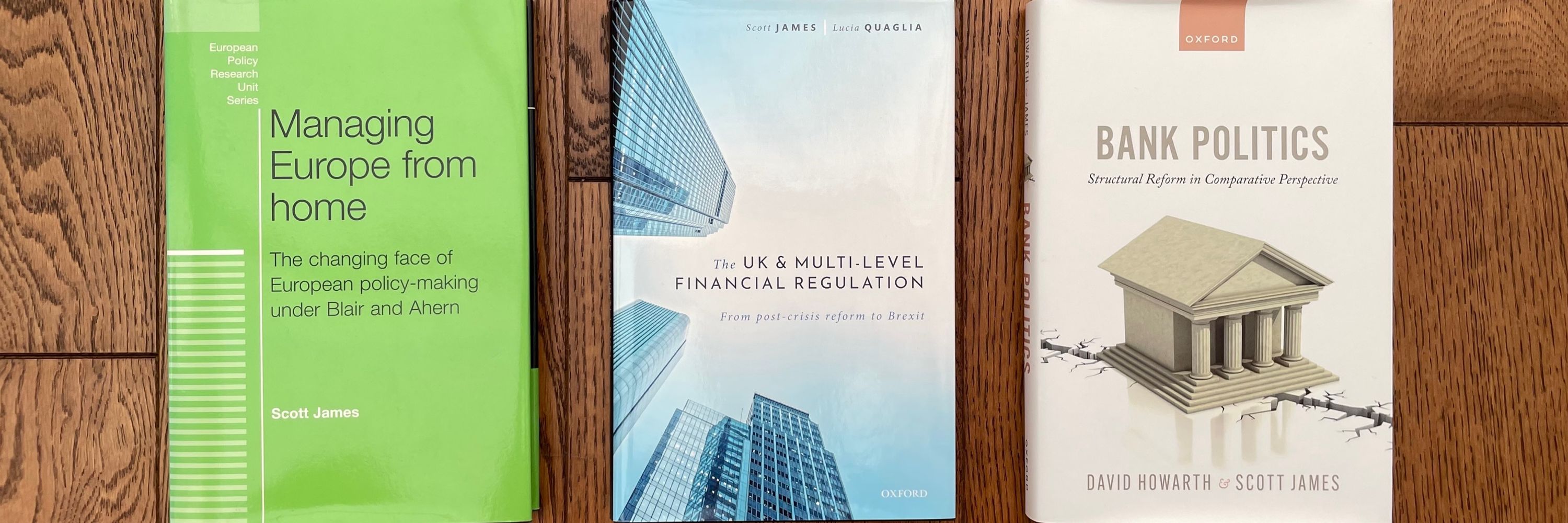

Scott James

@drscottjames.bsky.social

Reader in Political Economy, King’s College London

www.kcl.ac.uk/people/dr-scott-james

IPE of finance and tech, monetary politics, City of London

BANK POLITICS (OUP, 2023)

https://global.oup.com/academic/product/bank-politics-9780192898609?cc=gb&lang=en&

www.kcl.ac.uk/people/dr-scott-james

IPE of finance and tech, monetary politics, City of London

BANK POLITICS (OUP, 2023)

https://global.oup.com/academic/product/bank-politics-9780192898609?cc=gb&lang=en&

Pinned

Scott James

@drscottjames.bsky.social

· Mar 18

New article with Lucia Quaglia on how EU banks and EU regulators engaged in ‘noisy geopolitics’ by leveraging the digital sovereignty agenda to push for tighter controls on (US) bigtechs. Part of a special issue on ‘Transformation of Banking’ in Competition and Change

doi.org/10.1177/1024...

doi.org/10.1177/1024...

‘Presenting its consultation paper on rules for regulating widely used stablecoins, the BoE said it was “considering central bank liquidity arrangements to support systemic stablecoin issuers in times of stress” 📌

Bank of England dilutes planned rules for UK stablecoins

Central bank partly backs down after industry criticism over plan for digital tokens

www.ft.com

November 10, 2025 at 8:07 PM

‘Presenting its consultation paper on rules for regulating widely used stablecoins, the BoE said it was “considering central bank liquidity arrangements to support systemic stablecoin issuers in times of stress” 📌

At least it’s not a pound stablecoin

If an ex-chancellor pumps crypto and no one notices, does it make a noise?

Kwasi be stacking, no one be caring

www.ft.com

November 6, 2025 at 8:30 AM

At least it’s not a pound stablecoin

‘Bailey told the committee that the BoE was considering conducting a “system-wide exploratory scenario” next year to test how the private credit market would manage in a crisis.’ ⏰

BoE governor warns ‘alarm bells’ ringing over private credit market

Andrew Bailey draws parallel with practices before 2008 financial crisis

www.ft.com

October 21, 2025 at 1:16 PM

‘Bailey told the committee that the BoE was considering conducting a “system-wide exploratory scenario” next year to test how the private credit market would manage in a crisis.’ ⏰

Whether or not AI is a bubble is less interesting than thinking about the commercial and epistemological interests served by the performative act of framing it as such

Silicon Valley takes stock of the AI bubble

Plus, Karel Komárek, the man bringing the fight to US gambling giants

www.ft.com

October 20, 2025 at 7:25 AM

Whether or not AI is a bubble is less interesting than thinking about the commercial and epistemological interests served by the performative act of framing it as such

Attempting and failing to reset relations with China now part of the British Political Tradition™

October 16, 2025 at 8:32 AM

Attempting and failing to reset relations with China now part of the British Political Tradition™

Treasury seizes the £5bn for a new strategic bitcoin reserve on my 2026 bingo card

October 15, 2025 at 10:18 PM

Treasury seizes the £5bn for a new strategic bitcoin reserve on my 2026 bingo card

I’d forgotten about this characteristically punchy Adam Curtis documentary from 1996

www.bbc.co.uk/programmes/p...

www.bbc.co.uk/programmes/p...

October 15, 2025 at 11:47 AM

I’d forgotten about this characteristically punchy Adam Curtis documentary from 1996

www.bbc.co.uk/programmes/p...

www.bbc.co.uk/programmes/p...

A reminder that what might look like a dash for fintech is often just the UK playing catch up with the US and EU

UK moves to allow tokenisation of investment funds

FCA’s proposals would bring Britain into line with fund administration hubs in Ireland and Luxembourg

www.ft.com

October 15, 2025 at 11:25 AM

A reminder that what might look like a dash for fintech is often just the UK playing catch up with the US and EU

Less appreciated is just how quickly Trump and Farage have shifted the Overton window on finance and regulation

Nigel Farage tells crypto conference ‘I am your champion’

Reform UK leader touts plans to create a state-owned bitcoin reserve

www.ft.com

October 15, 2025 at 7:11 AM

Less appreciated is just how quickly Trump and Farage have shifted the Overton window on finance and regulation

Old enough to remember varieties of capitalism

JPMorgan backs ‘America First’ push with up to $10bn investment

Chief executive Jamie Dimon says US too dependent on ‘unreliable’ sources of materials ‘essential’ to national security

www.ft.com

October 14, 2025 at 7:16 AM

Old enough to remember varieties of capitalism

Reposted by Scott James

1/ Who are the globalists? Right wing, Christian group from US seeks to transform UK politics. The latest in a string of transnational moves by the far right to shift the global political debate. Welcome to the nationalist international.

www.nytimes.com/2025/10/13/w...

www.nytimes.com/2025/10/13/w...

They Helped Topple Roe v. Wade. Now Their Sights Are Set on Britain.

www.nytimes.com

October 13, 2025 at 11:55 AM

1/ Who are the globalists? Right wing, Christian group from US seeks to transform UK politics. The latest in a string of transnational moves by the far right to shift the global political debate. Welcome to the nationalist international.

www.nytimes.com/2025/10/13/w...

www.nytimes.com/2025/10/13/w...

The Reinhart/Rogoff bargain here is that generational deregulation > crisis > bailouts = the price of credit creation, creative destruction, etc. But it relies on a logic of mean reversion for central bank balance sheets and public debt that we left in 2008. So next time probably will be different.

October 13, 2025 at 8:47 AM

The Reinhart/Rogoff bargain here is that generational deregulation > crisis > bailouts = the price of credit creation, creative destruction, etc. But it relies on a logic of mean reversion for central bank balance sheets and public debt that we left in 2008. So next time probably will be different.

Looking forward to Basel 666

Conservative tech lord Thiel said tighter financial regulations “were a sign that a singular world government has begun to emerge that could be taken over by an Antichrist figure who could then use it to exert control over people.” Via WashPost

Inside billionaire Peter Thiel’s private lectures: Warnings of ‘the Antichrist’ and U.S. destruction

In leaked recordings of private lectures by tech billionaire Peter Thiel he argued that “the Antichrist” is likely to take the form of a critic of technology.

www.washingtonpost.com

October 10, 2025 at 12:17 PM

Looking forward to Basel 666

If AGI is possible in the future, wouldn’t it have found a way to manipulate the present to avoid a bubble? 🧐

October 8, 2025 at 4:40 PM

If AGI is possible in the future, wouldn’t it have found a way to manipulate the present to avoid a bubble? 🧐

Opposing perspectives on the UK’s macro predicament, but both of which echo postwar left and right narratives about declinism rooted in pathologies of the British state, ie. BOE orthodoxy vs Westminster politics

October 8, 2025 at 8:10 AM

Opposing perspectives on the UK’s macro predicament, but both of which echo postwar left and right narratives about declinism rooted in pathologies of the British state, ie. BOE orthodoxy vs Westminster politics

Fama: ‘Bitcoin is going to zero within 10 years…or we’ll need to start all over with monetary theory’

www.capitalisnt.com/episodes/why...

www.capitalisnt.com/episodes/why...

Why This Nobel Economist Thinks Bitcoin Is Going to Zero, with Eugene Fama | Capitalisn't

In December 2024, Bitcoin, one of the earliest cryptocurrencies and undoubtedly the most famous, hit $2 trillion in market capitalization, bigger than Tesla, Meta, and Saudi Aramco. In this episode, N...

www.capitalisnt.com

October 5, 2025 at 3:27 PM

Fama: ‘Bitcoin is going to zero within 10 years…or we’ll need to start all over with monetary theory’

www.capitalisnt.com/episodes/why...

www.capitalisnt.com/episodes/why...

‘Treasury officials privately queried the size of the potential windfall…but the OBR does not score asset seizures in its forecasts and crypto assets are not recorded as financial assets for the purpose of fiscal statistics, one Treasury official said.’ 🙁

www.ft.com/content/9b01...

www.ft.com/content/9b01...

UK seeks to keep £5bn bitcoin haul after money laundering convictions

Complex legal battle over seized assets could run for years

www.ft.com

October 3, 2025 at 10:25 PM

‘Treasury officials privately queried the size of the potential windfall…but the OBR does not score asset seizures in its forecasts and crypto assets are not recorded as financial assets for the purpose of fiscal statistics, one Treasury official said.’ 🙁

www.ft.com/content/9b01...

www.ft.com/content/9b01...

Onto central bank balance sheets presumably

Wasn’t the entire point to move risk away from banks? Now we want to move risk away from NBFI too? Where will it go? To NNNBFI (Non-NBFI Non-Bank Financial Institutions)?

Christine Lagarde calls for tougher rules on ‘darker corners’ of finance on.ft.com/3VKr7BF

October 3, 2025 at 1:59 PM

Onto central bank balance sheets presumably

London calling 🚨

Turbocharging stablecoins 🤝 DeFi-ing the digital pound?

www.bloomberg.com/opinion/news...

Turbocharging stablecoins 🤝 DeFi-ing the digital pound?

www.bloomberg.com/opinion/news...

October 3, 2025 at 10:17 AM

London calling 🚨

Turbocharging stablecoins 🤝 DeFi-ing the digital pound?

www.bloomberg.com/opinion/news...

Turbocharging stablecoins 🤝 DeFi-ing the digital pound?

www.bloomberg.com/opinion/news...

Reposted by Scott James

This line right at the end of Bailey’s stablecoin piece seems the most significant and radical idea to me: “we will set out that widely used UK stablecoins should have access to accounts at the BoE in order to reinforce their status as money”.

gift lnk

on.ft.com/3IQ9NYU The new stablecoin regime

gift lnk

on.ft.com/3IQ9NYU The new stablecoin regime

The new stablecoin regime

An innovative technology must still answer old central banking questions

on.ft.com

October 1, 2025 at 2:54 PM

This line right at the end of Bailey’s stablecoin piece seems the most significant and radical idea to me: “we will set out that widely used UK stablecoins should have access to accounts at the BoE in order to reinforce their status as money”.

gift lnk

on.ft.com/3IQ9NYU The new stablecoin regime

gift lnk

on.ft.com/3IQ9NYU The new stablecoin regime

Reposted by Scott James

A lot depends on what he spent it on. He’s set off on a very bad foot (if he’s set off anywhere at all) because you can’t ignore those who are considering lending to you.

Burnham: I don't think the bond market should dictate what we can and can't do

Bond market: Woah, woah, woah, you can't say that

on.ft.com/3IfUrNh

Bond market: Woah, woah, woah, you can't say that

on.ft.com/3IfUrNh

Andy Burnham’s borrowing plans would spook gilt market, investors warn

Fund managers say fresh borrowing spree would drive up gilt yields and dent the pound

on.ft.com

September 25, 2025 at 2:20 PM

A lot depends on what he spent it on. He’s set off on a very bad foot (if he’s set off anywhere at all) because you can’t ignore those who are considering lending to you.

We’re now a truth social post away from weaponised swap lines ⏰

Sounds like the US is about to bail out Trump’s pal Javier Milei. ‘America First’ always has lots of exceptions.

September 22, 2025 at 5:11 PM

We’re now a truth social post away from weaponised swap lines ⏰

New article with Lucia Quaglia examining the EU’s defensive statecraft to defend financial sovereignty around central clearing houses and Bigtech digital platforms, in Journal of International Economic Law

doi.org/10.1093/jiel...

doi.org/10.1093/jiel...

September 22, 2025 at 4:37 PM

New article with Lucia Quaglia examining the EU’s defensive statecraft to defend financial sovereignty around central clearing houses and Bigtech digital platforms, in Journal of International Economic Law

doi.org/10.1093/jiel...

doi.org/10.1093/jiel...

Admittedly far beyond the scope of what’s proposed here, but arguably a category error to assume that a decentralised blockchain is a natural evolution of postwar eurodollar markets when it represents something entirely new

Feels like a well worn path but raises many questions:

1) What exactly would the UK be aligning with given all the US loopholes?

2) How will issues of multi issuance / cross-border redemptions be managed?

3) Ultimately will the Fed backstop all this with swap lines?

www.ft.com/content/3b81...

1) What exactly would the UK be aligning with given all the US loopholes?

2) How will issues of multi issuance / cross-border redemptions be managed?

3) Ultimately will the Fed backstop all this with swap lines?

www.ft.com/content/3b81...

UK set to announce closer co-operation with US on cryptocurrencies

Chancellor Rachel Reeves hopes greater regulatory alignment will allow better access to America’s deep capital markets

www.ft.com

September 19, 2025 at 2:01 PM

Admittedly far beyond the scope of what’s proposed here, but arguably a category error to assume that a decentralised blockchain is a natural evolution of postwar eurodollar markets when it represents something entirely new