Reader in Political Economy, King’s College London

www.kcl.ac.uk/people/dr-scott-james

IPE of finance and tech, monetary politics, City of London

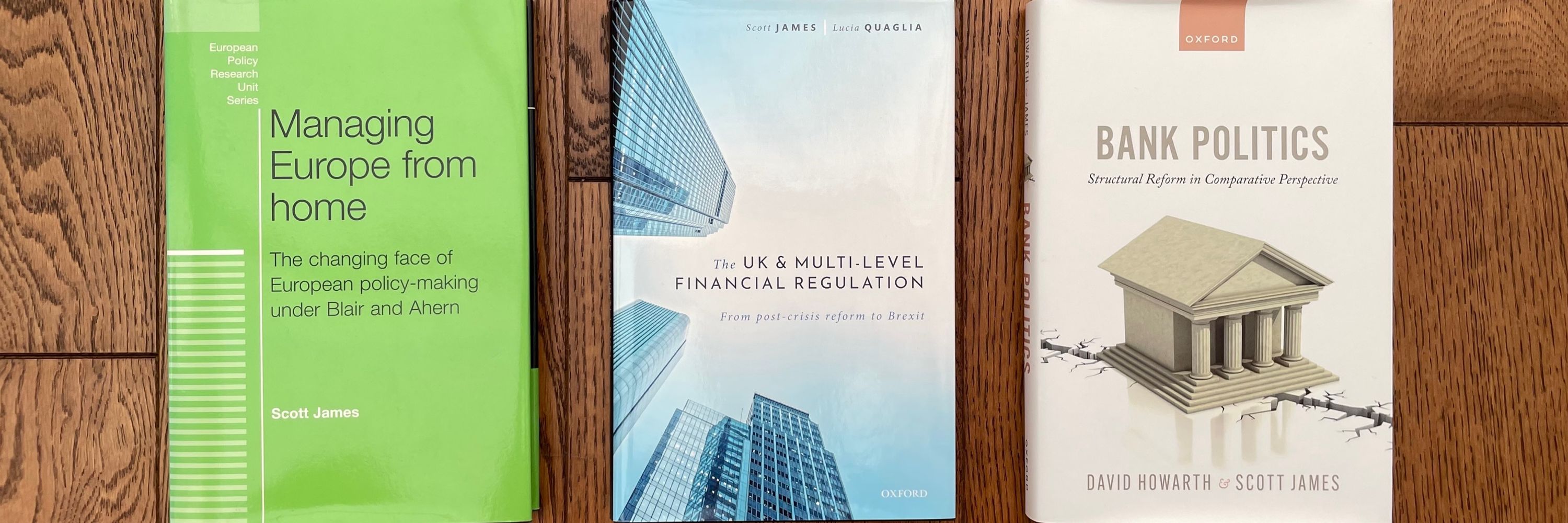

BANK POLITICS (OUP, 2023)

https://global.oup.com/academic/product/bank-politics-9780192898609?cc=gb&lang=en& ..

more

Reader in Political Economy, King’s College London

www.kcl.ac.uk/people/dr-scott-james

IPE of finance and tech, monetary politics, City of London

BANK POLITICS (OUP, 2023)

https://global.oup.com/academic/product/bank-politics-9780192898609?cc=gb&lang=en&

doi.org/10.1177/1024...

www.youtube.com/live/M6vebFZ...

Starmer has the lowest approval rating of any PM in history bar Truss. Senior ministers are openly and unsubtly positioning. His Chief of Staff, Director of Comms and Cab Sec have all resigned on the same day.

I mean come on...

Reposted by James Scott

Starmer has the lowest approval rating of any PM in history bar Truss. Senior ministers are openly and unsubtly positioning. His Chief of Staff, Director of Comms and Cab Sec have all resigned on the same day.

I mean come on...

Reposted by James Scott

www.phenomenalworld.org/analysis/tru...

25-year cycles of de/redollarisation?

Reposted by Jonathan Portes, James Scott

Can’t see any of the likely successors making *major* changes to borrowing. You might get more taxes & more spending.

And don’t rule out a more pro-growth attitude to immigration.

www.ft.com/content/c855... Starmer camp warns leadership challenge risks economic chaos

www.youtube.com/live/M6vebFZ...

Reposted by James Scott, Pepper D. Culpepper

Reposted by James Scott

Reposted by James Scott

Agency meets structure, a love story

Reposted by James Scott

Reposted by James Scott