#EconFin

#Economy

#Stockmarket

#EconFin

#Economy

#Stockmarket

#StockMarket

#Economy

#Investing

#StockMarket

#Economy

#Investing

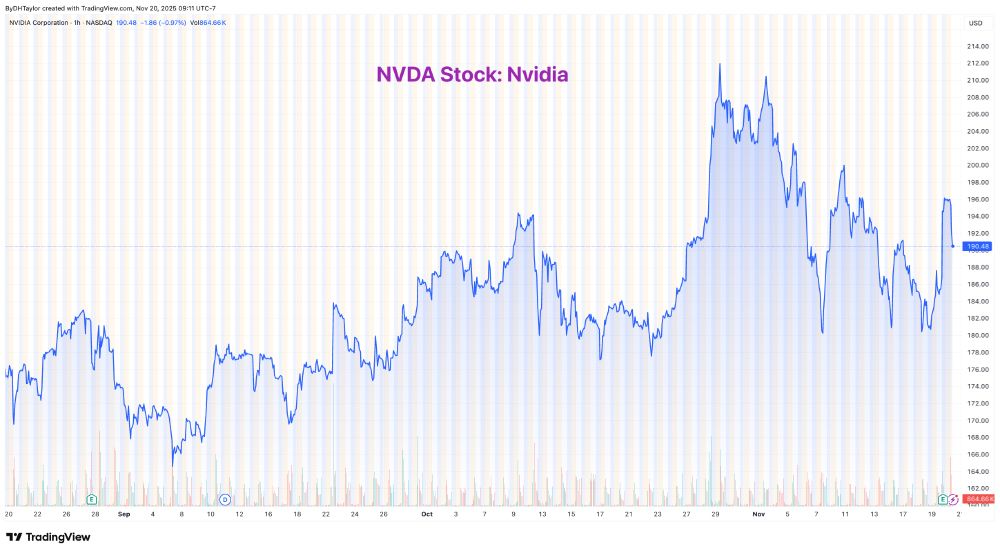

NVDA is trading at 29.9x forward, whereas the S&P500 is at 22.36x

Other stocks within the AI trade may be overvalued, and #NVDA stock may not move because of other stocks

#StockMarket

#Trading

#Economy

NVDA is trading at 29.9x forward, whereas the S&P500 is at 22.36x

Other stocks within the AI trade may be overvalued, and #NVDA stock may not move because of other stocks

#StockMarket

#Trading

#Economy

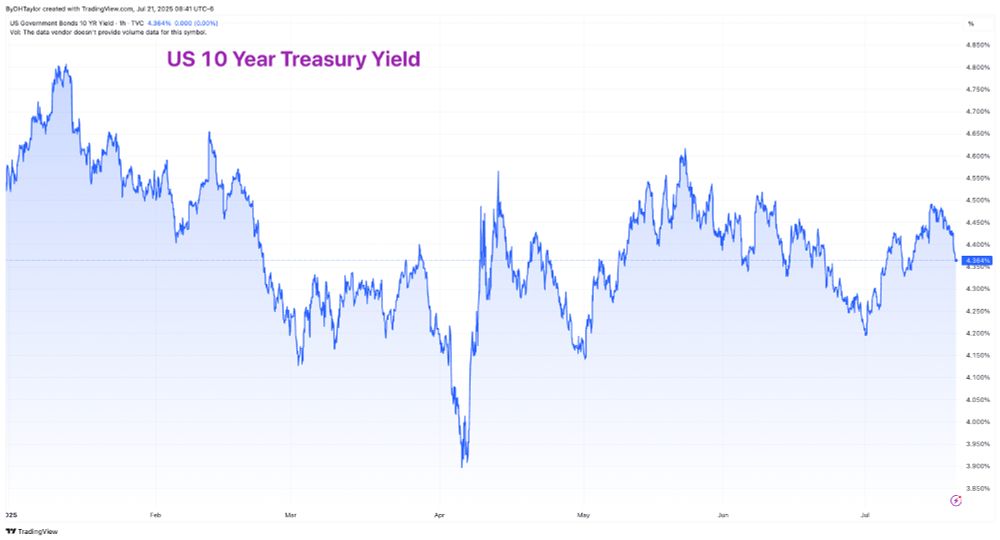

The Federal Reserve will have to contend with data skew in its upcoming decision.

I expect no move in the upcoming meeting

#Economy

#StockMarket

#Investing

The Federal Reserve will have to contend with data skew in its upcoming decision.

I expect no move in the upcoming meeting

#Economy

#StockMarket

#Investing

Look for future bottom up revenue declines from other AI companies first

#StockMarket

#Investing

#Economy

Look for future bottom up revenue declines from other AI companies first

#StockMarket

#Investing

#Economy

#Stockmarket

#Investing

#Economy

#Stockmarket

#Investing

#Economy

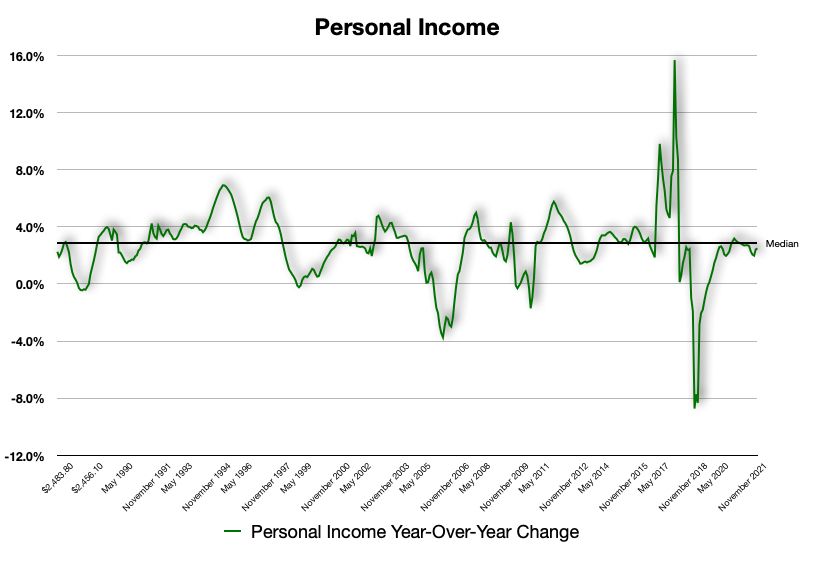

But the tariffs will eventually be struck down by the Supreme Court, giving the consumer their money back.

#StockMarket

#Investing

#Economy

But the tariffs will eventually be struck down by the Supreme Court, giving the consumer their money back.

#StockMarket

#Investing

#Economy

#Trading

#StockMarket

#Trading

#StockMarket

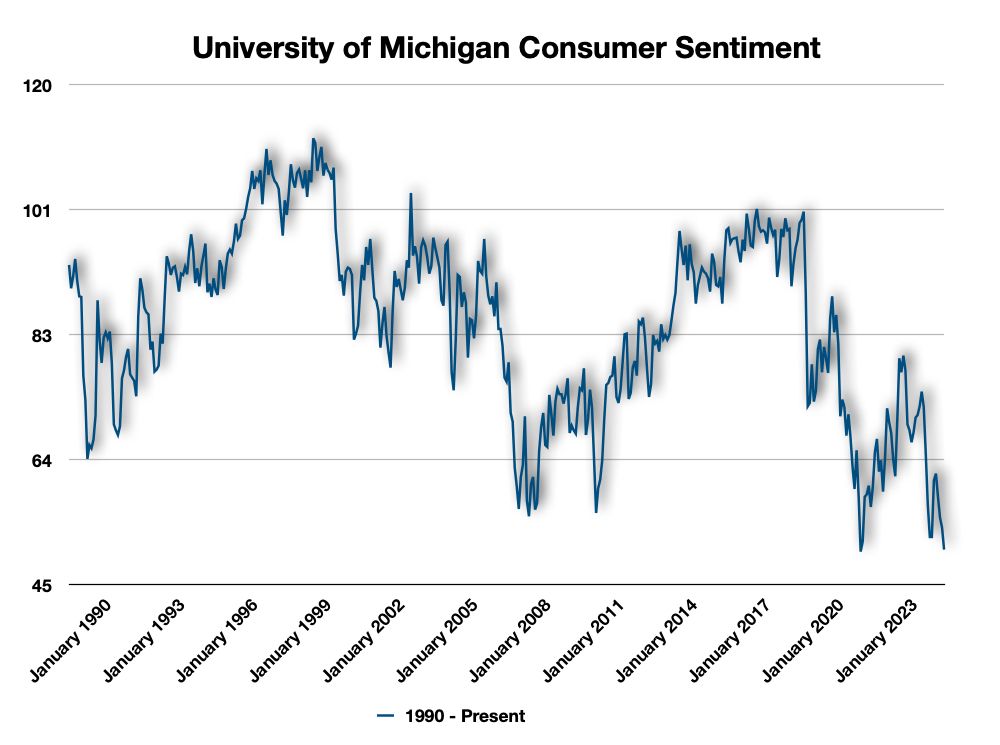

Given that, the consumer looks taxed and weary of the future as we saw in the University of Michigan Consumer Sentiment index last week.

Given that, the consumer looks taxed and weary of the future as we saw in the University of Michigan Consumer Sentiment index last week.

Unemployment will move as Federal workers who've taken voluntary furloughs start to show up in data, just not jobless claims

#EconSky

#FinSky

#FinSky

#EconSky

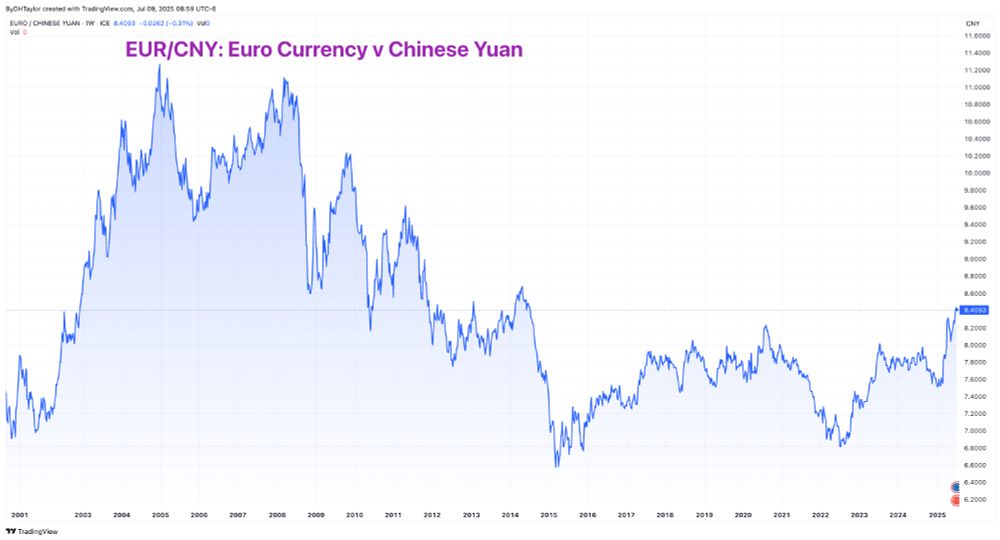

Copper typically follows economic expansion. However, tariffs are an anomaly, and the price of copper is artificially inflated as a result.

#EconSky

#FinSky

In the meantime, tariffs are back in consideration with a slew of activity likely to occur this week as the deadline looms.

The Big Beautiful Bill passed: bond market has taken notice.

#EconSky

#FinSky