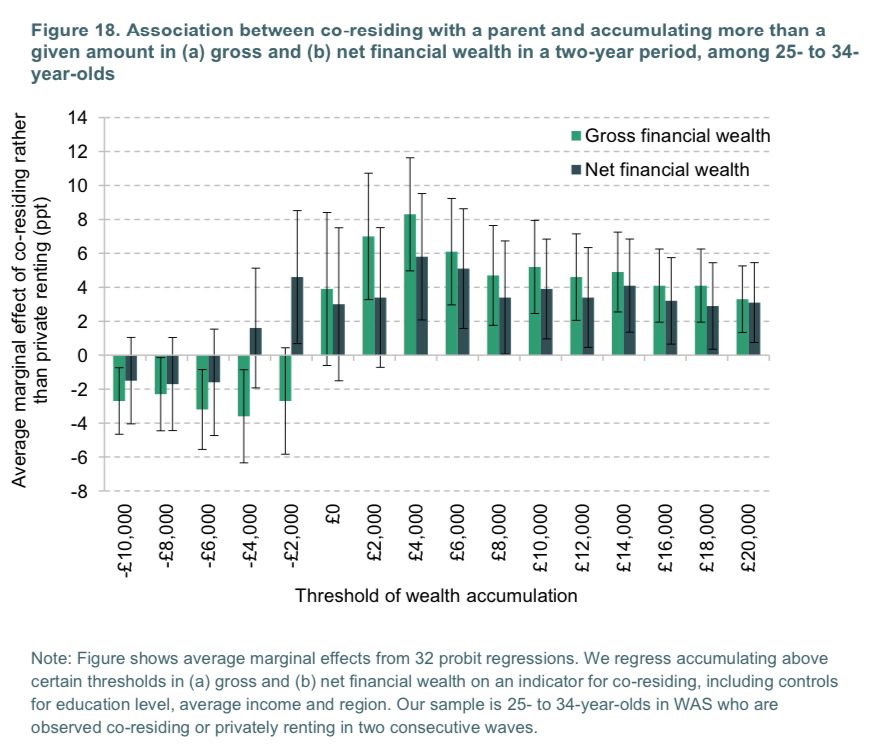

14% of those living at home built up more than £10k in extra savings over a 2-year period. That was a rate about 30% higher than for an equivalent group of private renters. 7/

14% of those living at home built up more than £10k in extra savings over a 2-year period. That was a rate about 30% higher than for an equivalent group of private renters. 7/

But among parents living in the capital, having a child at home is particularly common. 6/

But among parents living in the capital, having a child at home is particularly common. 6/

But these changes together could only explain about 10% of the rise. In any case, settling down later might be a symptom not cause.4/

But these changes together could only explain about 10% of the rise. In any case, settling down later might be a symptom not cause.4/

The “Hotel of Mum and Dad” has become more popular but why? And who is benefitting from or giving intergenerational support in this way?

Our new @theifs.bsky.social report takes a deep dive. 1/

The “Hotel of Mum and Dad” has become more popular but why? And who is benefitting from or giving intergenerational support in this way?

Our new @theifs.bsky.social report takes a deep dive. 1/

HMRC and DEFRA figure are not inconsistent with each other. They measure different things: estates vs farm businesses

HMRC and DEFRA figure are not inconsistent with each other. They measure different things: estates vs farm businesses