@beeboileau.bsky.social, @maxwarner.bsky.social and @benzaranko.bsky.social explain why tough choices will be unavoidable at the upcoming Spending Review in our new briefing:

@beeboileau.bsky.social, @maxwarner.bsky.social and @benzaranko.bsky.social explain why tough choices will be unavoidable at the upcoming Spending Review in our new briefing:

Join us at 11am on Monday 2 June for analysis of the key choices at next month's Spending Review, with speakers @beeboileau.bsky.social and @instituteforgovernment.org.uk's @stuarthoddinott.bsky.social.

Sign up here: ifs.org.uk/events/look-...

Join us at 11am on Monday 2 June for analysis of the key choices at next month's Spending Review, with speakers @beeboileau.bsky.social and @instituteforgovernment.org.uk's @stuarthoddinott.bsky.social.

Sign up here: ifs.org.uk/events/look-...

Not all types of work are beneficial, however.

James Banks, Jonathan Cribb, Carl Emmerson and @david-sturrock.bsky.social summarise their new research:

Not all types of work are beneficial, however.

James Banks, Jonathan Cribb, Carl Emmerson and @david-sturrock.bsky.social summarise their new research:

Some people choose to - or need to - work longer as a result. Does it run down their health? Or can work keep you young?

We investigated for women whose pension age rose in the 2010s… 1/

Some people choose to - or need to - work longer as a result. Does it run down their health? Or can work keep you young?

We investigated for women whose pension age rose in the 2010s… 1/

Do come along for some discussion of what one Nobel Prize-winning economist called 'the nastiest, hardest problem in finance' (!)

Sign up:

Do come along for some discussion of what one Nobel Prize-winning economist called 'the nastiest, hardest problem in finance' (!)

Thurs 23 Jan 2025 | 2pm – 3pm | Online

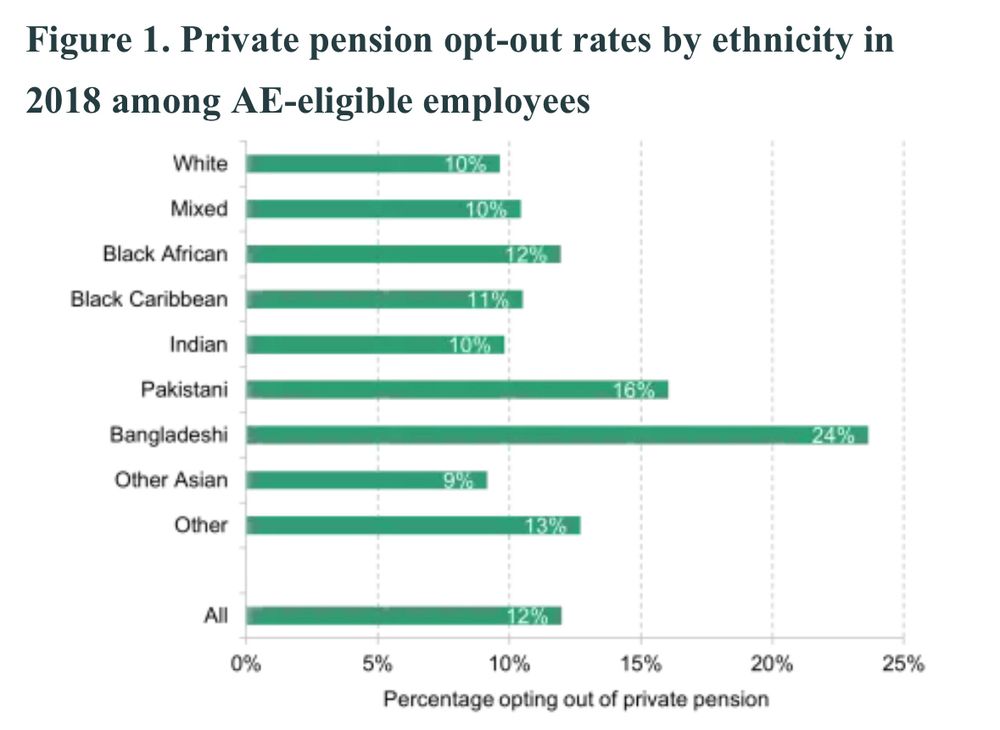

We present new findings on ethnic gaps in pension participation rates, with Taha Choukhmane, Athina Vlachantoni, @laurenceobrien.bsky.social and Carl Emmerson.

Sign up here: ifs.org.uk/events/ethni...

Thurs 23 Jan 2025 | 2pm – 3pm | Online

We present new findings on ethnic gaps in pension participation rates, with Taha Choukhmane, Athina Vlachantoni, @laurenceobrien.bsky.social and Carl Emmerson.

Sign up here: ifs.org.uk/events/ethni...

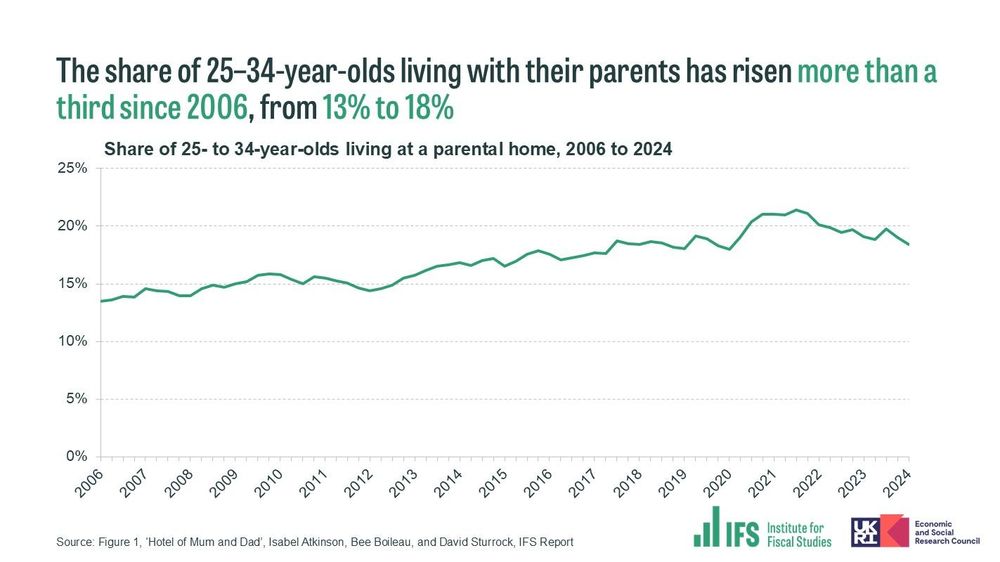

43% of 25-year-olds were living with their parents in 2023–24, up from 29% in 2006–07.

Our report: https://buff.ly/3WeRJLB

@beeboileau.bsky.social, @david-sturrock.bsky.social and Isabel Atkinson's new report the ‘Hotel of Mum and Dad’ looks at who lives with parents, why and the implications for their savings.

[THREAD: 1/9]

@beeboileau.bsky.social, @david-sturrock.bsky.social and Isabel Atkinson's new report the ‘Hotel of Mum and Dad’ looks at who lives with parents, why and the implications for their savings.

[THREAD: 1/9]

The “Hotel of Mum and Dad” has become more popular but why? And who is benefitting from or giving intergenerational support in this way?

Our new @theifs.bsky.social report takes a deep dive. 1/

The “Hotel of Mum and Dad” has become more popular but why? And who is benefitting from or giving intergenerational support in this way?

Our new @theifs.bsky.social report takes a deep dive. 1/

Listen here: www.financialfairness.org.uk/en-gb/what-w...

Listen here: www.financialfairness.org.uk/en-gb/what-w...

Key for a government aiming to expand opportunity to keep wealth in mind:

Wealth transfers are a growing part of lifetime income and high house prices will shape who lives and works where.

Big Wealth is killing opportunity; eg

- under-40s raised in rented homes now less than half as likely to own as their counterparts whose parents owned

- being from a "top 1% wealth" family now has more bearing on who makes the elite (defined as in Who's Who) than a generation ago

Key for a government aiming to expand opportunity to keep wealth in mind:

Wealth transfers are a growing part of lifetime income and high house prices will shape who lives and works where.

📈 Explore how house prices and house building have changed in your area, and compare how responsive construction has been to prices, with our interactive map: ifs.org.uk/calculators/...

[THREAD: 1/8]

HMRC and DEFRA figure are not inconsistent with each other. They measure different things: estates vs farm businesses

HMRC and DEFRA figure are not inconsistent with each other. They measure different things: estates vs farm businesses

ifs.org.uk/articles/inh...

ifs.org.uk/articles/inh...

- pensions brought into estates

- business and agricultural assets: no IHT on first £1m of assets (combined)

- 50% relief for agricultural and business assets above this £1m threshold ie 20% IHT where previously could be none

- 50% relief for AIM

Now we wait for the doc..

- pensions brought into estates

- business and agricultural assets: no IHT on first £1m of assets (combined)

- 50% relief for agricultural and business assets above this £1m threshold ie 20% IHT where previously could be none

- 50% relief for AIM

Now we wait for the doc..

- pensions brought into estates

- business and agricultural assets: no IHT on first £1m of assets (combined)

- 50% relief for agricultural and business assets above this £1m threshold ie 20% IHT where previously could be none

- 50% relief for AIM

Now we wait for the doc..

- pensions brought into estates

- business and agricultural assets: no IHT on first £1m of assets (combined)

- 50% relief for agricultural and business assets above this £1m threshold ie 20% IHT where previously could be none

- 50% relief for AIM

Now we wait for the doc..

IFS researchers will present their initial response to Rachel Reeves' first Budget.

Thursday 31 October | 10:30am - 12pm | Online

Sign-up here:

IFS researchers will present their initial response to Rachel Reeves' first Budget.

Thursday 31 October | 10:30am - 12pm | Online

Sign-up here: