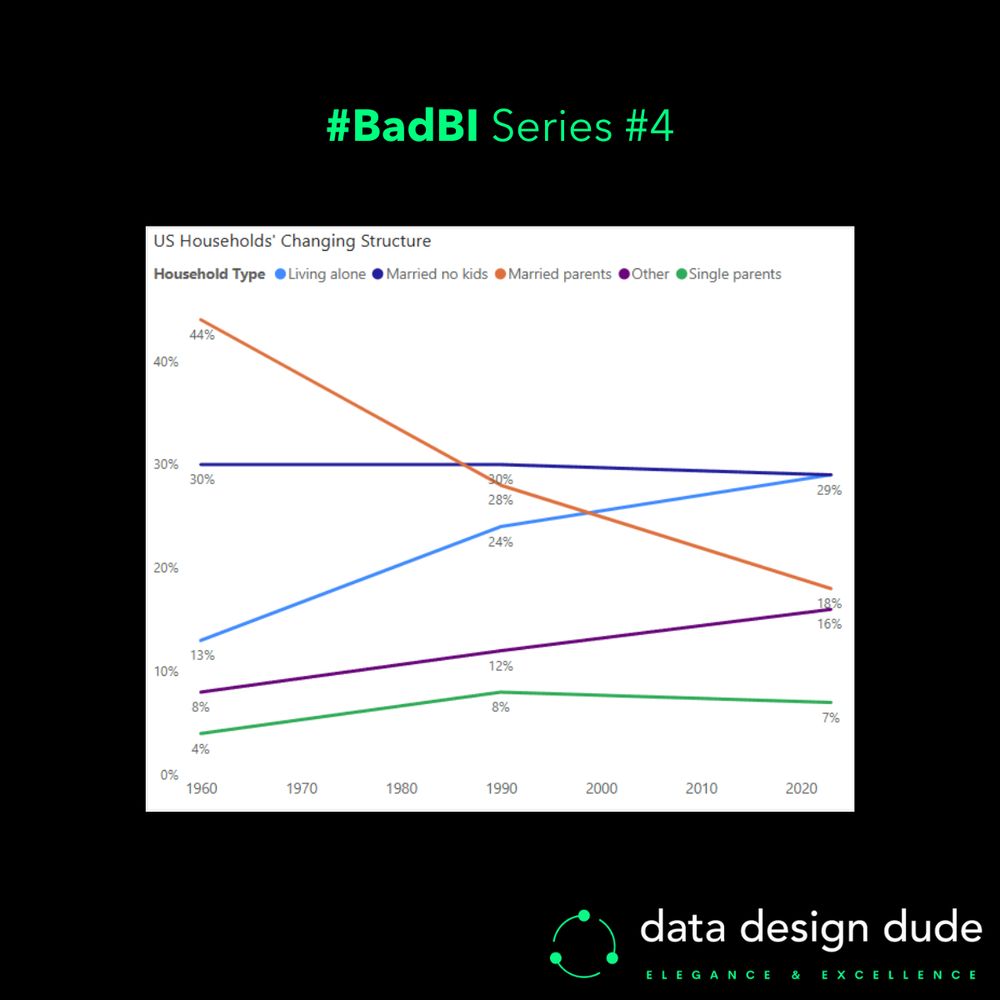

(𝗮𝗹𝗺𝗼𝘀𝘁 𝗮𝗹𝘄𝗮𝘆𝘀) 𝘂𝘀𝗲 𝗟𝗶𝗻𝗲 𝗰𝗵𝗮𝗿𝘁𝘀 𝘁𝗼 𝘀𝗵𝗼𝘄 𝘁𝗿𝗲𝗻𝗱𝘀 𝗼𝘃𝗲𝗿 𝗧𝗶𝗺𝗲 ⏳📈

(𝗮𝗹𝗺𝗼𝘀𝘁 𝗮𝗹𝘄𝗮𝘆𝘀) 𝘂𝘀𝗲 𝗟𝗶𝗻𝗲 𝗰𝗵𝗮𝗿𝘁𝘀 𝘁𝗼 𝘀𝗵𝗼𝘄 𝘁𝗿𝗲𝗻𝗱𝘀 𝗼𝘃𝗲𝗿 𝗧𝗶𝗺𝗲 ⏳📈

Now look at the second chart I made (with data points for just three years) and see how each of the problems above go away.

Now look at the second chart I made (with data points for just three years) and see how each of the problems above go away.

- We can’t accurately compare the rate of change for a category in a certain period, against another category in the same period, or against itself/another in a different period.

I could go on.

- We can’t accurately compare the rate of change for a category in a certain period, against another category in the same period, or against itself/another in a different period.

I could go on.

- We can’t tell the ranking of categories at any point in time except the first and last years… and even then, it’s not instantaneous for the first year.

- We can’t tell the ranking of categories at any point in time except the first and last years… and even then, it’s not instantaneous for the first year.

Regardless of if you thought the move was a NoT-C sAlo0t or not, I can guarantee you the world’s most minted doesn’t give 2 💩s… So let's not forget that bad press is good press! 💡

#BusinessIntelligence #Data #Analytics

Regardless of if you thought the move was a NoT-C sAlo0t or not, I can guarantee you the world’s most minted doesn’t give 2 💩s… So let's not forget that bad press is good press! 💡

#BusinessIntelligence #Data #Analytics

Lastly, while the “part-to-whole” meaning is somewhat reduced by not using stacked bars, user's eyes no longer flit between the legend and chart to figure out the category. 👀

Lastly, while the “part-to-whole” meaning is somewhat reduced by not using stacked bars, user's eyes no longer flit between the legend and chart to figure out the category. 👀

▶ 𝗩𝗲𝗿𝘀𝗶𝗼𝗻 𝟯

A simple horizontal Bar chart.

Now with the 𝘄𝗶𝗱𝗲𝗻𝗲𝗱 bars, even the very thin 1% one is more visible.

▶ 𝗩𝗲𝗿𝘀𝗶𝗼𝗻 𝟯

A simple horizontal Bar chart.

Now with the 𝘄𝗶𝗱𝗲𝗻𝗲𝗱 bars, even the very thin 1% one is more visible.

▶ 𝗩𝗲𝗿𝘀𝗶𝗼𝗻 𝟮

The same 100% Stacked column chart, now with the colours reversed.

▶ 𝗩𝗲𝗿𝘀𝗶𝗼𝗻 𝟮

The same 100% Stacked column chart, now with the colours reversed.

I used a simple 100% Stacked column chart to show the disparity between ‘useful’ and ‘not useful’ conversations regarding Elon…

(𝘐 𝘱𝘪𝘤𝘬𝘦𝘥 1% 𝘧𝘰𝘳 𝘵𝘩𝘦 ‘𝘶𝘴𝘦𝘧𝘶𝘭’ 𝘤𝘢𝘵𝘦𝘨𝘰𝘳𝘺 𝘵𝘰 𝘣𝘦 𝘢𝘣𝘭𝘦 𝘵𝘰 𝘴𝘩𝘰𝘸 𝘴𝘰𝘮𝘦𝘵𝘩𝘪𝘯𝘨, 𝘣𝘶𝘵 𝘐 𝘵𝘩𝘪𝘯𝘬 𝘪𝘵’𝘴 𝘳𝘦𝘢𝘭𝘭𝘺 0% 😂)

I used a simple 100% Stacked column chart to show the disparity between ‘useful’ and ‘not useful’ conversations regarding Elon…

(𝘐 𝘱𝘪𝘤𝘬𝘦𝘥 1% 𝘧𝘰𝘳 𝘵𝘩𝘦 ‘𝘶𝘴𝘦𝘧𝘶𝘭’ 𝘤𝘢𝘵𝘦𝘨𝘰𝘳𝘺 𝘵𝘰 𝘣𝘦 𝘢𝘣𝘭𝘦 𝘵𝘰 𝘴𝘩𝘰𝘸 𝘴𝘰𝘮𝘦𝘵𝘩𝘪𝘯𝘨, 𝘣𝘶𝘵 𝘐 𝘵𝘩𝘪𝘯𝘬 𝘪𝘵’𝘴 𝘳𝘦𝘢𝘭𝘭𝘺 0% 😂)

So I thought up a random hashtag#DataVisualization exercise to visualise it:

So I thought up a random hashtag#DataVisualization exercise to visualise it:

I call it "reverse fomo"... a friend/mentor yesterday told me it's just "ambition" :)

I call it "reverse fomo"... a friend/mentor yesterday told me it's just "ambition" :)

just experimenting here with the least amount of effort possible)

just experimenting here with the least amount of effort possible)

>> 𝗔𝗹𝘄𝗮𝘆𝘀 𝘀𝘁𝗮𝗿𝘁 𝘆𝗼𝘂𝗿 𝗮𝘅𝗶𝘀 𝘃𝗮𝗹𝘂𝗲𝘀 𝗳𝗿𝗼𝗺 𝟬 <<

>> 𝗔𝗹𝘄𝗮𝘆𝘀 𝘀𝘁𝗮𝗿𝘁 𝘆𝗼𝘂𝗿 𝗮𝘅𝗶𝘀 𝘃𝗮𝗹𝘂𝗲𝘀 𝗳𝗿𝗼𝗺 𝟬 <<

The reason for this is very simple… the Y-axis doesn’t start from zero.

The reason for this is very simple… the Y-axis doesn’t start from zero.

And while March’s value isn’t even double that of September’s (it’s 46% higher) it looks to be many times higher. 👀

And while March’s value isn’t even double that of September’s (it’s 46% higher) it looks to be many times higher. 👀

The Y-axis shows the inflation rate in intervals of 0.2%.

All looks good right? It’s simple and easy to read, and we can easily tell in a glance that March had the highest inflation (3.5%) and September had the lowest (2.4%).

The Y-axis shows the inflation rate in intervals of 0.2%.

All looks good right? It’s simple and easy to read, and we can easily tell in a glance that March had the highest inflation (3.5%) and September had the lowest (2.4%).