Daniel Kral

@danielkral.bsky.social

Europe macro at Oxford Economics. Opinions my own.

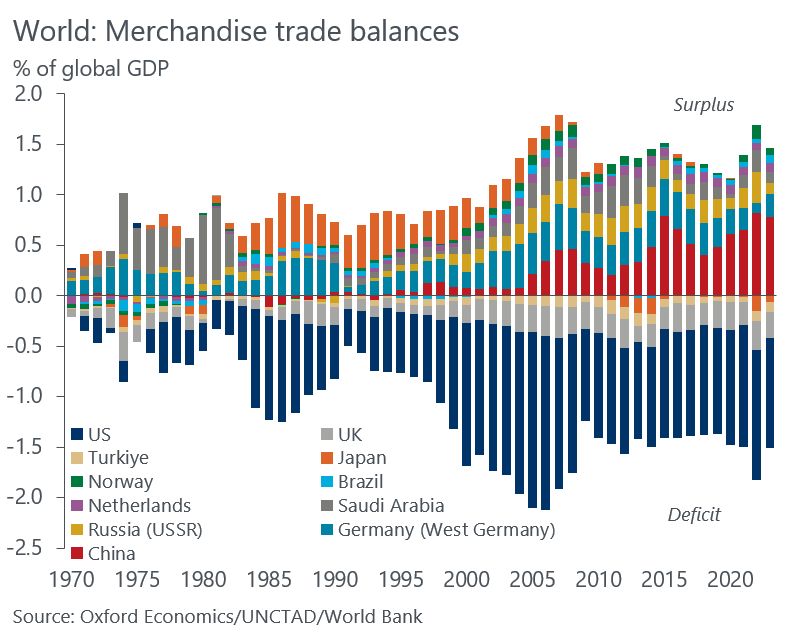

For decades, the US has been the primary source of global demand (& issuer of reserve assets) running large external deficits and debts. This proved politically unsustainable. Biden tried to reverse it via large subsidies. Trump via tariffs. Their objective is the same: reindustrialize US.

April 3, 2025 at 9:43 AM

For decades, the US has been the primary source of global demand (& issuer of reserve assets) running large external deficits and debts. This proved politically unsustainable. Biden tried to reverse it via large subsidies. Trump via tariffs. Their objective is the same: reindustrialize US.

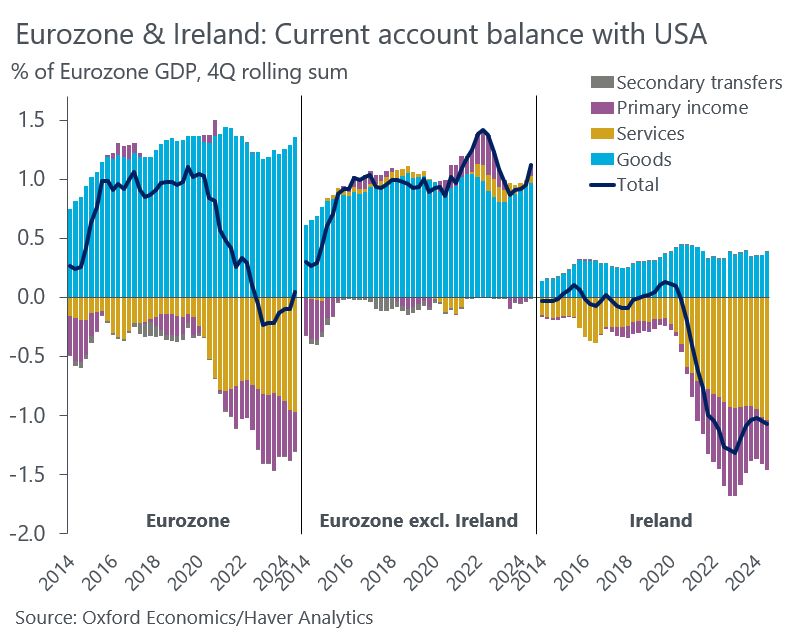

Some argue that while the EU runs a large goods trade surplus with the US, its large deficit in services gives it leverage. But this deficit is driven by accounting tricks of Irish-domiciled US multinationals. Excluding Ireland, the EU runs a (small) surplus in services, too.

March 24, 2025 at 9:36 AM

Some argue that while the EU runs a large goods trade surplus with the US, its large deficit in services gives it leverage. But this deficit is driven by accounting tricks of Irish-domiciled US multinationals. Excluding Ireland, the EU runs a (small) surplus in services, too.

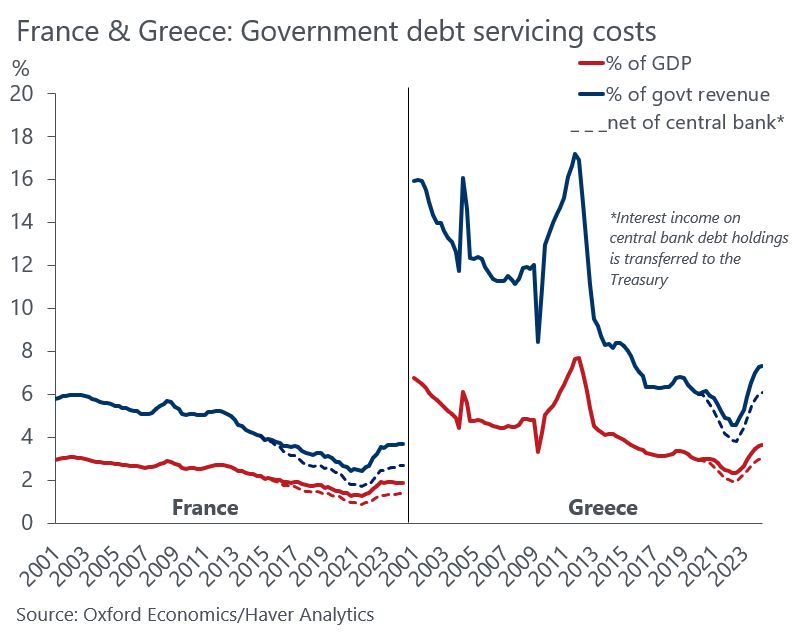

Is France facing a Greek-style sovereign debt crisis?

No.

At the height of the € debt crisis, Greek govt was spending almost 20% of all its revenue on interest payments. France is spending less than 4% (even less when subtracting interest paid on debt held by central bank).

No.

At the height of the € debt crisis, Greek govt was spending almost 20% of all its revenue on interest payments. France is spending less than 4% (even less when subtracting interest paid on debt held by central bank).

December 2, 2024 at 12:35 PM

Is France facing a Greek-style sovereign debt crisis?

No.

At the height of the € debt crisis, Greek govt was spending almost 20% of all its revenue on interest payments. France is spending less than 4% (even less when subtracting interest paid on debt held by central bank).

No.

At the height of the € debt crisis, Greek govt was spending almost 20% of all its revenue on interest payments. France is spending less than 4% (even less when subtracting interest paid on debt held by central bank).

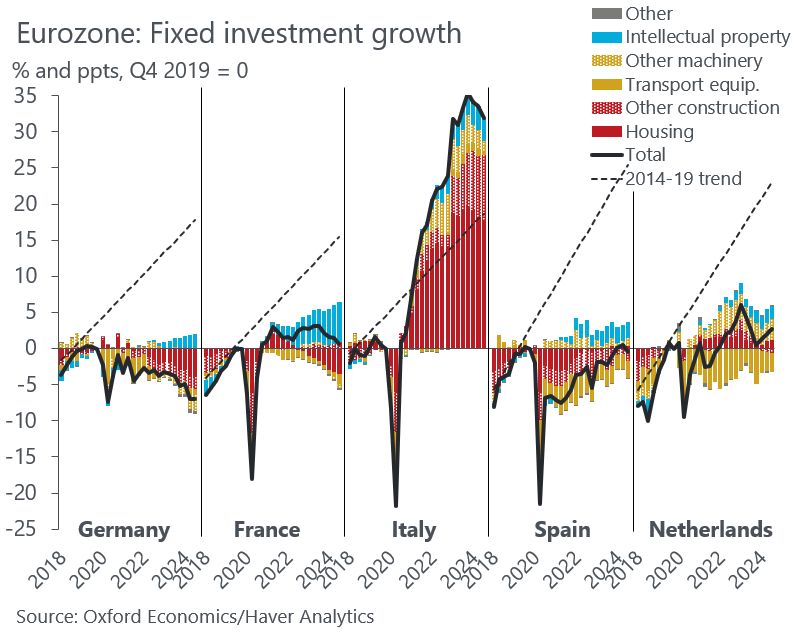

Fixed investment has been hammered by high interest rates & weak demand. Germany is the worst performer (no surprises), France propped up by fake IP and Spain & Neth. around pre-pandemic level (way below trend). After Superbonus-fuelled bonanza in Italy comes the inevitable - a protracted recession.

December 2, 2024 at 11:43 AM

Fixed investment has been hammered by high interest rates & weak demand. Germany is the worst performer (no surprises), France propped up by fake IP and Spain & Neth. around pre-pandemic level (way below trend). After Superbonus-fuelled bonanza in Italy comes the inevitable - a protracted recession.

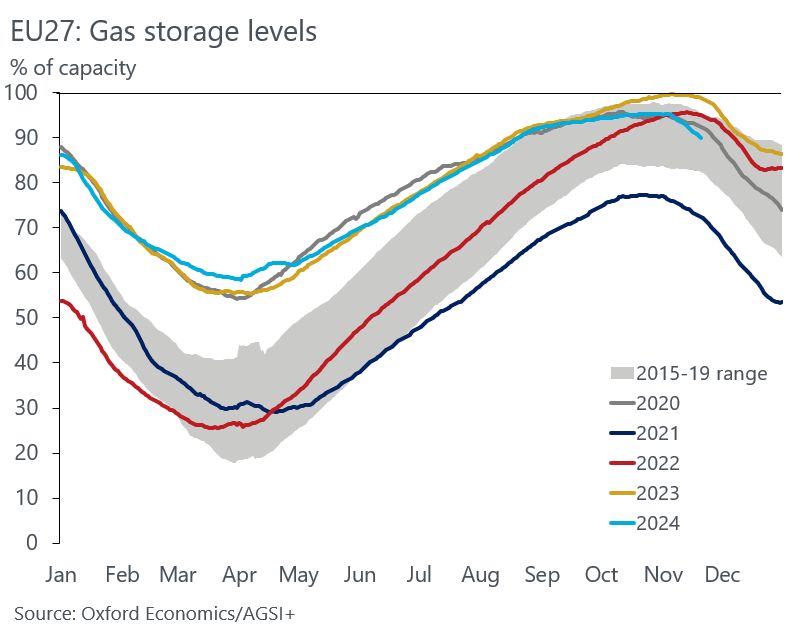

Current cold spell across Europe drives an earlier drawdown from gas storages than in previous years, as wholesale prices hit the highest in a year. Gazprom cutting off Austria this week and uncertainty over Ukraine transit route next year means Europe again bidding up spot LNG.

November 21, 2024 at 10:22 AM

Current cold spell across Europe drives an earlier drawdown from gas storages than in previous years, as wholesale prices hit the highest in a year. Gazprom cutting off Austria this week and uncertainty over Ukraine transit route next year means Europe again bidding up spot LNG.

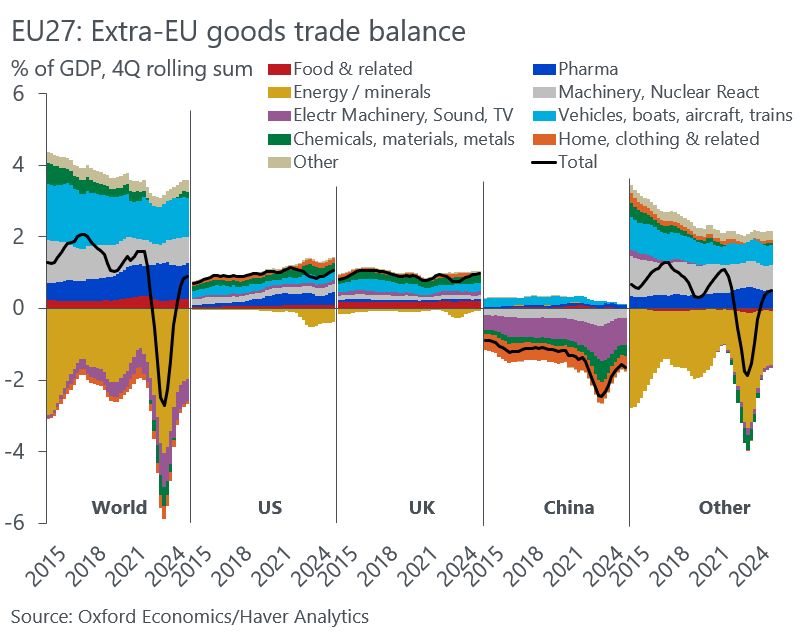

Hard to see how the EU would benefit from a big US-China trade war. Chinese exporters would seek to replace lost US market and flood the world with goods at dumping prices, undermining EU companies at home and abroad - worsening EU trade balance & compounding the "China shock" for industry.

November 19, 2024 at 12:27 PM

Hard to see how the EU would benefit from a big US-China trade war. Chinese exporters would seek to replace lost US market and flood the world with goods at dumping prices, undermining EU companies at home and abroad - worsening EU trade balance & compounding the "China shock" for industry.

Or we can recycle Eurozone's large private sector surpluses into government deficits and allow the debt-to-GDP ratio and the ECB's balance sheet to balloon up, keeping debt servicing costs contained. Having our welfare state with no growth. Like, you know, Japan.

November 19, 2024 at 9:55 AM

Or we can recycle Eurozone's large private sector surpluses into government deficits and allow the debt-to-GDP ratio and the ECB's balance sheet to balloon up, keeping debt servicing costs contained. Having our welfare state with no growth. Like, you know, Japan.

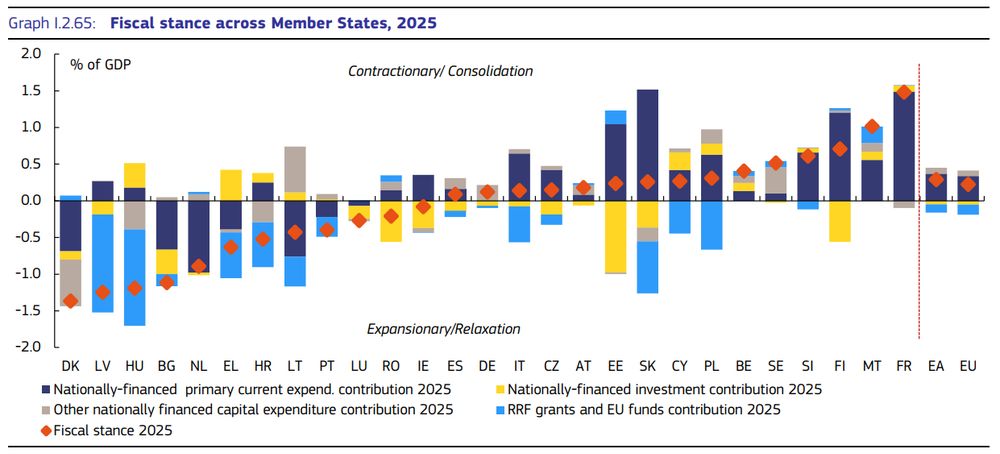

@ec.europa.eu analysis points to a sizeable fiscal tightening in EU next year.

RRF / EU funds key offset in large recipients (CEE & South Europe).

Largest tightening planned in FRA but unlikely to fully materialize.

Large loosening in DNK, LAT, HUN (big assumptions on frozen EU funds in HUN tho).

RRF / EU funds key offset in large recipients (CEE & South Europe).

Largest tightening planned in FRA but unlikely to fully materialize.

Large loosening in DNK, LAT, HUN (big assumptions on frozen EU funds in HUN tho).

November 18, 2024 at 5:00 PM

@ec.europa.eu analysis points to a sizeable fiscal tightening in EU next year.

RRF / EU funds key offset in large recipients (CEE & South Europe).

Largest tightening planned in FRA but unlikely to fully materialize.

Large loosening in DNK, LAT, HUN (big assumptions on frozen EU funds in HUN tho).

RRF / EU funds key offset in large recipients (CEE & South Europe).

Largest tightening planned in FRA but unlikely to fully materialize.

Large loosening in DNK, LAT, HUN (big assumptions on frozen EU funds in HUN tho).

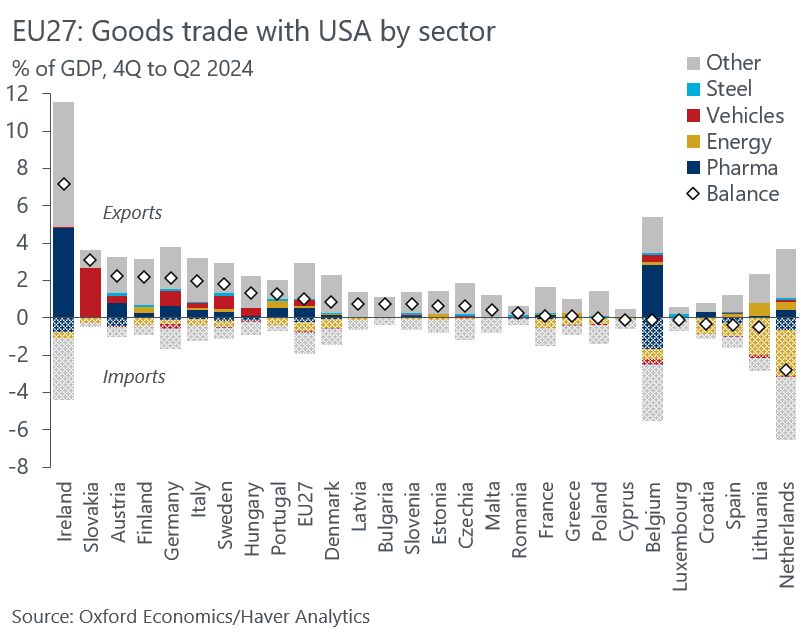

IRL, BEL, NLD have the largest direct trade exposure to US. But this is distorted by IRL contract manufacturing and large Dutch & Belgian ports handling much of EU trade. Also, their large pharma surpluses are rarely mentioned.

This leaves GER, FIN, SWE, ITA & auto-heavy CEE economies most at risk.

This leaves GER, FIN, SWE, ITA & auto-heavy CEE economies most at risk.

November 18, 2024 at 12:16 PM

IRL, BEL, NLD have the largest direct trade exposure to US. But this is distorted by IRL contract manufacturing and large Dutch & Belgian ports handling much of EU trade. Also, their large pharma surpluses are rarely mentioned.

This leaves GER, FIN, SWE, ITA & auto-heavy CEE economies most at risk.

This leaves GER, FIN, SWE, ITA & auto-heavy CEE economies most at risk.