No.

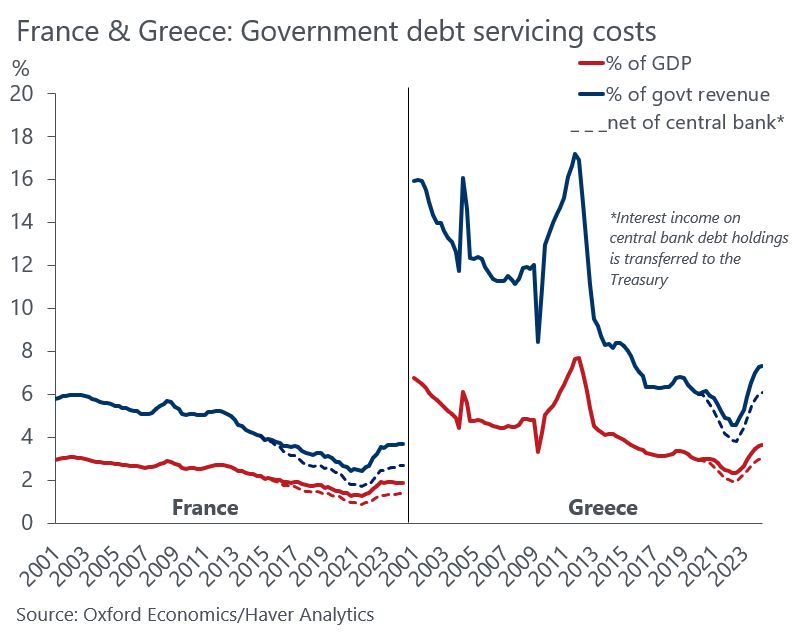

At the height of the € debt crisis, Greek govt was spending almost 20% of all its revenue on interest payments. France is spending less than 4% (even less when subtracting interest paid on debt held by central bank).

No.

At the height of the € debt crisis, Greek govt was spending almost 20% of all its revenue on interest payments. France is spending less than 4% (even less when subtracting interest paid on debt held by central bank).

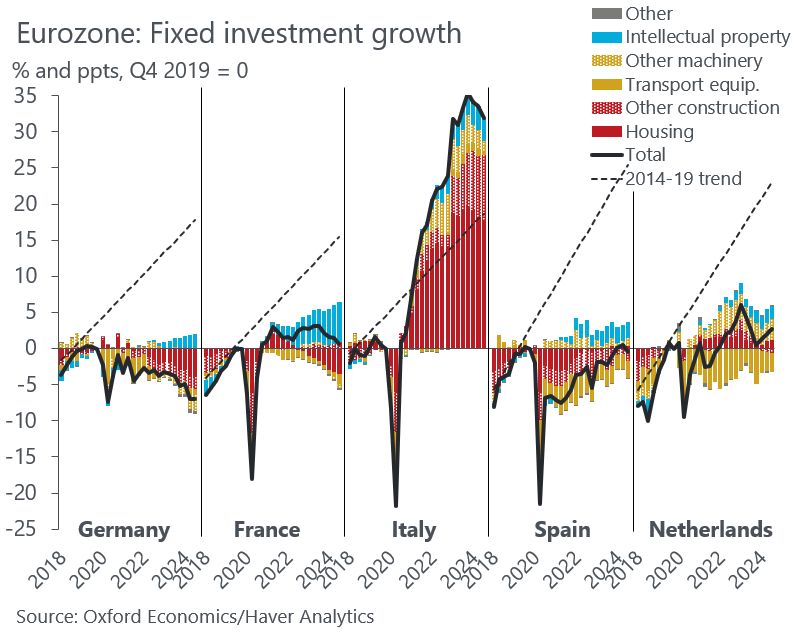

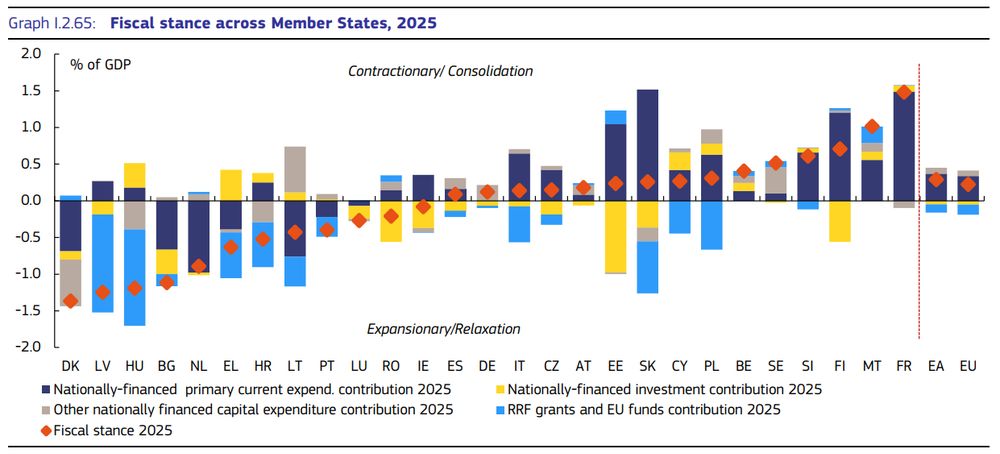

RRF / EU funds key offset in large recipients (CEE & South Europe).

Largest tightening planned in FRA but unlikely to fully materialize.

Large loosening in DNK, LAT, HUN (big assumptions on frozen EU funds in HUN tho).

RRF / EU funds key offset in large recipients (CEE & South Europe).

Largest tightening planned in FRA but unlikely to fully materialize.

Large loosening in DNK, LAT, HUN (big assumptions on frozen EU funds in HUN tho).

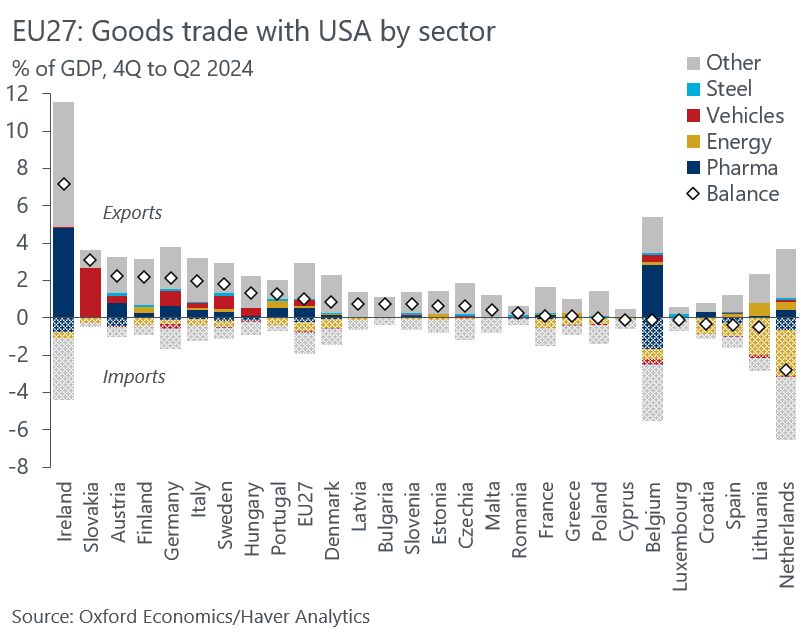

This leaves GER, FIN, SWE, ITA & auto-heavy CEE economies most at risk.

This leaves GER, FIN, SWE, ITA & auto-heavy CEE economies most at risk.