Chirag Lala

@cthelala.bsky.social

Indian-American. VP of Research & Chief Economist at Center for Public Enterprise. PhD Candidate at UMass Economics. Macro + Finance + Industrial Policy + Decarbonization + Grids + Investment

https://publicenterprise.org/author/chirag/

https://publicenterprise.org/author/chirag/

Last hurrah for me and the tax credits till IRA 2.0!

Leased my first EV!

Leased my first EV!

September 6, 2025 at 7:15 PM

Last hurrah for me and the tax credits till IRA 2.0!

Leased my first EV!

Leased my first EV!

This from @aarmlovi.bsky.social is the best path forward with AVs. It's also @johnericson.me thought iirc.

Labor, congestion, vehicle utilization, and safety are all constraints on mobility (and hence growth). Let's use automation to tackle all and enhance our transit systems.

Labor, congestion, vehicle utilization, and safety are all constraints on mobility (and hence growth). Let's use automation to tackle all and enhance our transit systems.

August 31, 2025 at 3:30 PM

This from @aarmlovi.bsky.social is the best path forward with AVs. It's also @johnericson.me thought iirc.

Labor, congestion, vehicle utilization, and safety are all constraints on mobility (and hence growth). Let's use automation to tackle all and enhance our transit systems.

Labor, congestion, vehicle utilization, and safety are all constraints on mobility (and hence growth). Let's use automation to tackle all and enhance our transit systems.

Huge huge fan!

Though I'm a big believer public entities need / benefit from derisking policies as well. Tax credits helped BPRA pass, would've helped even more if they were transferable + depreciable by public entities. NYPA also needs the authority to build infra ahead of time.

Though I'm a big believer public entities need / benefit from derisking policies as well. Tax credits helped BPRA pass, would've helped even more if they were transferable + depreciable by public entities. NYPA also needs the authority to build infra ahead of time.

August 26, 2025 at 6:06 PM

Huge huge fan!

Though I'm a big believer public entities need / benefit from derisking policies as well. Tax credits helped BPRA pass, would've helped even more if they were transferable + depreciable by public entities. NYPA also needs the authority to build infra ahead of time.

Though I'm a big believer public entities need / benefit from derisking policies as well. Tax credits helped BPRA pass, would've helped even more if they were transferable + depreciable by public entities. NYPA also needs the authority to build infra ahead of time.

Great snippet from @lovering.bsky.social.

It is wrong to suggest the economics of nuclear power are intrinsically bad. Policy makes the economics.

It is wrong to suggest the economics of nuclear power are intrinsically bad. Policy makes the economics.

August 25, 2025 at 5:14 PM

Great snippet from @lovering.bsky.social.

It is wrong to suggest the economics of nuclear power are intrinsically bad. Policy makes the economics.

It is wrong to suggest the economics of nuclear power are intrinsically bad. Policy makes the economics.

PSA that GDP critics should not reason from accounting identities.

August 16, 2025 at 7:30 PM

PSA that GDP critics should not reason from accounting identities.

Bookmarking this from @robinsonmeyer.bsky.social because I think it's true and because a lot of overlapping intra-party alliances (both natural and strange) can find their preferred visions in the mix.

August 3, 2025 at 6:08 PM

Bookmarking this from @robinsonmeyer.bsky.social because I think it's true and because a lot of overlapping intra-party alliances (both natural and strange) can find their preferred visions in the mix.

I love this 2010s-ish (?) boxy housing aesthetic. Sighted near Lebanon, NH.

August 1, 2025 at 10:07 PM

I love this 2010s-ish (?) boxy housing aesthetic. Sighted near Lebanon, NH.

This from @davidbeckworth.bsky.social is excellent. Rising public debt limits CB autonomy to set rates how the CB might wish.

They need (expect?) governments to complement tight money with fiscal consolidation. A government without a strong forex constraint has a lot of bargaining power to refuse.

They need (expect?) governments to complement tight money with fiscal consolidation. A government without a strong forex constraint has a lot of bargaining power to refuse.

July 26, 2025 at 2:01 AM

This from @davidbeckworth.bsky.social is excellent. Rising public debt limits CB autonomy to set rates how the CB might wish.

They need (expect?) governments to complement tight money with fiscal consolidation. A government without a strong forex constraint has a lot of bargaining power to refuse.

They need (expect?) governments to complement tight money with fiscal consolidation. A government without a strong forex constraint has a lot of bargaining power to refuse.

This is wild to read given the insufficient pace of renewable penetration and interconnection reform, the nimbyism surrounding T&D, and the ongoing concerns around electrification cost + winter fuel supplies.

Imagine if we still had Vermont Yankee, Pilgrim Station, or Yankee Rowe.

Imagine if we still had Vermont Yankee, Pilgrim Station, or Yankee Rowe.

July 19, 2025 at 3:07 PM

This is wild to read given the insufficient pace of renewable penetration and interconnection reform, the nimbyism surrounding T&D, and the ongoing concerns around electrification cost + winter fuel supplies.

Imagine if we still had Vermont Yankee, Pilgrim Station, or Yankee Rowe.

Imagine if we still had Vermont Yankee, Pilgrim Station, or Yankee Rowe.

CPE's @pewilliams.bsky.social praising NYPA's 3 GW renewable project pipeline in an article by our friend @fredstaffordcs.bsky.social which celebrates Gov Hochul's directive that NYPA build a nuclear plant upstate.

Public developers can end inter-generational conflict.

jacobin.com/2025/07/hoch...

Public developers can end inter-generational conflict.

jacobin.com/2025/07/hoch...

July 19, 2025 at 2:57 PM

CPE's @pewilliams.bsky.social praising NYPA's 3 GW renewable project pipeline in an article by our friend @fredstaffordcs.bsky.social which celebrates Gov Hochul's directive that NYPA build a nuclear plant upstate.

Public developers can end inter-generational conflict.

jacobin.com/2025/07/hoch...

Public developers can end inter-generational conflict.

jacobin.com/2025/07/hoch...

The fourth piece is important too: preventing job losses. Crucial to integrate their proposed measures with a far stronger countercyclical macro stance.

The 2001 recession helped make the first China Shock. So it's vital we ensure industrial and labor adjustment occur during healthy labor markets.

The 2001 recession helped make the first China Shock. So it's vital we ensure industrial and labor adjustment occur during healthy labor markets.

July 15, 2025 at 5:41 AM

The fourth piece is important too: preventing job losses. Crucial to integrate their proposed measures with a far stronger countercyclical macro stance.

The 2001 recession helped make the first China Shock. So it's vital we ensure industrial and labor adjustment occur during healthy labor markets.

The 2001 recession helped make the first China Shock. So it's vital we ensure industrial and labor adjustment occur during healthy labor markets.

A smart call for American industrial policy with 3 notable components:

1) Chinese FDI

2) a large-scale public venture fund strategy

3) Ingredients: a politically insulated strategic investment capacity, cheap energy, federal support to higher ed + R&D, immigration

www.nytimes.com/2025/07/14/o...

1) Chinese FDI

2) a large-scale public venture fund strategy

3) Ingredients: a politically insulated strategic investment capacity, cheap energy, federal support to higher ed + R&D, immigration

www.nytimes.com/2025/07/14/o...

July 15, 2025 at 5:41 AM

A smart call for American industrial policy with 3 notable components:

1) Chinese FDI

2) a large-scale public venture fund strategy

3) Ingredients: a politically insulated strategic investment capacity, cheap energy, federal support to higher ed + R&D, immigration

www.nytimes.com/2025/07/14/o...

1) Chinese FDI

2) a large-scale public venture fund strategy

3) Ingredients: a politically insulated strategic investment capacity, cheap energy, federal support to higher ed + R&D, immigration

www.nytimes.com/2025/07/14/o...

Motivation of this thread is to disagree with Michael’s thinking that taxes on those outflows can really change country behavior.

Moreover, if you impose this system, export-reliant countries would already have agreed to change their policies. It still need not result in more “balanced” accounts.

Moreover, if you impose this system, export-reliant countries would already have agreed to change their policies. It still need not result in more “balanced” accounts.

July 8, 2025 at 2:12 PM

Motivation of this thread is to disagree with Michael’s thinking that taxes on those outflows can really change country behavior.

Moreover, if you impose this system, export-reliant countries would already have agreed to change their policies. It still need not result in more “balanced” accounts.

Moreover, if you impose this system, export-reliant countries would already have agreed to change their policies. It still need not result in more “balanced” accounts.

This is the rub. Taxing behaviors to induce fundamental policy change is really tough. It’s true of negative interest rates. True of capital inflow taxes. It’s true of reserve holdings (the comment below anticipates Brad Setser’s work on Chinese reserve holdings).

July 8, 2025 at 2:07 PM

This is the rub. Taxing behaviors to induce fundamental policy change is really tough. It’s true of negative interest rates. True of capital inflow taxes. It’s true of reserve holdings (the comment below anticipates Brad Setser’s work on Chinese reserve holdings).

Similarly, getting China to agree to effectively change its policy surrounding the current account is a much tougher lift than incenting a switch from USD to SDRs.

They’d have to change domestic policy around redistribution and consumption while possibly liberalizing their capital markets!

They’d have to change domestic policy around redistribution and consumption while possibly liberalizing their capital markets!

July 8, 2025 at 2:07 PM

Similarly, getting China to agree to effectively change its policy surrounding the current account is a much tougher lift than incenting a switch from USD to SDRs.

They’d have to change domestic policy around redistribution and consumption while possibly liberalizing their capital markets!

They’d have to change domestic policy around redistribution and consumption while possibly liberalizing their capital markets!

Another issue is “the day of reckoning has to come in the end.” It never did for American or European debt. Both blocs could have run even more expansionary policy in the 2010s but chose not to. That’s not a system consequence, that’s bad domestic policy.

July 8, 2025 at 2:07 PM

Another issue is “the day of reckoning has to come in the end.” It never did for American or European debt. Both blocs could have run even more expansionary policy in the 2010s but chose not to. That’s not a system consequence, that’s bad domestic policy.

Seems untenable to describe 2003 - 2009 American macro policy as 1) Keynesian (sufficiently or excessively expansionary); 2) *causing* an asset or consumption boom.

From Skidelsky & Joshi 2010 on international monetary reform.

From Skidelsky & Joshi 2010 on international monetary reform.

July 8, 2025 at 2:07 PM

Seems untenable to describe 2003 - 2009 American macro policy as 1) Keynesian (sufficiently or excessively expansionary); 2) *causing* an asset or consumption boom.

From Skidelsky & Joshi 2010 on international monetary reform.

From Skidelsky & Joshi 2010 on international monetary reform.

Talk to an economist *before* you say stuff like this.

July 6, 2025 at 9:27 PM

Talk to an economist *before* you say stuff like this.

Trouble with bancor literature is there’s no clear reason 1) why minimizing imbalances should be a goal; 2) why forced devaluations on countries deemed to have excessive deficits are necessarily superior or even different to the USD system; 3) what surplus country interest penalties aim to do. 🧵

July 6, 2025 at 5:33 PM

Trouble with bancor literature is there’s no clear reason 1) why minimizing imbalances should be a goal; 2) why forced devaluations on countries deemed to have excessive deficits are necessarily superior or even different to the USD system; 3) what surplus country interest penalties aim to do. 🧵

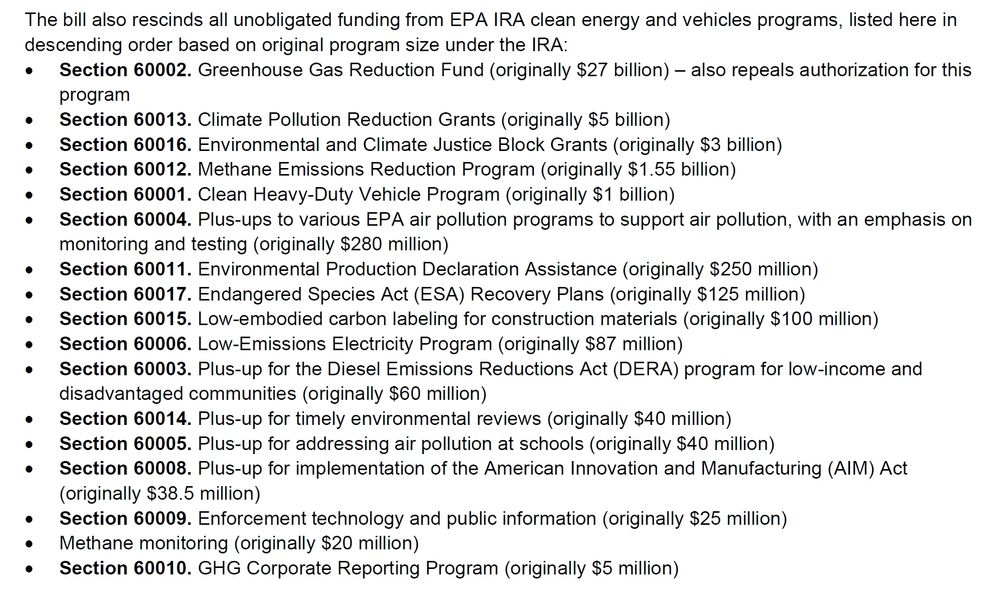

Methane fee paused for ten years. Between 2024-2026, it was supposed to ramp from $900 - $1500 per ton. Funding for IRA clean transport programs is gone as are civil penalties for violating CAFE standards.

July 4, 2025 at 2:06 PM

Methane fee paused for ten years. Between 2024-2026, it was supposed to ramp from $900 - $1500 per ton. Funding for IRA clean transport programs is gone as are civil penalties for violating CAFE standards.

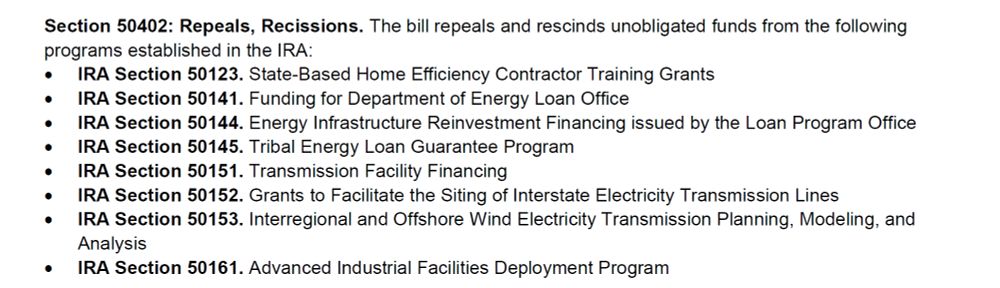

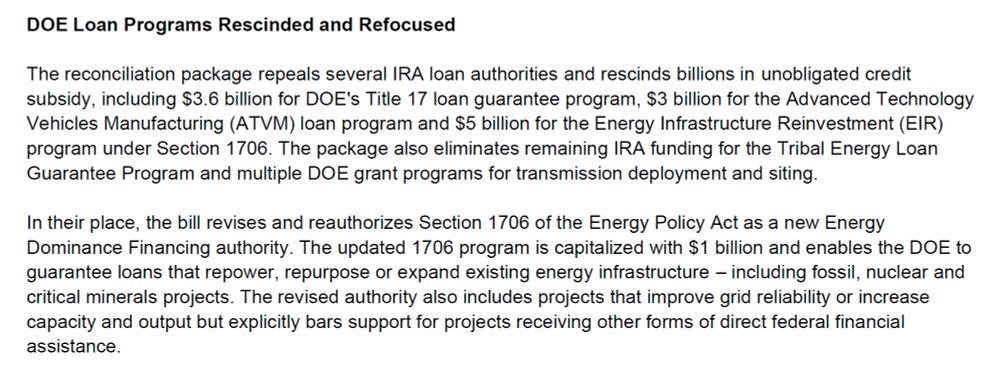

Wreckage of OBBB (Holland & Knight).

Financing for transmission development, tribal + state-led projects, manufacturing projects all see funding rescinded. Previous LPO facilities like SEFI & innovative tech replaced by an EIR-style authority for brownfield development. GGRF & CPRG rescinded.

Financing for transmission development, tribal + state-led projects, manufacturing projects all see funding rescinded. Previous LPO facilities like SEFI & innovative tech replaced by an EIR-style authority for brownfield development. GGRF & CPRG rescinded.

July 4, 2025 at 2:00 PM

Wreckage of OBBB (Holland & Knight).

Financing for transmission development, tribal + state-led projects, manufacturing projects all see funding rescinded. Previous LPO facilities like SEFI & innovative tech replaced by an EIR-style authority for brownfield development. GGRF & CPRG rescinded.

Financing for transmission development, tribal + state-led projects, manufacturing projects all see funding rescinded. Previous LPO facilities like SEFI & innovative tech replaced by an EIR-style authority for brownfield development. GGRF & CPRG rescinded.

The line about tax credits is unfortunate and way too common. We've learned a ton in recent years about forging them into effective tools of redistribution and investment. Those same innovations make credits less "inscrutable."

The GOP is trying to torch that progress for a reason.

The GOP is trying to torch that progress for a reason.

June 30, 2025 at 5:34 AM

The line about tax credits is unfortunate and way too common. We've learned a ton in recent years about forging them into effective tools of redistribution and investment. Those same innovations make credits less "inscrutable."

The GOP is trying to torch that progress for a reason.

The GOP is trying to torch that progress for a reason.

Outstanding news. There’s a lot of support NYPA will need, but a major public power advantage is it can make more credible commitments big capital projects. We already see it with the renewables deployment. Onwards to clean firm! Thanks to @fredstaffordcs.bsky.social for flagging this.

June 23, 2025 at 3:19 PM

Outstanding news. There’s a lot of support NYPA will need, but a major public power advantage is it can make more credible commitments big capital projects. We already see it with the renewables deployment. Onwards to clean firm! Thanks to @fredstaffordcs.bsky.social for flagging this.

These passages ring especially. To say nothing of the policy recommendations.

There's basically no downside / fiscal risk to the US from using fiscal policy for socially beneficial investments and to offset any macro downsides of a trade deficit. It's also better for ROW that we do this.

There's basically no downside / fiscal risk to the US from using fiscal policy for socially beneficial investments and to offset any macro downsides of a trade deficit. It's also better for ROW that we do this.

June 18, 2025 at 10:09 PM

These passages ring especially. To say nothing of the policy recommendations.

There's basically no downside / fiscal risk to the US from using fiscal policy for socially beneficial investments and to offset any macro downsides of a trade deficit. It's also better for ROW that we do this.

There's basically no downside / fiscal risk to the US from using fiscal policy for socially beneficial investments and to offset any macro downsides of a trade deficit. It's also better for ROW that we do this.