Enduring Structural Power? Assessing the Dominance of the Anglosphere in Global Finance Before the Trump Turn

Includes novel visualizations of global finance (banking, portfolio inv & FDI) showing persistent US centrality

hrcak.srce.hr/clanak/487488

Intl Jet fuel tax exemptions are 80 years old and cost the EU 22 million EUR/yr for the Paris-Berlin route alone.

And you're cutting... the sleeper?

www.theguardian.com/travel/2025/...

Intl Jet fuel tax exemptions are 80 years old and cost the EU 22 million EUR/yr for the Paris-Berlin route alone.

And you're cutting... the sleeper?

www.theguardian.com/travel/2025/...

Bent into Submission? Domestic Investors and Populist Governments - cup.org/4l2b2l5

- Alison L. Johnston & @excubs.bsky.social

#FirstView

www.ft.com/content/d593...

www.ft.com/content/d593...

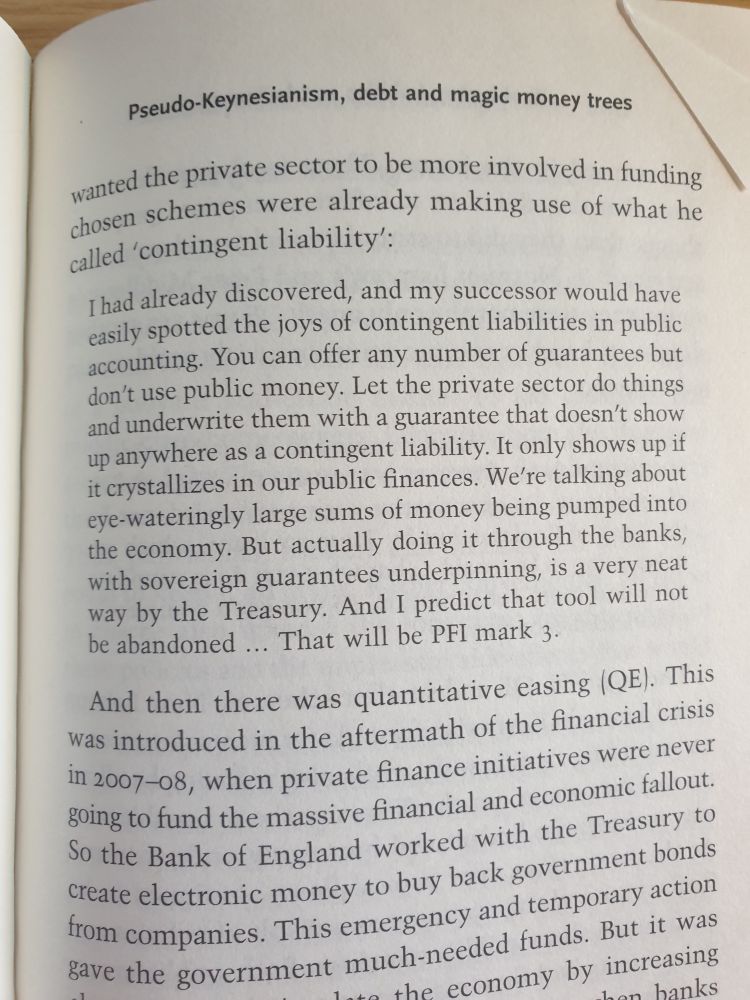

Only last year, the Treasury paid the Bank of England around 40bn for its 'losses' on the QE gilt portfolio.

It didnt have to. No other central bank expects to be compensated.

Sources says government is ‘not going to find a way’ to ditch cap despite predictions that child poverty levels will soar.

www.theguardian.com/society/2025...

Only last year, the Treasury paid the Bank of England around 40bn for its 'losses' on the QE gilt portfolio.

It didnt have to. No other central bank expects to be compensated.

'we must recognize how foundational coercive power, and thus coercive policy, is to sustaining a well-ordered democratic state'

www.tandfonline.com/doi/full/10....

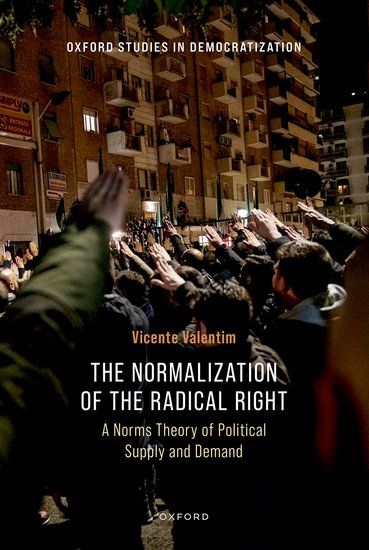

His theory of normalization not just helps explain recent rise of far right but also warns for overestimating strength of democracy.

His theory of normalization not just helps explain recent rise of far right but also warns for overestimating strength of democracy.

www.tandfonline.com/doi/full/10....

www.tandfonline.com/doi/full/10....

"Colonial patterns of extraction plainly did not disappear with the withdrawal of troops, flags and bureaucrats."

www.theguardian.com/commentisfre...

"Colonial patterns of extraction plainly did not disappear with the withdrawal of troops, flags and bureaucrats."

www.theguardian.com/commentisfre...

www.phenomenalworld.org/analysis/new...

www.phenomenalworld.org/analysis/new...

➡️70% of Germans endorse the ECB’s engagement on climate

➡️Only 17-20% are concerned that the ECB’s climate actions compromise price stability or ECB independence

➡️Bundesbank staff tend to overestimate the impact of green monetary policy on inflation expectations😏

www.tandfonline.com/doi/full/10....

www.ucl.ac.uk/bartlett/pub...

www.ucl.ac.uk/bartlett/pub...

www.lrb.co.uk/the-paper/v1...

www.lrb.co.uk/the-paper/v1...