In one camp are officials like Hammack (Cleveland), who told @nytimes.com she preferred not to cut last month and suggested a December one was not needed. Others are more worried about the labor market

In one camp are officials like Hammack (Cleveland), who told @nytimes.com she preferred not to cut last month and suggested a December one was not needed. Others are more worried about the labor market

www.nytimes.com/2025/10/28/b... @nytimes.com

www.nytimes.com/2025/10/28/b... @nytimes.com

www.nytimes.com/2025/10/19/b... @nytimes.com

www.nytimes.com/2025/10/19/b... @nytimes.com

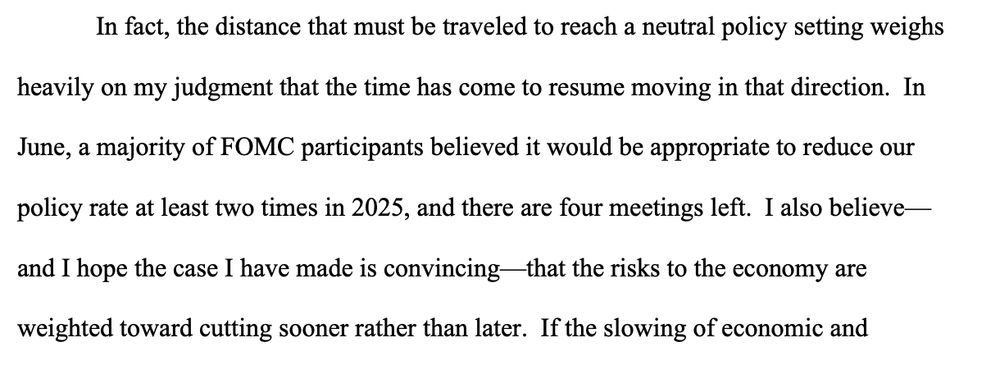

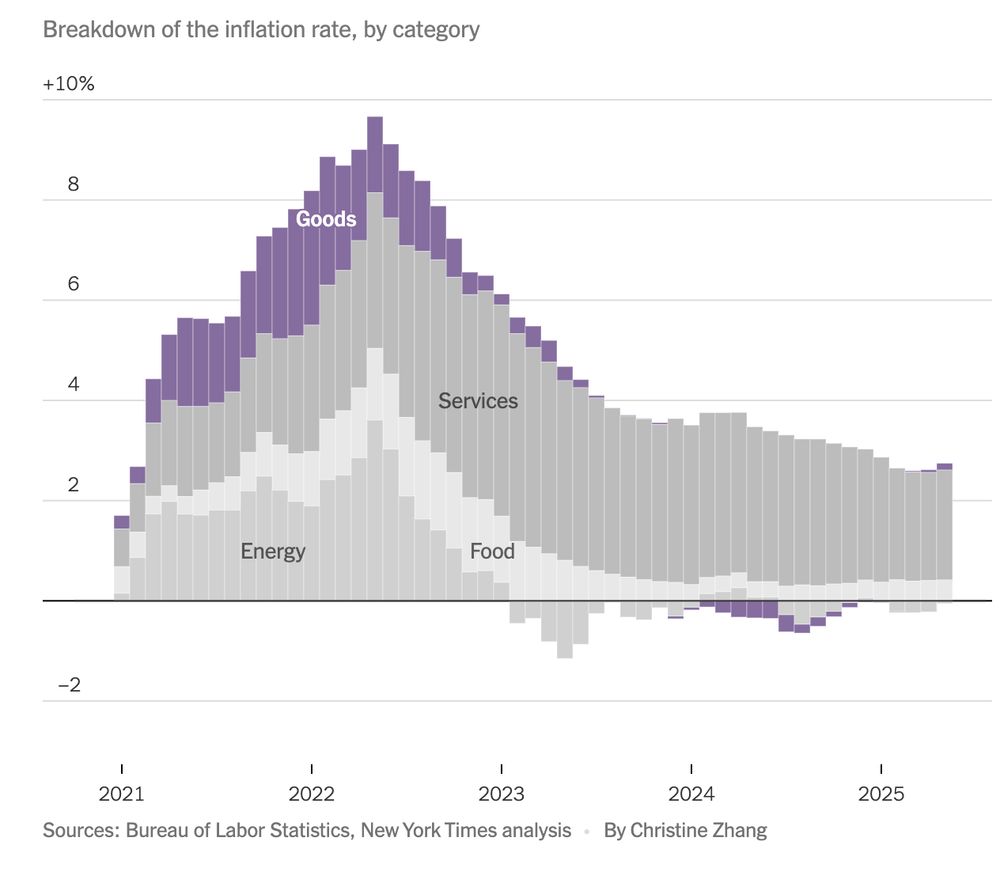

"With inflation near target and the upside risks to inflation limited, we should not wait until the labor market deteriorates before we cut the policy rate"

"With inflation near target and the upside risks to inflation limited, we should not wait until the labor market deteriorates before we cut the policy rate"

www.nytimes.com/2025/07/15/b... @nytimes.com

www.nytimes.com/2025/07/15/b... @nytimes.com

That 'wait-and-see' approach keeps it on a collision course with the president with little reprieve in sight

nytimes.com/2025/06/19/b... @tonyromm.bsky.social @nytimes.com

That 'wait-and-see' approach keeps it on a collision course with the president with little reprieve in sight

nytimes.com/2025/06/19/b... @tonyromm.bsky.social @nytimes.com

Economists are split as to whether it will show 1 or 2 cuts this year

www.nytimes.com/live/2025/06...

Economists are split as to whether it will show 1 or 2 cuts this year

www.nytimes.com/live/2025/06...

www.nytimes.com/2025/06/17/o... @nytimes.com

www.nytimes.com/2025/06/17/o... @nytimes.com

www.nytimes.com/2025/06/17/b... @nytimes.com

www.nytimes.com/2025/06/17/b... @nytimes.com

www.nytimes.com/2025/06/13/b... @nytimes.com

www.nytimes.com/2025/06/13/b... @nytimes.com

"It is crucial to examine how possible changes in the role of U.S. financial assets as a safe haven might affect financial stability"

"It is crucial to examine how possible changes in the role of U.S. financial assets as a safe haven might affect financial stability"