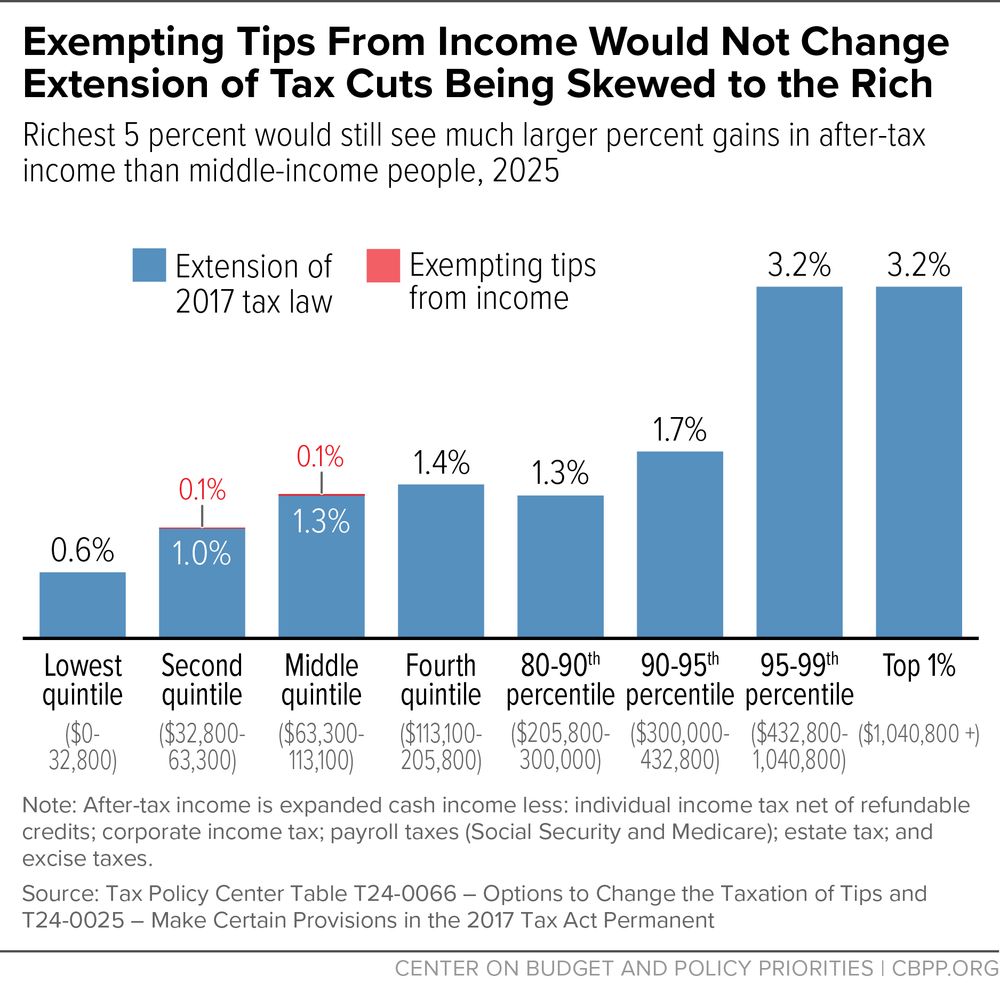

www.cbpp.org/research/fed...

www.cbpp.org/research/fed...

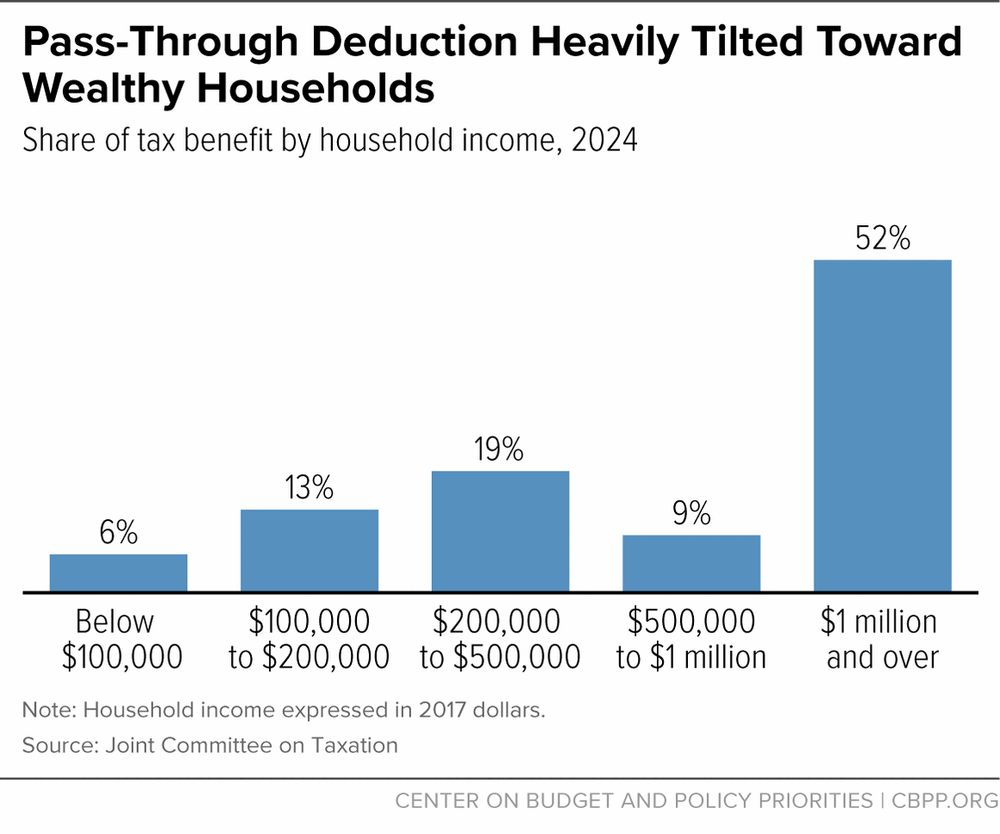

www.cbo.gov/system/files...

www.cbo.gov/system/files...

www.dallasfed.org/~/media/docu...

www.dallasfed.org/~/media/docu...

stacker.com/stories/busi...

stacker.com/stories/busi...

x.com/sarahL202/st...

x.com/sarahL202/st...