www.cbo.gov/system/files...

www.cbo.gov/system/files...

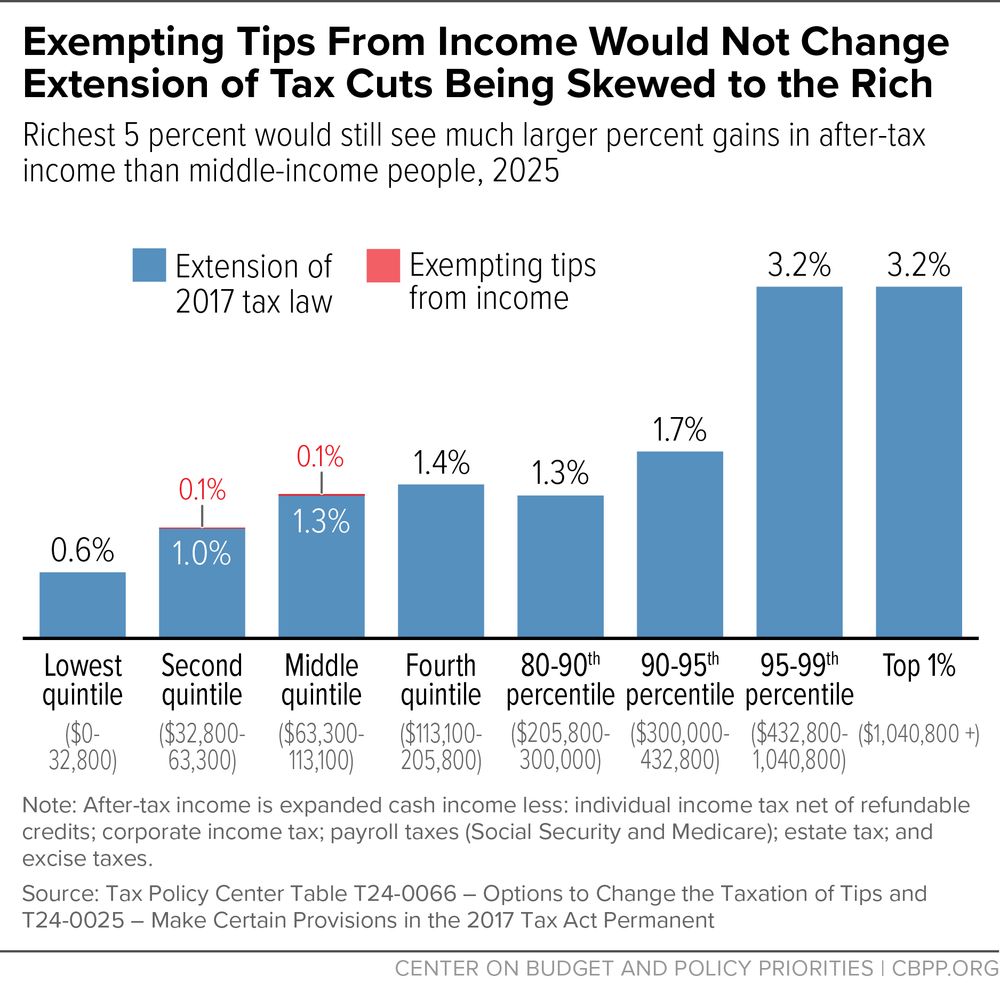

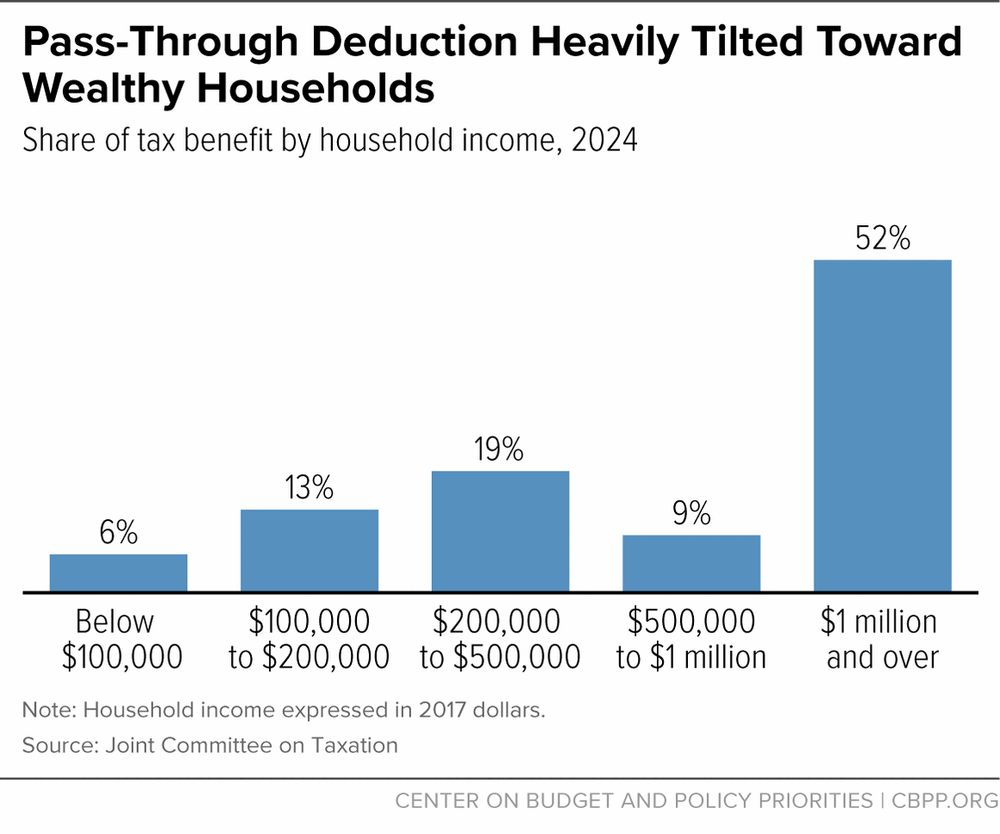

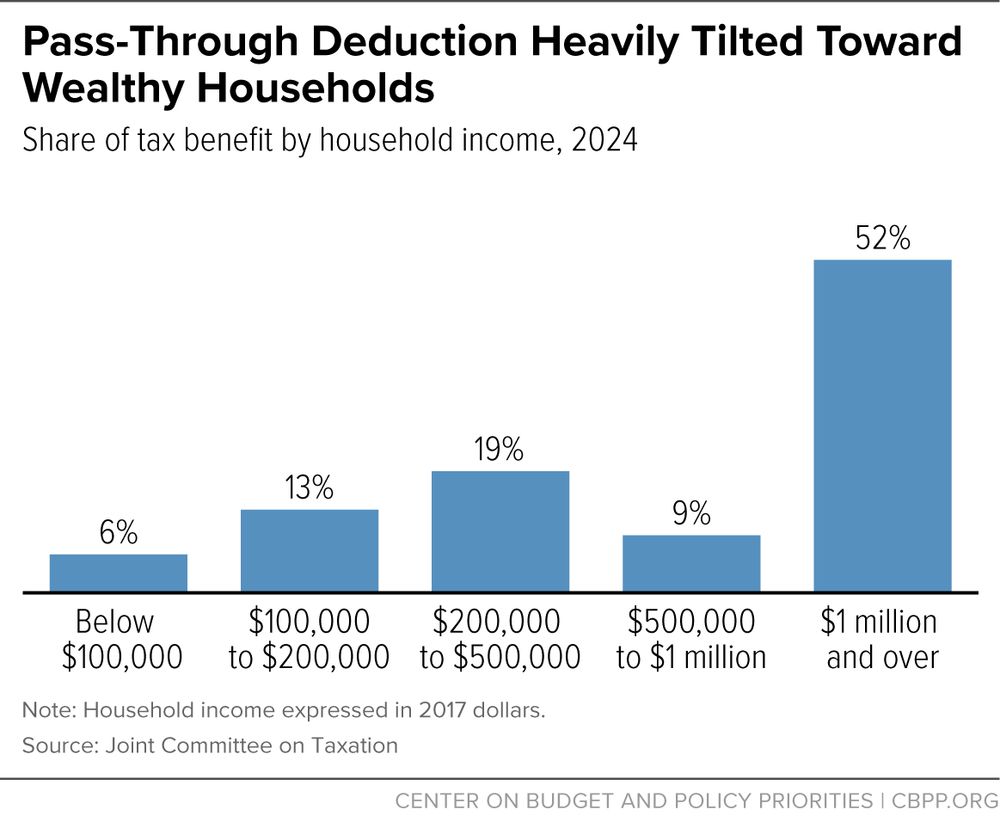

This is bad policy that Rs seem determined to enact but doesn’t move the needle for working-class people & doesn’t change what Rs are doing: massive tax cuts for the rich

This is bad policy that Rs seem determined to enact but doesn’t move the needle for working-class people & doesn’t change what Rs are doing: massive tax cuts for the rich

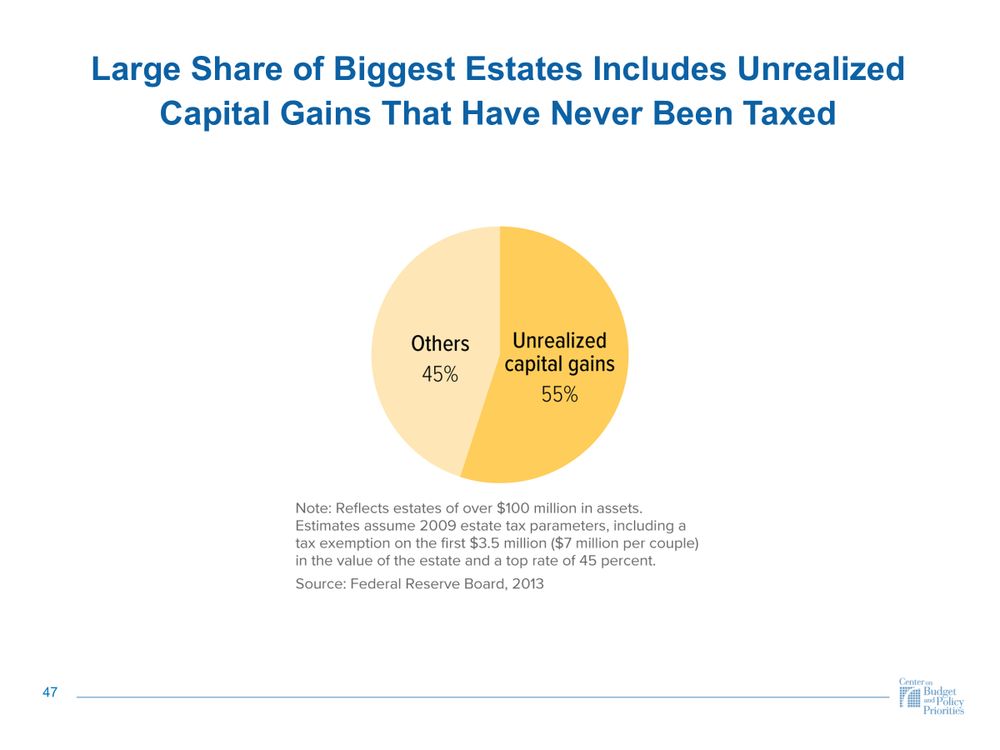

That didn’t happen ⬇️

That didn’t happen ⬇️