Job postings: data.indeed.com#/postings

Remote work: data.indeed.com#/remote

AI and GenAI: data.indeed.com#/ai

Wage growth: data.indeed.com#/wages (not available in Australia)

Check it out!

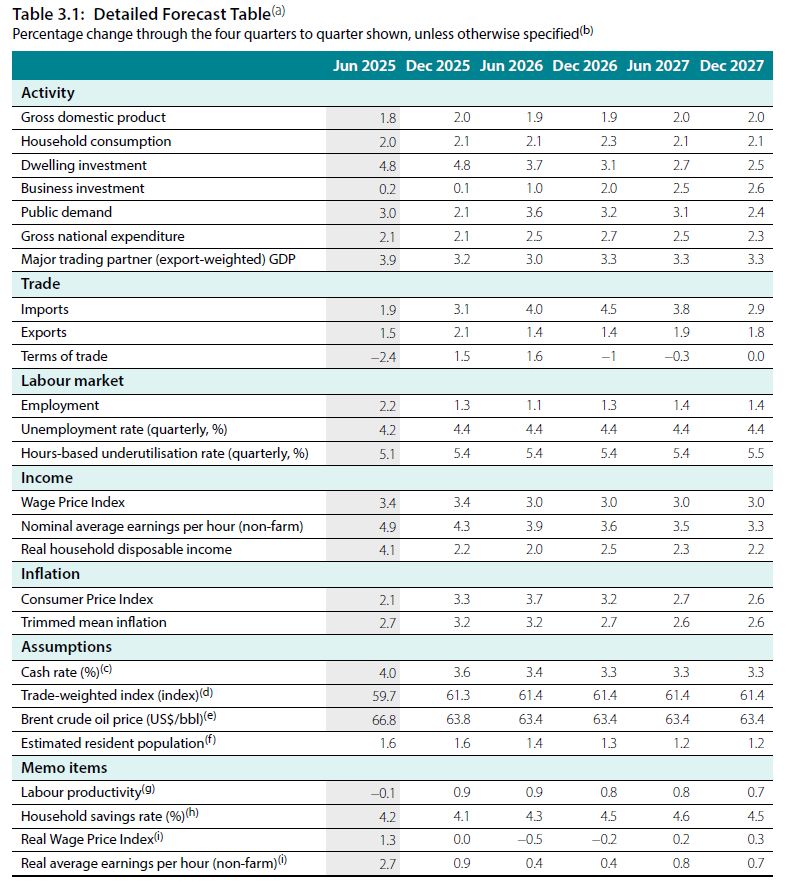

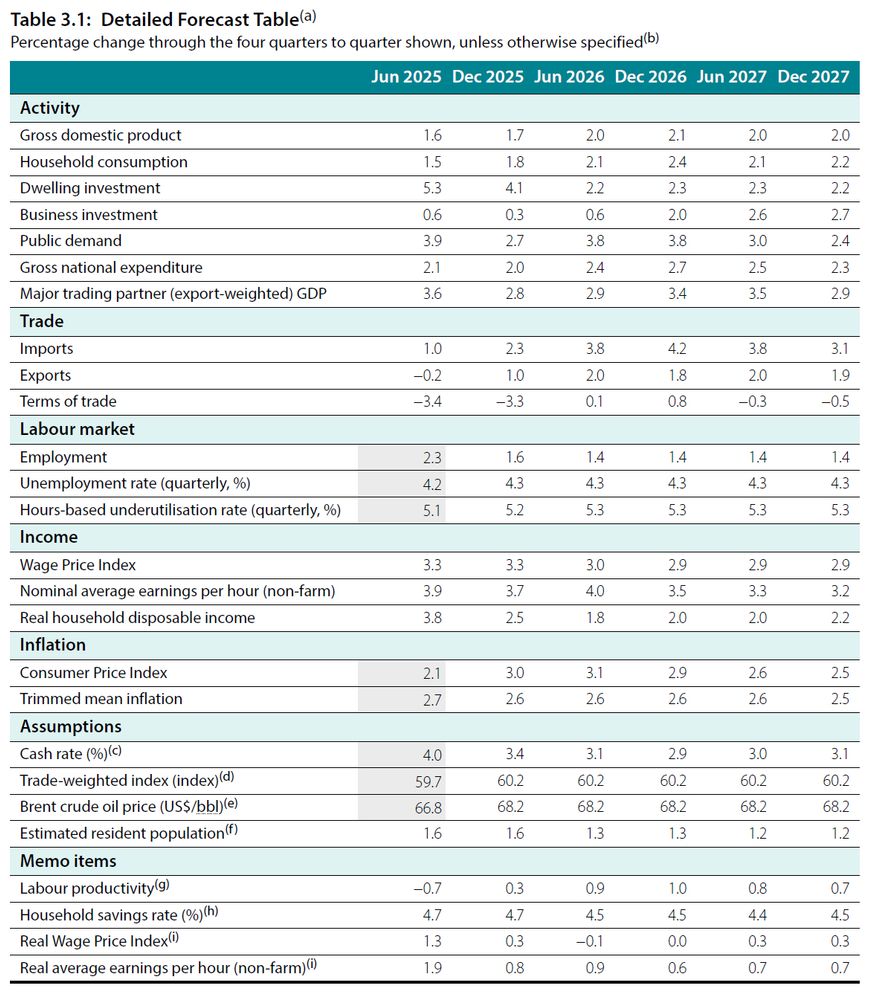

Trimmed mean inflation revised higher (3.2% in Dec-25 compared to 2.6% previously).

Unemployment rate revised higher (4.4% in Dec-25 compared to 4.3% previously). This one seems too optimistic to me!

Trimmed mean inflation revised higher (3.2% in Dec-25 compared to 2.6% previously).

Unemployment rate revised higher (4.4% in Dec-25 compared to 4.3% previously). This one seems too optimistic to me!

And if you are wondering why it's because employment growth has slowed significantly. Up 116k from January to September this year, compared to 323k over the same period last year #ausbiz #auspol

Employment is up just 103k this year, compared to +282k over the same period last year.

If that doesn't pick up soon, a spike in the unemployment rate is inevitable #ausbiz #auspol

Employment is up just 103k this year, compared to +282k over the same period last year.

If that doesn't pick up soon, a spike in the unemployment rate is inevitable #ausbiz #auspol

By comparison, consumer prices have increased by 2% over the past year.

By comparison, consumer prices have increased by 2% over the past year.

And yet the debate is dominated by tweaks to tax policy #auspol

And yet the debate is dominated by tweaks to tax policy #auspol

Unemployment and inflation forecasts unchanged from 3 months ago.

GDP growth 1.7% in Dec 2025 (vs 2.1% previously) and 2.1% in Dec 2026 (vs 2.2%).

Cash rate is assumed to drop to 2.9% in the Dec quarter next year, compared to 3.6% as of today #ausbiz

Unemployment and inflation forecasts unchanged from 3 months ago.

GDP growth 1.7% in Dec 2025 (vs 2.1% previously) and 2.1% in Dec 2026 (vs 2.2%).

Cash rate is assumed to drop to 2.9% in the Dec quarter next year, compared to 3.6% as of today #ausbiz

The timing ultimately won't impact the economy in a meaningful way, but the failure to cut last month is still one of the weirder RBA decisions I've seen.

Massive comms blunder, hurt their credibility and for what?

The timing ultimately won't impact the economy in a meaningful way, but the failure to cut last month is still one of the weirder RBA decisions I've seen.

Massive comms blunder, hurt their credibility and for what?

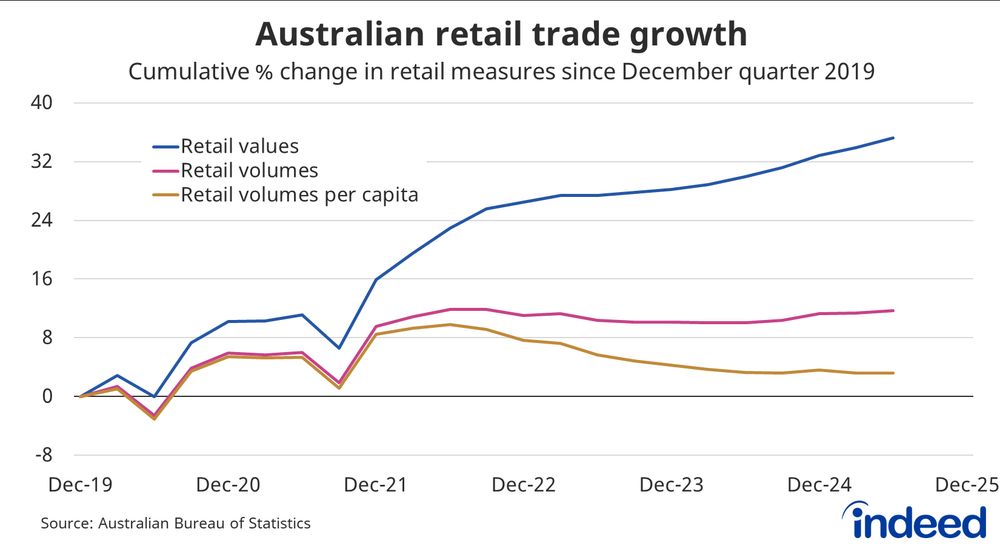

But the volume of goods sold has been broadly unchanged in recent years, due to higher prices.

And volume per capita is almost 6% below its peak.

So we are spending more, but consuming less #ausbiz

But the volume of goods sold has been broadly unchanged in recent years, due to higher prices.

And volume per capita is almost 6% below its peak.

So we are spending more, but consuming less #ausbiz

That's a good sign that domestic price pressures have eased.

That's a good sign that domestic price pressures have eased.

The RBA has achieved its inflation target over the past decade and they've achieved it by pretty consistently missing the target most years.

Undershooting in the years before the pandemic and then overshooting during the cost-of-living crisis.

The RBA has achieved its inflation target over the past decade and they've achieved it by pretty consistently missing the target most years.

Undershooting in the years before the pandemic and then overshooting during the cost-of-living crisis.

The result is slightly stronger than the RBA's forecasts from May, but it should dip towards 2.5% next quarter.

Is that sufficient for the RBA to cut rates? Perhaps not on its own.

The result is slightly stronger than the RBA's forecasts from May, but it should dip towards 2.5% next quarter.

Is that sufficient for the RBA to cut rates? Perhaps not on its own.

They've backed themselves into a corner tying the decision so closely with the quarterly inflation figures. Particularly in an economic environment where backward-looking economic data has rightfully taken a backseat to geopolitical & economic uncertainty.

They've backed themselves into a corner tying the decision so closely with the quarterly inflation figures. Particularly in an economic environment where backward-looking economic data has rightfully taken a backseat to geopolitical & economic uncertainty.