Inflation will exceed the Fed's target for a fifth straight year this year-- not great! -- but Black workers' jobs data are sounding klaxons that shouldn't be ignored

Inflation will exceed the Fed's target for a fifth straight year this year-- not great! -- but Black workers' jobs data are sounding klaxons that shouldn't be ignored

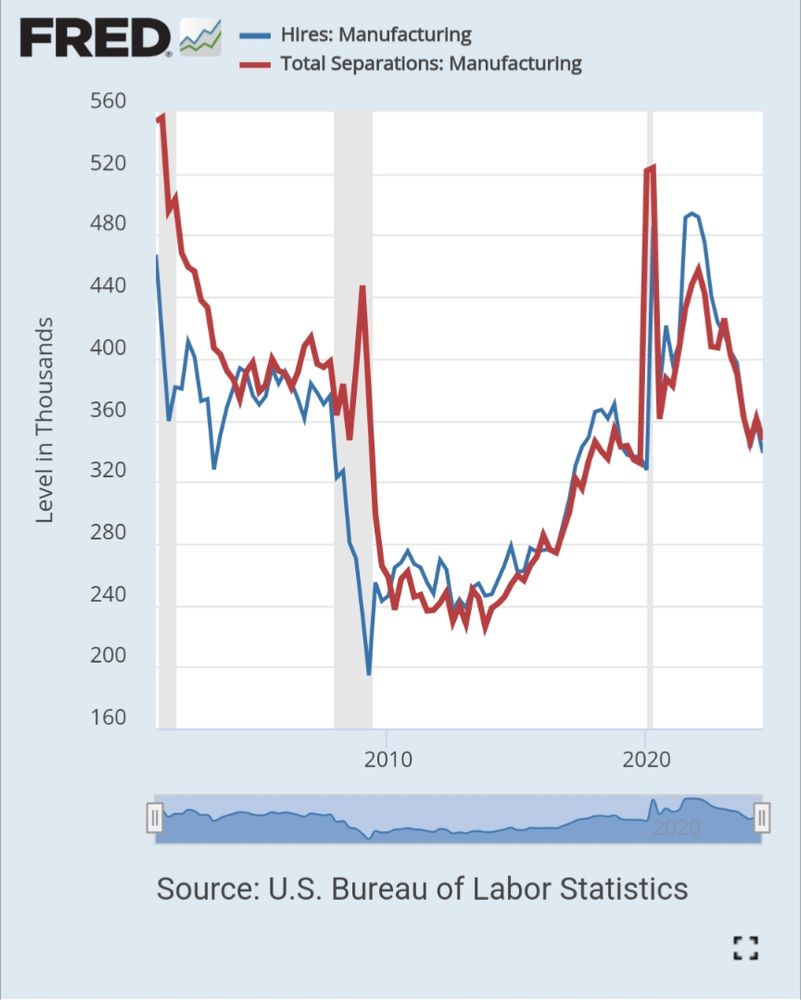

fred.stlouisfed.org/graph/fredgr...

fred.stlouisfed.org/graph/fredgr...

People who are afraid of losing their jobs aren't buying houses or cars, aren't going on vacation, aren't going out to eat.

Bad, bad news.

People who are afraid of losing their jobs aren't buying houses or cars, aren't going on vacation, aren't going out to eat.

Bad, bad news.

Markets, Rocked by Trump, Show Economic Fear Across Wall Street,

or

Markets Rocked by Trump Show,

Economic Fear Across Wall Street?

Works either way I suppose, well done folks

Markets, Rocked by Trump, Show Economic Fear Across Wall Street,

or

Markets Rocked by Trump Show,

Economic Fear Across Wall Street?

Works either way I suppose, well done folks

Both residential and nonresidential revised higher.

Spending up 5.0% Y/Y.

Both residential and nonresidential revised higher.

Spending up 5.0% Y/Y.

The market for condos and co-ops is especially soft: months' supply is the highest in a decade (ignore the crazy 2020 spike). Chart via @bloomberg.com

The market for condos and co-ops is especially soft: months' supply is the highest in a decade (ignore the crazy 2020 spike). Chart via @bloomberg.com