Benn Steil

@bennsteil.bsky.social

Director of International Economics, Council on Foreign Relations. Award-winning author, THE WORLD THAT WASN'T, THE MARSHALL PLAN, & THE BATTLE OF BRETTON WOODS. Future HC of NYJ.

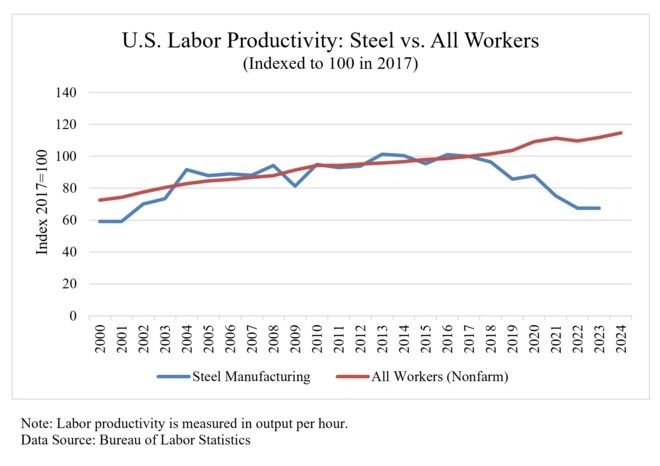

Studies have shown that tariffs depress productivity in protected industries. As I show in my latest @CFR.org Geo-Graphics blog post with Elisabeth Harding, U.S. steel is a case in point . . .

"Steel Productivity has Plummeted Since Trump’s 2018 Tariffs"

www.cfr.org/blog/steel-p...

"Steel Productivity has Plummeted Since Trump’s 2018 Tariffs"

www.cfr.org/blog/steel-p...

March 7, 2025 at 1:00 AM

Studies have shown that tariffs depress productivity in protected industries. As I show in my latest @CFR.org Geo-Graphics blog post with Elisabeth Harding, U.S. steel is a case in point . . .

"Steel Productivity has Plummeted Since Trump’s 2018 Tariffs"

www.cfr.org/blog/steel-p...

"Steel Productivity has Plummeted Since Trump’s 2018 Tariffs"

www.cfr.org/blog/steel-p...

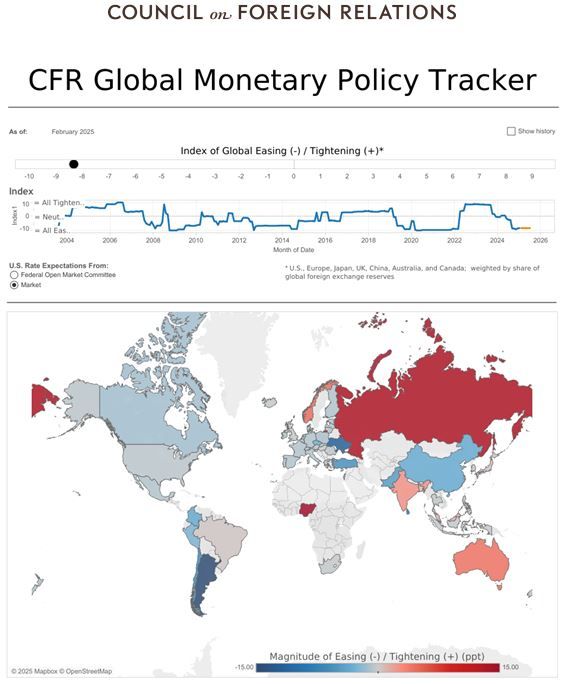

The @CFR.org Global Monetary Policy Tracker is updated. With China, by our algorithm, having shifted from a loosening to a neutral stance, our CFR Index of Global Easing (-)/ Tightening (+) rises slightly from -8.54/10 to -8.31/10.

cfr.org/global/globa...

cfr.org/global/globa...

February 6, 2025 at 12:13 AM

The @CFR.org Global Monetary Policy Tracker is updated. With China, by our algorithm, having shifted from a loosening to a neutral stance, our CFR Index of Global Easing (-)/ Tightening (+) rises slightly from -8.54/10 to -8.31/10.

cfr.org/global/globa...

cfr.org/global/globa...

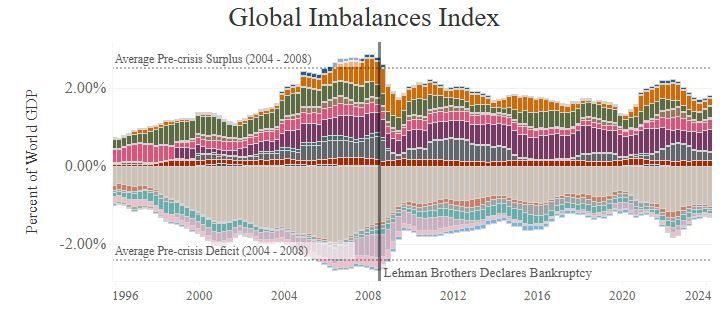

My CFR Global Imbalances Tracker is updated.

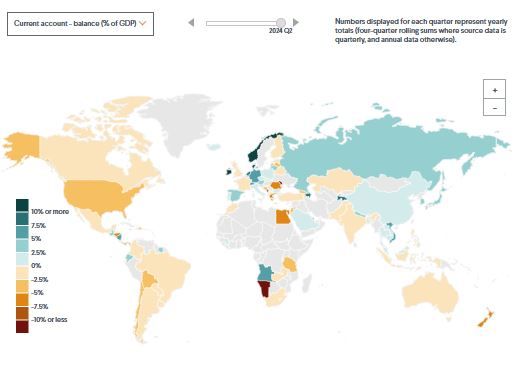

The big imbalance story of 2024 is the United States and China, with the former achieving a trillion-dollar trade deficit and the latter a near-equivalent surplus.

www.cfr.org/report/globa...

The big imbalance story of 2024 is the United States and China, with the former achieving a trillion-dollar trade deficit and the latter a near-equivalent surplus.

www.cfr.org/report/globa...

January 28, 2025 at 7:03 PM

My CFR Global Imbalances Tracker is updated.

The big imbalance story of 2024 is the United States and China, with the former achieving a trillion-dollar trade deficit and the latter a near-equivalent surplus.

www.cfr.org/report/globa...

The big imbalance story of 2024 is the United States and China, with the former achieving a trillion-dollar trade deficit and the latter a near-equivalent surplus.

www.cfr.org/report/globa...

My CFR Global Trade Tracker is updated.

After falling by 5% in 2023, the value of global goods trade rebounded by an estimated 2% in 2024. Trump-triggered tariff wars, however, threaten to hit trade hard in 2025.

www.cfr.org/tracker/glob...

After falling by 5% in 2023, the value of global goods trade rebounded by an estimated 2% in 2024. Trump-triggered tariff wars, however, threaten to hit trade hard in 2025.

www.cfr.org/tracker/glob...

January 28, 2025 at 7:01 PM

My CFR Global Trade Tracker is updated.

After falling by 5% in 2023, the value of global goods trade rebounded by an estimated 2% in 2024. Trump-triggered tariff wars, however, threaten to hit trade hard in 2025.

www.cfr.org/tracker/glob...

After falling by 5% in 2023, the value of global goods trade rebounded by an estimated 2% in 2024. Trump-triggered tariff wars, however, threaten to hit trade hard in 2025.

www.cfr.org/tracker/glob...

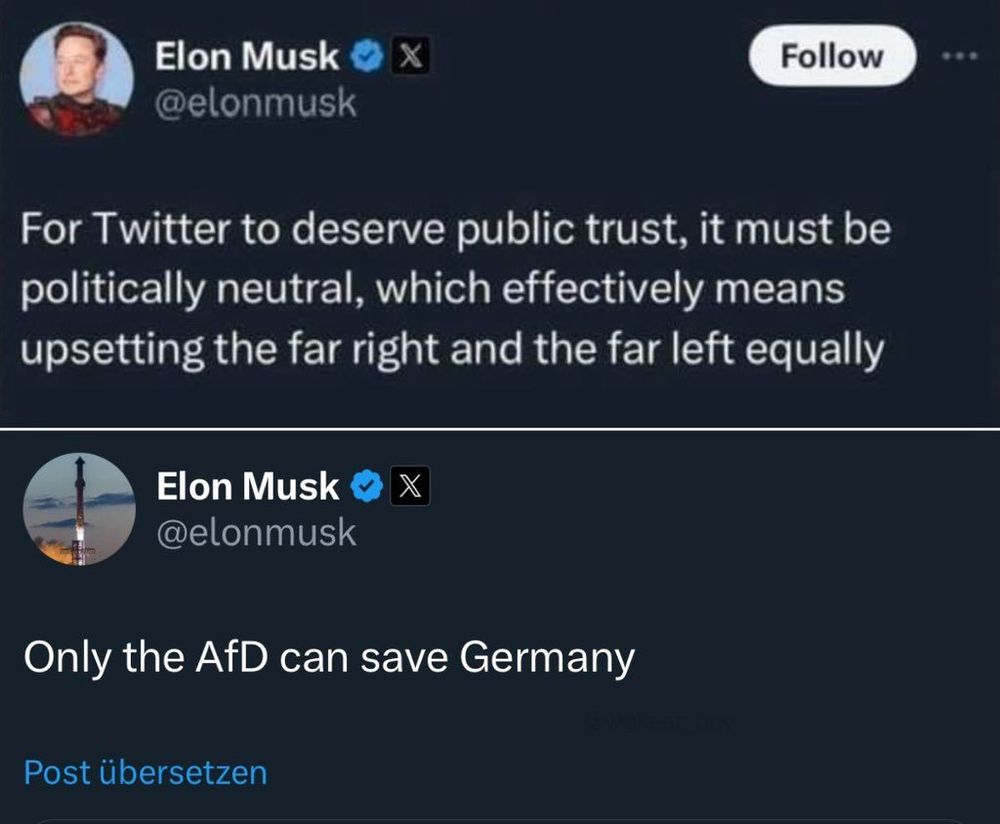

Why I'm here, reason 42.

December 21, 2024 at 2:26 PM

Why I'm here, reason 42.

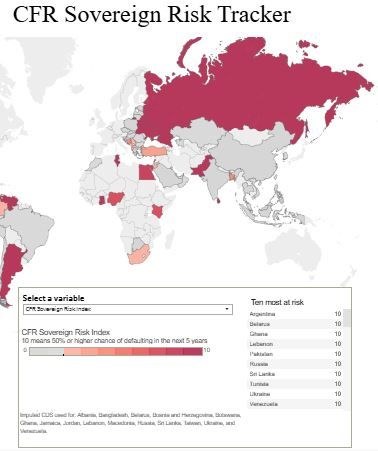

The @cfr.org Sovereign Risk Tracker is updated.

10 countries have our highest default-risk rating (10)—meaning a 50%+ chance of default in the next 5 years: Argentina, Belarus, Ghana, Lebanon, Pakistan, Russia, Sri Lanka, Tunisia, Ukraine, & Venezuela.

on.cfr.org/48kSWoC

10 countries have our highest default-risk rating (10)—meaning a 50%+ chance of default in the next 5 years: Argentina, Belarus, Ghana, Lebanon, Pakistan, Russia, Sri Lanka, Tunisia, Ukraine, & Venezuela.

on.cfr.org/48kSWoC

November 18, 2024 at 8:34 PM

The @cfr.org Sovereign Risk Tracker is updated.

10 countries have our highest default-risk rating (10)—meaning a 50%+ chance of default in the next 5 years: Argentina, Belarus, Ghana, Lebanon, Pakistan, Russia, Sri Lanka, Tunisia, Ukraine, & Venezuela.

on.cfr.org/48kSWoC

10 countries have our highest default-risk rating (10)—meaning a 50%+ chance of default in the next 5 years: Argentina, Belarus, Ghana, Lebanon, Pakistan, Russia, Sri Lanka, Tunisia, Ukraine, & Venezuela.

on.cfr.org/48kSWoC