Ben Casselman

@bencasselman.bsky.social

Chief Economics Correspondent for The New York Times. Adjunct at CUNY Newmark. Ex: FiveThirtyEight, WSJ. He/him.

Email: ben.casselman@nytimes.com

Signal: @bencasselman.96

📸: Earl Wilson/NYT

Email: ben.casselman@nytimes.com

Signal: @bencasselman.96

📸: Earl Wilson/NYT

Unemployment filings among federal workers fell for a second straight week, but are still very elevated. About 37,000 federal employees have filed for benefits since the shutdown began.

November 7, 2025 at 2:36 PM

Unemployment filings among federal workers fell for a second straight week, but are still very elevated. About 37,000 federal employees have filed for benefits since the shutdown began.

Continuing claims continue to drift up. No surge here either, but definitely consistent with the idea that unemployment is gradually rising, and that it's getting harder to find a job.

November 7, 2025 at 2:36 PM

Continuing claims continue to drift up. No surge here either, but definitely consistent with the idea that unemployment is gradually rising, and that it's getting harder to find a job.

More in my story today. And here's hoping we get some official data soon! www.nytimes.com/2025/11/07/b... #NumbersDay #EconSky

The Job Market Is Cooling but Not Collapsing (if Private Data Can Be Trusted)

www.nytimes.com

November 7, 2025 at 1:34 PM

More in my story today. And here's hoping we get some official data soon! www.nytimes.com/2025/11/07/b... #NumbersDay #EconSky

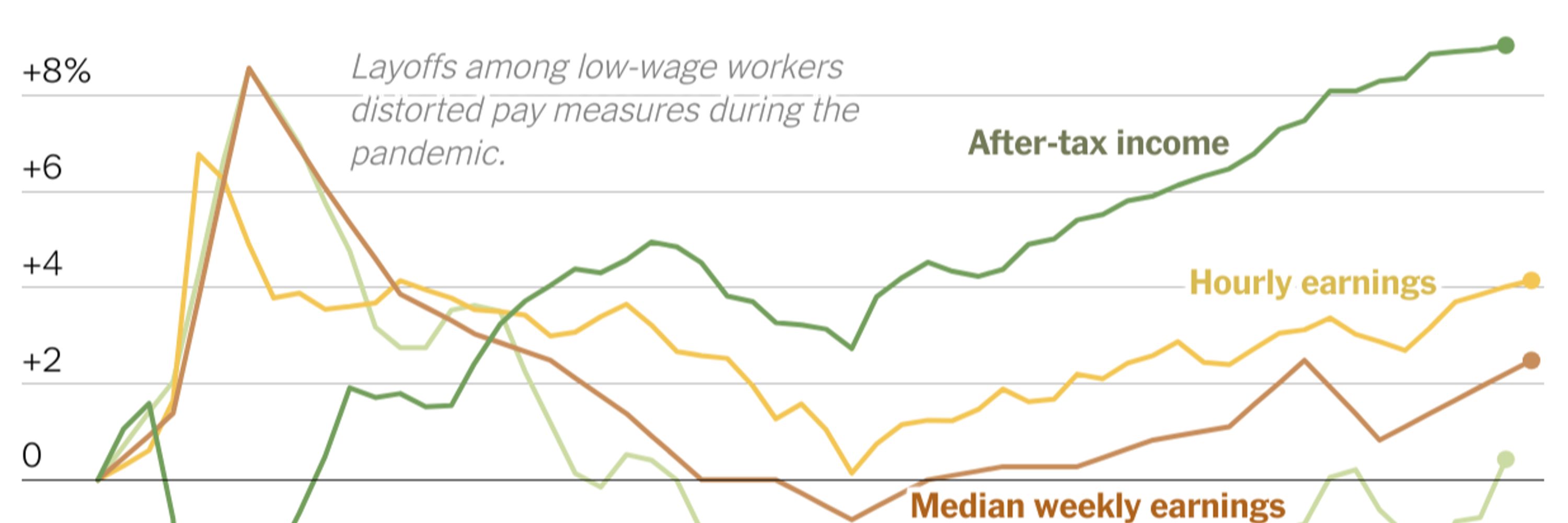

That helps explain why people are so dour on this economy. You might have a job, but you aren't getting a big raise (especially true for lower-wage workers), you don't have many outside options, and you're hearing lots of stories about layoffs. Hard not to get nervous!

November 7, 2025 at 1:34 PM

That helps explain why people are so dour on this economy. You might have a job, but you aren't getting a big raise (especially true for lower-wage workers), you don't have many outside options, and you're hearing lots of stories about layoffs. Hard not to get nervous!

Final point: "Low-hire, low-fire" is better than "low-hire, high-fire," obviously. But it still isn't exactly great for workers. It makes it very hard for the unemployed to find jobs. And it leaves the employed with less leverage to demand raises.

November 7, 2025 at 1:34 PM

Final point: "Low-hire, low-fire" is better than "low-hire, high-fire," obviously. But it still isn't exactly great for workers. It makes it very hard for the unemployed to find jobs. And it leaves the employed with less leverage to demand raises.

That makes it hard to distinguish between a benign or even healthy slowdown in hiring and something much more troublesome. Our best guide to that is the unemployment rate and other labor force statistics, which are what the private data has the hardest time replicating.

November 7, 2025 at 1:34 PM

That makes it hard to distinguish between a benign or even healthy slowdown in hiring and something much more troublesome. Our best guide to that is the unemployment rate and other labor force statistics, which are what the private data has the hardest time replicating.

Second, this is a very hard labor market to interpret right now. We have good private-sector measures of labor *demand.* But a lot of the action right now is on labor *supply* as a result of big shifts in immigration flows. And we have much less good data on that.

November 7, 2025 at 1:34 PM

Second, this is a very hard labor market to interpret right now. We have good private-sector measures of labor *demand.* But a lot of the action right now is on labor *supply* as a result of big shifts in immigration flows. And we have much less good data on that.

But two big reasons for caution:

First, when the labor market turns, it can turn quickly. And there are signs of fragility -- job growth is highly concentrated in a few sectors, most notably health care. If those roll over for whatever reason, the wheels could come off.

First, when the labor market turns, it can turn quickly. And there are signs of fragility -- job growth is highly concentrated in a few sectors, most notably health care. If those roll over for whatever reason, the wheels could come off.

November 7, 2025 at 1:34 PM

But two big reasons for caution:

First, when the labor market turns, it can turn quickly. And there are signs of fragility -- job growth is highly concentrated in a few sectors, most notably health care. If those roll over for whatever reason, the wheels could come off.

First, when the labor market turns, it can turn quickly. And there are signs of fragility -- job growth is highly concentrated in a few sectors, most notably health care. If those roll over for whatever reason, the wheels could come off.

So, taken together, the available data suggests the labor market hasn't changed dramatically since our last batch of BLS data in August. The "low-hire, low-fire" regime still seems to be in place, albeit with some cracks showing.

November 7, 2025 at 1:34 PM

So, taken together, the available data suggests the labor market hasn't changed dramatically since our last batch of BLS data in August. The "low-hire, low-fire" regime still seems to be in place, albeit with some cracks showing.

So far, we haven't seen a big increase in filings for unemployment benefits. And the Chicago Fed estimates (using a blend of available data sources) that the unemployment rate crept up only ever so slightly in October.

November 7, 2025 at 1:34 PM

So far, we haven't seen a big increase in filings for unemployment benefits. And the Chicago Fed estimates (using a blend of available data sources) that the unemployment rate crept up only ever so slightly in October.

But public announcements aren't always a reliable guide to what's happening with layoffs overall. (For one thing, most layoffs are never announced.) Just look at last spring, when Challenger reported a huge spike in layoffs that never really showed up in other data.

November 7, 2025 at 1:34 PM

But public announcements aren't always a reliable guide to what's happening with layoffs overall. (For one thing, most layoffs are never announced.) Just look at last spring, when Challenger reported a huge spike in layoffs that never really showed up in other data.

Layoffs have been very much in the news lately, with job cuts announced at several big companies. Challenger Gray & Christmas yesterday said there had been about 150,000 layoffs announced in October, nearly triple a year ago.

November 7, 2025 at 1:34 PM

Layoffs have been very much in the news lately, with job cuts announced at several big companies. Challenger Gray & Christmas yesterday said there had been about 150,000 layoffs announced in October, nearly triple a year ago.

(Note: I stress the private sector there because a lot of the DOGE-era federal job cuts will likely show up in the October jobs numbers when we get them. So the headline payrolls figure will probably be quite a bit weaker when we get it.)

November 7, 2025 at 1:34 PM

(Note: I stress the private sector there because a lot of the DOGE-era federal job cuts will likely show up in the October jobs numbers when we get them. So the headline payrolls figure will probably be quite a bit weaker when we get it.)

Start with job growth: Measures from ADP, Revelio, LinkedIn, etc., all tell subtly different stories, but they mostly agree on the big picture. After slowing dramatically over the summer, private-sector job growth has remained weak, but it hasn't necessarily slowed much further.

November 7, 2025 at 1:34 PM

Start with job growth: Measures from ADP, Revelio, LinkedIn, etc., all tell subtly different stories, but they mostly agree on the big picture. After slowing dramatically over the summer, private-sector job growth has remained weak, but it hasn't necessarily slowed much further.

(Prefer your jobs day news in story form? I got you: www.nytimes.com/2025/11/07/b...)

The Job Market Is Cooling but Not Collapsing (if Private Data Can Be Trusted)

www.nytimes.com

November 7, 2025 at 1:34 PM

(Prefer your jobs day news in story form? I got you: www.nytimes.com/2025/11/07/b...)

Continuing claims lag by a week, so we're just beginning to see the shutdown's effect there. About 23,000 federal workers were receiving unemployment benefits as of 10/18. If you add the 10/25 claims, it'd top 30k.

November 3, 2025 at 5:22 PM

Continuing claims lag by a week, so we're just beginning to see the shutdown's effect there. About 23,000 federal workers were receiving unemployment benefits as of 10/18. If you add the 10/25 claims, it'd top 30k.

Claims from federal workers ticked down the week ending 10/25, but remain very elevated. Some historical context is important here, though -- not nearly as many claims so far as in past shutdowns. That might change as the shutdown drags on.

November 3, 2025 at 5:22 PM

Claims from federal workers ticked down the week ending 10/25, but remain very elevated. Some historical context is important here, though -- not nearly as many claims so far as in past shutdowns. That might change as the shutdown drags on.

Continuing claims continue to drift upward. That suggests that workers who lose their jobs are struggling to find news ones. Still, no sign of a dramatic deterioration since the August payroll report.

November 3, 2025 at 5:22 PM

Continuing claims continue to drift upward. That suggests that workers who lose their jobs are struggling to find news ones. Still, no sign of a dramatic deterioration since the August payroll report.