Born in Milan, lives in London. Macro-finance: Pension funds, emerging economies, capital flows and financialisation.

Same madness in Italy btw where emigration has become an enormous problem (about 1.5m left since 2000), but somehow the priority is to be nasty to people on dinghies.

Same madness in Italy btw where emigration has become an enormous problem (about 1.5m left since 2000), but somehow the priority is to be nasty to people on dinghies.

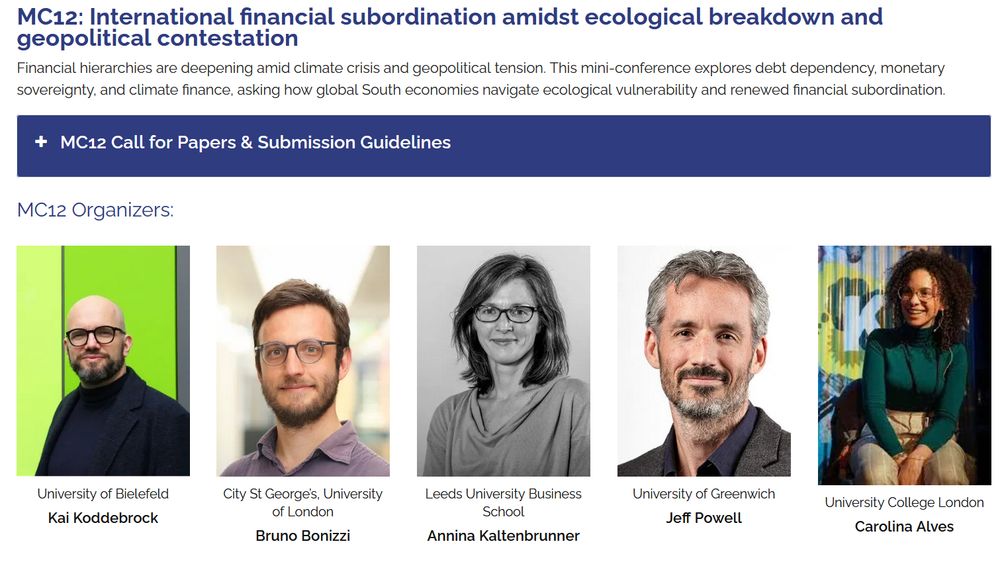

The upcoming SASE conference will feature a mini-conference on International Financial Subordination (IFS). How does IFS evolve in the current context of climate crisis and geopolitical tensions?

More info here 👉 sase.org/events/2026-...

The upcoming SASE conference will feature a mini-conference on International Financial Subordination (IFS). How does IFS evolve in the current context of climate crisis and geopolitical tensions?

More info here 👉 sase.org/events/2026-...

Fragmented funding channels and complex rules make access slow, unpredictable and unfair.

▶️ New UNCTAD report: https://ow.ly/HbMO50Xmt9I

#COP30 #ClimateFinance

We examine pension financialisation and pension wealth inequality in the UK — focusing on how the rise of Defined Contribution (DC).

academic.oup.com/ser/advance-...

We examine pension financialisation and pension wealth inequality in the UK — focusing on how the rise of Defined Contribution (DC).

academic.oup.com/ser/advance-...

Why does financialisation happen — and who benefits?

Hannah Hasenberger digs into the politics behind state financialisation

www.tandfonline.com/doi/full/10....

Why does financialisation happen — and who benefits?

Hannah Hasenberger digs into the politics behind state financialisation

www.tandfonline.com/doi/full/10....

We examine pension financialisation and pension wealth inequality in the UK — focusing on how the rise of Defined Contribution (DC).

academic.oup.com/ser/advance-...

We examine pension financialisation and pension wealth inequality in the UK — focusing on how the rise of Defined Contribution (DC).

academic.oup.com/ser/advance-...

Really shows that any talk of pension funds funding a just transition (and other nice things) means by-passing the large asset managers. For most people contributing to individual pension pots, this may not even be a possibility.

Our argument: because the Big Three are hardly universal. They mainly invest in those that can insulate themselves from environmental harm - big tech & financials in the Global North.

🧵

Really shows that any talk of pension funds funding a just transition (and other nice things) means by-passing the large asset managers. For most people contributing to individual pension pots, this may not even be a possibility.

Der Hauptpreis 2025 geht an Annina Kaltenbrunner @anninak.bsky.social für ihr Arbeiten zu „International Financial Subordination (Internationale finanzielle Unterordnung)“. @universityofleeds.bsky.social

It looks promising on paper, but the focus on individual saving is a bit problematic.

"The relaunched Commission will explore the complex barriers stopping people from saving enough for retirement"

www.gov.uk/government/n...

It looks promising on paper, but the focus on individual saving is a bit problematic.

"The relaunched Commission will explore the complex barriers stopping people from saving enough for retirement"

www.gov.uk/government/n...

Resonates with the work we did with @redjen.bsky.social and @sahildutta.bsky.social

The state must use its fiscal might to enable better outcomes for both the economy & the public, while policymakers must be innovative & take risks.

www.common-wealth.org/publications...

Resonates with the work we did with @redjen.bsky.social and @sahildutta.bsky.social

www.ft.com/content/ebb2...

👇

👇

(Especially if you make it an individual responsibility)

@sahildutta.bsky.social @bbonizzi.bsky.social @redjen.bsky.social explored this for @cmmonwealth.bsky.social

www.common-wealth.org/publications...

(Especially if you make it an individual responsibility)

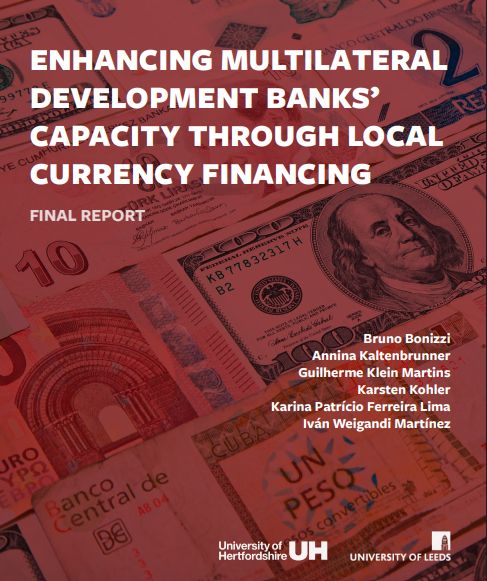

It deals with how MDBs can help with sustainable forms of finance, i.e. by lending in the local currency of recepient borrowers in developing countries.

Summary 👇

It deals with how MDBs can help with sustainable forms of finance, i.e. by lending in the local currency of recepient borrowers in developing countries.

Summary 👇

Given how PE is doing this encouragement is basically offering an escape route to other investors, at the pension scheme members' expense.

Given how PE is doing this encouragement is basically offering an escape route to other investors, at the pension scheme members' expense.

1) UK can get closer to the EU without provoking Brexit betrayal narratives.

2) Germany doing public spending

3) Private Equity funds going down

1) UK can get closer to the EU without provoking Brexit betrayal narratives.

2) Germany doing public spending

3) Private Equity funds going down

The big big winners from positioning Ukrainian security against poor British people & our public services are the far right.

TAX THE RICH TO PAY FOR DEFENSE. PROTECT OUR WELFARE STATE.

The big big winners from positioning Ukrainian security against poor British people & our public services are the far right.

TAX THE RICH TO PAY FOR DEFENSE. PROTECT OUR WELFARE STATE.

If you are PhD student in pluralist economics, apply by Fri 7 March, to receive feedback on your work from a senior academic + connect with like-minded researchers.

More info: ysi.ineteconomics.org/event/16th-p...

If you are PhD student in pluralist economics, apply by Fri 7 March, to receive feedback on your work from a senior academic + connect with like-minded researchers.

More info: ysi.ineteconomics.org/event/16th-p...