The contexts are vastly different. Yes Bank’s write-down came amid a genuine systemic risk, backed by RBI and aimed at preserving public trust.

The contexts are vastly different. Yes Bank’s write-down came amid a genuine systemic risk, backed by RBI and aimed at preserving public trust.

Direct cash transfer schemes have become the new centrepiece of state politics — popular, expansive, and electorally rewarding.

Direct cash transfer schemes have become the new centrepiece of state politics — popular, expansive, and electorally rewarding.

HUL’s decision to make its CEO contract public seemed bold — but is it governance or just good theatre?

HUL’s decision to make its CEO contract public seemed bold — but is it governance or just good theatre?

As the rupee faces tariff-driven pressure, the RBI is walking a tightrope—defending the currency through forex intervention while trying not to starve the system of liquidity.

As the rupee faces tariff-driven pressure, the RBI is walking a tightrope—defending the currency through forex intervention while trying not to starve the system of liquidity.

#BondMarkets

#BondMarkets

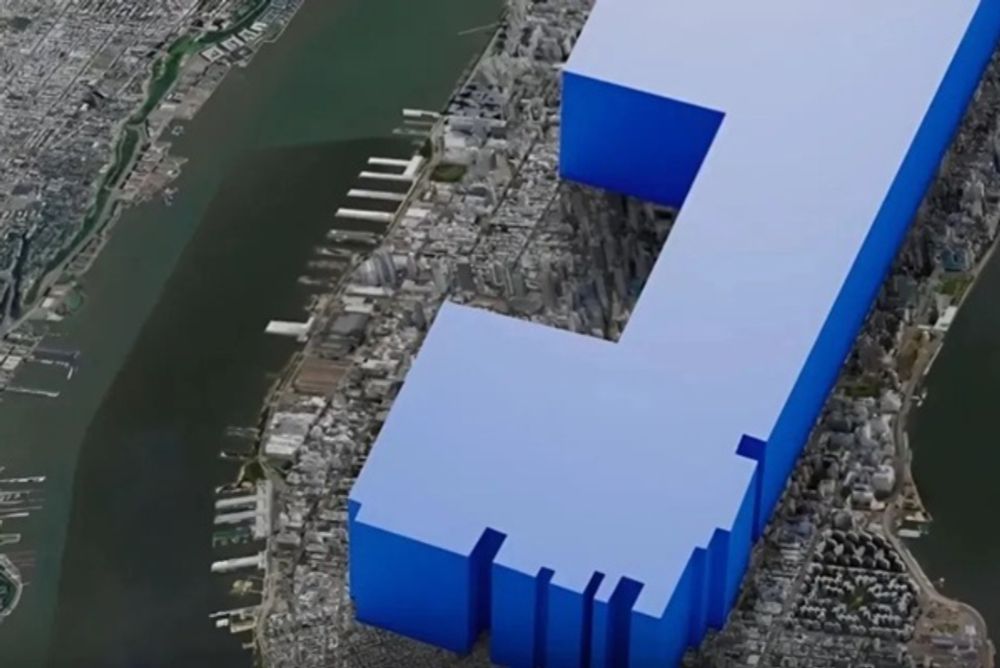

India’s journey to Viksit Bharat will be shaped by how we reimagine our cities. Urban India already drives most of our economic growth — now it must also lead in liveability, inclusivity, and sustainability.

#UrbanDevelopment #SustainableCities

India’s journey to Viksit Bharat will be shaped by how we reimagine our cities. Urban India already drives most of our economic growth — now it must also lead in liveability, inclusivity, and sustainability.

#UrbanDevelopment #SustainableCities

Every month, ₹20,000 crore flows into mutual funds on autopilot, regardless of valuation or volatility. What started as a shield against investor emotion now shapes the market itself, often overpowering analysis with habit.

Every month, ₹20,000 crore flows into mutual funds on autopilot, regardless of valuation or volatility. What started as a shield against investor emotion now shapes the market itself, often overpowering analysis with habit.

India’s energy transition isn’t just about clean power. It’s about who benefits, who pays, and how long each rupee lasts.

#CircularFinance #EnergyTransition #ClimatePolicy #SustainableFinance

India’s energy transition isn’t just about clean power. It’s about who benefits, who pays, and how long each rupee lasts.

#CircularFinance #EnergyTransition #ClimatePolicy #SustainableFinance

With 56.5% of banking frauds now tied to digital payments and over 13,500 cyber fraud cases in 2024–25 alone, the sector stands at a tipping point.

#cybersecurity #DigitalBanking #upi #AI #FinTech

With 56.5% of banking frauds now tied to digital payments and over 13,500 cyber fraud cases in 2024–25 alone, the sector stands at a tipping point.

#cybersecurity #DigitalBanking #upi #AI #FinTech

Sumitomo Mitsui’s recent ₹160 billion stake in YES Bank has revived confidence in the institution — and is being hailed as a regulatory success story.

#AT1Bonds #YesBank #BankingRisk #InvestorProtection

Sumitomo Mitsui’s recent ₹160 billion stake in YES Bank has revived confidence in the institution — and is being hailed as a regulatory success story.

#AT1Bonds #YesBank #BankingRisk #InvestorProtection

As banking becomes more complex—across risk, regulation, and capital markets—boards and CEOs face a new dilemma: Is leadership alone enough?

#LeadershipEvolution #BankLeadership #DigitalBanking #IndiaBanking #BFSI

As banking becomes more complex—across risk, regulation, and capital markets—boards and CEOs face a new dilemma: Is leadership alone enough?

#LeadershipEvolution #BankLeadership #DigitalBanking #IndiaBanking #BFSI

Financial stability is entering a new chapter—driven not by banks, but by compute, contracts, and capital.

AI is no longer just a tech story; it's a balance-sheet event. Mega data centers, power grids, and trillion-dollar equities are now deeply interlinked.

Financial stability is entering a new chapter—driven not by banks, but by compute, contracts, and capital.

AI is no longer just a tech story; it's a balance-sheet event. Mega data centers, power grids, and trillion-dollar equities are now deeply interlinked.

With 122 seats up for grabs, alliances are testing new equations: fresh faces vs. incumbents, rebels vs. loyalists, and caste balance vs. voter volatility.

#BiharElections #PoliticalStrategy #IndianDemocracy #Governance

With 122 seats up for grabs, alliances are testing new equations: fresh faces vs. incumbents, rebels vs. loyalists, and caste balance vs. voter volatility.

#BiharElections #PoliticalStrategy #IndianDemocracy #Governance

What sounds like inspiration often feels like pressure.

In a world that wants us constantly improving, have we forgotten how to simply exist?

#SelfImprovement #ModernAnxiety #Culture #DigitalLife #Mindfulness

What sounds like inspiration often feels like pressure.

In a world that wants us constantly improving, have we forgotten how to simply exist?

#SelfImprovement #ModernAnxiety #Culture #DigitalLife #Mindfulness

What if progress depends less on design and more on endurance?

This week on Basis Point Insight, we explored a single thread through very different subjects on how systems survive their own flaws.

#UrbanResilience #Mumbai #CivicValues

What if progress depends less on design and more on endurance?

This week on Basis Point Insight, we explored a single thread through very different subjects on how systems survive their own flaws.

#UrbanResilience #Mumbai #CivicValues

The government is considering allowing FDI-backed e-commerce platforms to hold inventory — but just for export. This could be the quiet beginning of bigger reform. From sourcing to logistics, Indian exporters need every edge in a turbulent trade environment.

The government is considering allowing FDI-backed e-commerce platforms to hold inventory — but just for export. This could be the quiet beginning of bigger reform. From sourcing to logistics, Indian exporters need every edge in a turbulent trade environment.

India’s oilseed strategy has been stretched too wide, chasing multiple crops with uneven focus.

#AgriculturePolicy #OilseedReform #MSP #FoodSecurity

India’s oilseed strategy has been stretched too wide, chasing multiple crops with uneven focus.

#AgriculturePolicy #OilseedReform #MSP #FoodSecurity

Stock splits may be simple math, but when executed with timing and strong fundamentals, they unlock broader ownership, energise retail participation, and signal confidence.

#Nvidia #StockSplits #AIInvesting #MarketParticipation

Stock splits may be simple math, but when executed with timing and strong fundamentals, they unlock broader ownership, energise retail participation, and signal confidence.

#Nvidia #StockSplits #AIInvesting #MarketParticipation

#UrbanDevelopment #India2047 #SmartCities #DistrictUrbanisation #SustainablePlanning #Governance #PublicPolicy #IndiaGrowth

#UrbanDevelopment #India2047 #SmartCities #DistrictUrbanisation #SustainablePlanning #Governance #PublicPolicy #IndiaGrowth

#StructuredFinance

#StructuredFinance

#FDIPolicy #RegulatoryClarity #IndiaEconomy #DigitalCommerce

#FDIPolicy #RegulatoryClarity #IndiaEconomy #DigitalCommerce

#BiharElections #PoliticalStrategy #IndianDemocracy #ElectoralReform #Governance

#BiharElections #PoliticalStrategy #IndianDemocracy #ElectoralReform #Governance

#Leadership #GenerationalShift #Geopolitics #UrbanGovernance

#Leadership #GenerationalShift #Geopolitics #UrbanGovernance

#MutualFunds #SEBI

#MutualFunds #SEBI

From demography to digital governance, trade to trust, India’s story this week was one of conviction and complexity.

#India #Economy #Policy