More than two-thirds of IRS senior leadership has left or been removed since January. Unprecedented and dangerous.

More than two-thirds of IRS senior leadership has left or been removed since January. Unprecedented and dangerous.

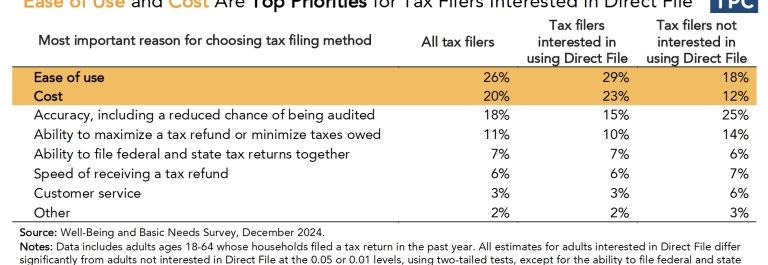

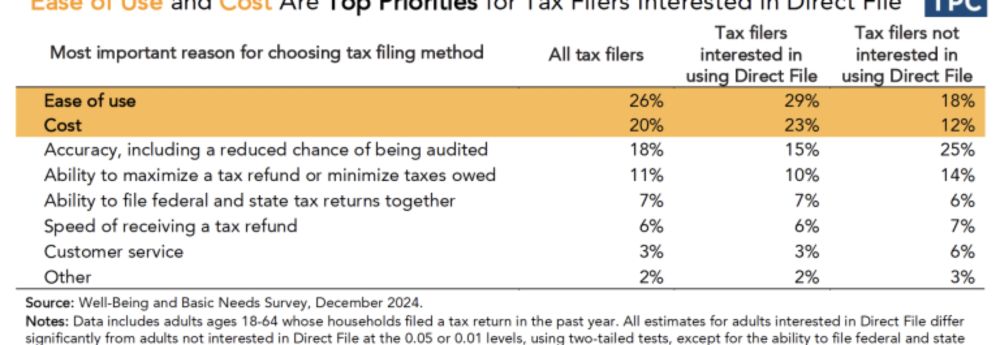

taxpolicycenter.org/taxvox/one-b...

taxpolicycenter.org/taxvox/one-b...

taxpolicycenter.org/briefs/how-p...

taxpolicycenter.org/briefs/how-p...

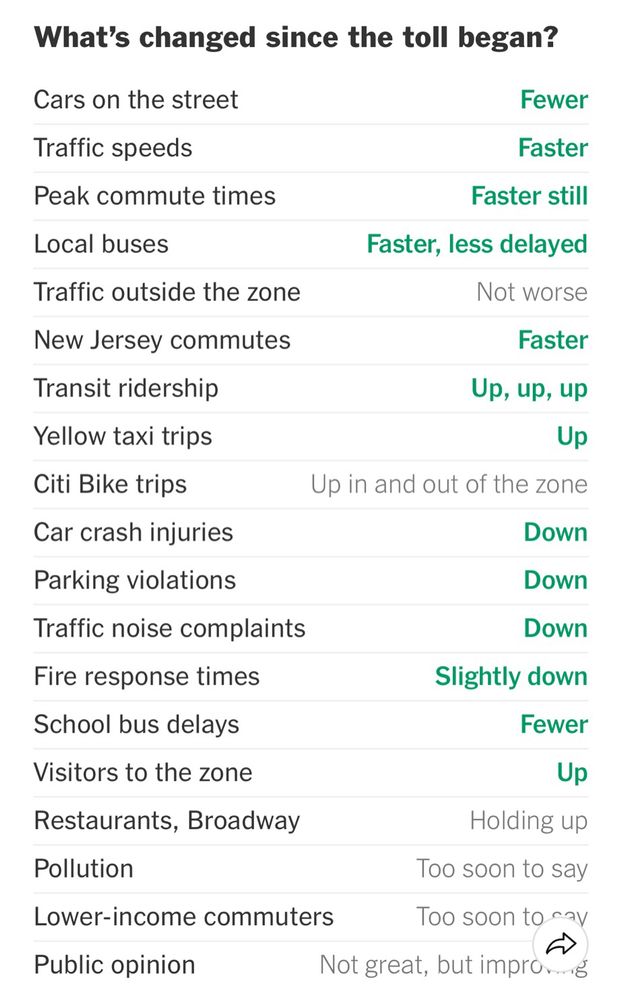

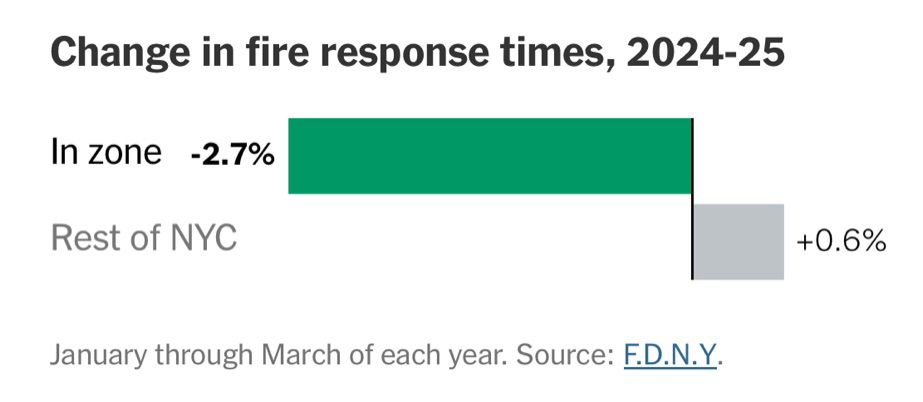

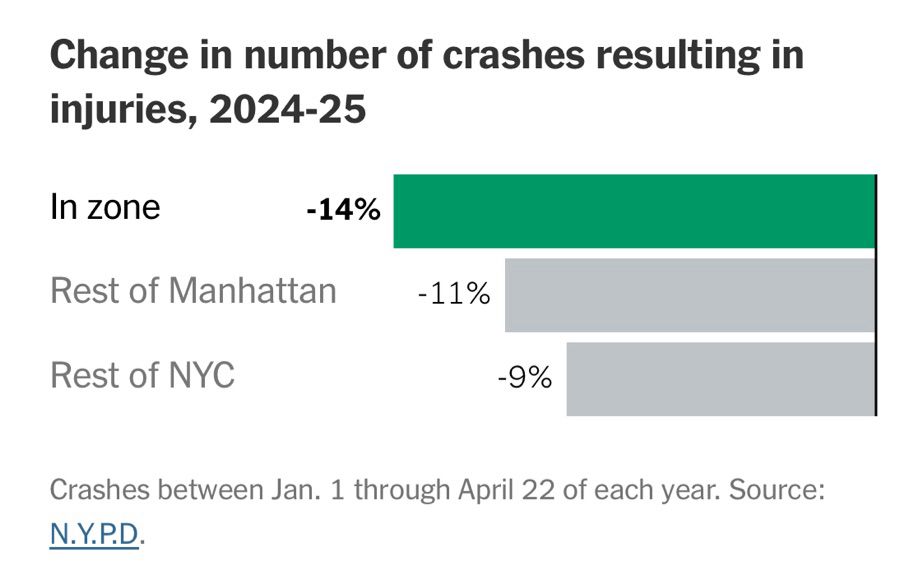

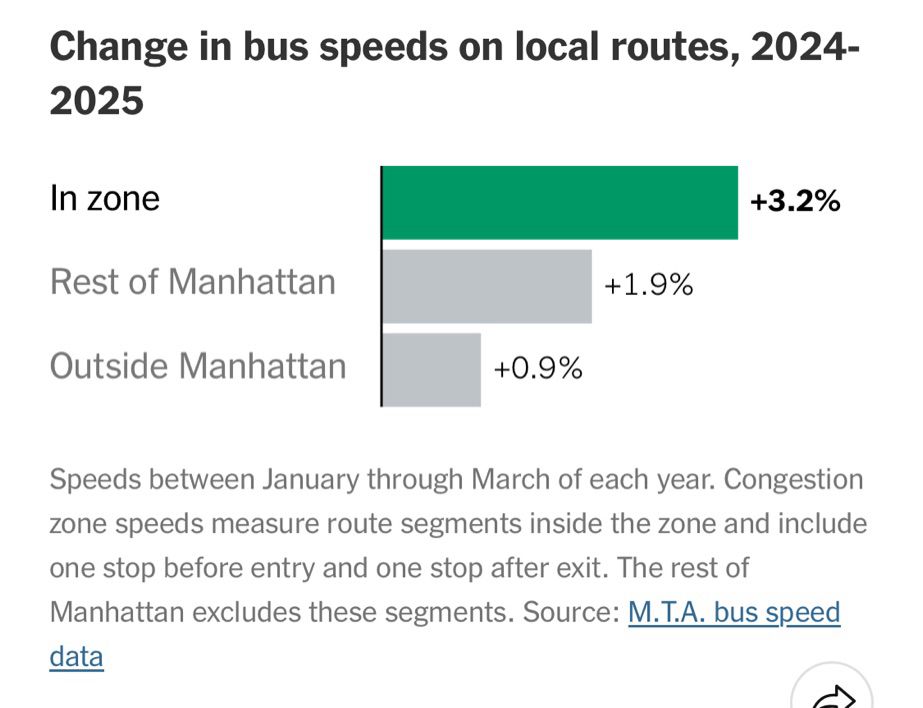

www.nytimes.com/interactive/...

www.nytimes.com/interactive/...

taxpolicycenter.org/taxvox/congr...

taxpolicycenter.org/taxvox/congr...

taxpolicycenter.org/taxvox/new-i...

taxpolicycenter.org/taxvox/new-i...

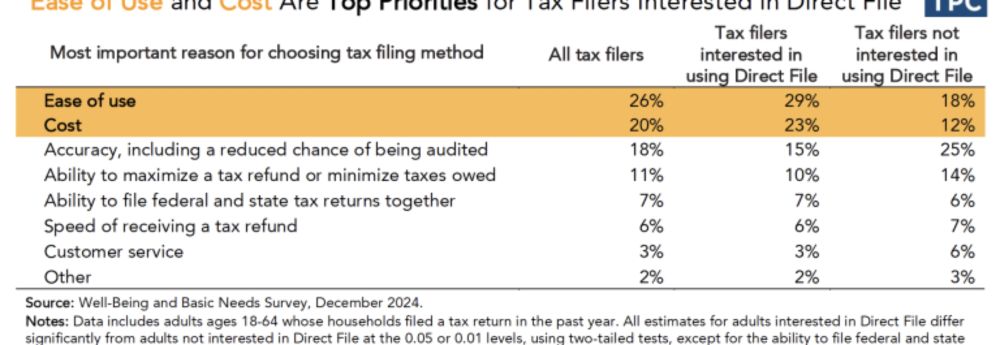

But news reports say the Administration plans to eliminate it.

taxpolicycenter.org/briefs/most-...

But news reports say the Administration plans to eliminate it.

taxpolicycenter.org/briefs/most-...

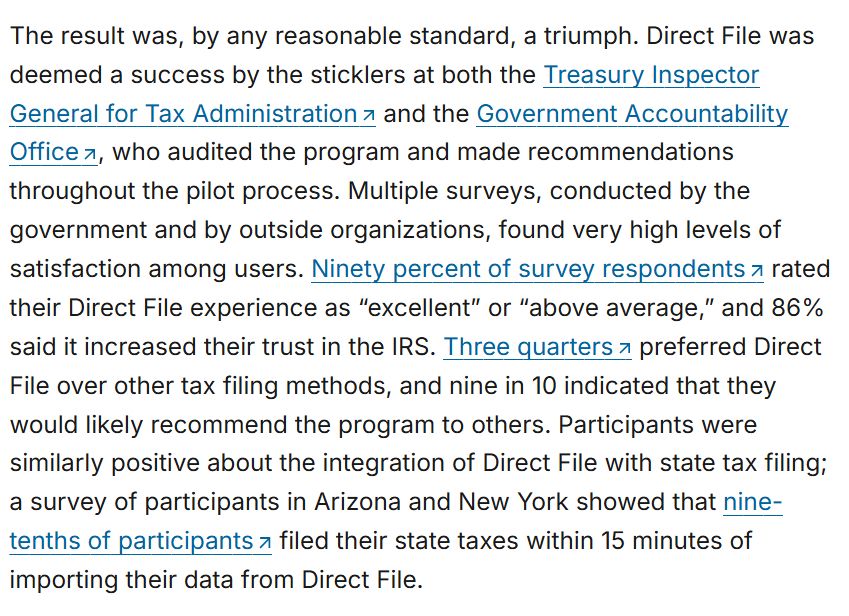

Last month I wrote about the success of the Direct File pilot, and what the history of IRS can tell us about resisting attacks on American governance.

www.brookings.edu/articles/the...

Last month I wrote about the success of the Direct File pilot, and what the history of IRS can tell us about resisting attacks on American governance.

www.brookings.edu/articles/the...

taxpolicycenter.org/briefs/most-...

taxpolicycenter.org/briefs/most-...

Again, none of this is about efficiency. I know the IRS is not popular, but for every dollar invested it generates about $7 in returns. The goal is not to save money but to stop collecting it.

Again, none of this is about efficiency. I know the IRS is not popular, but for every dollar invested it generates about $7 in returns. The goal is not to save money but to stop collecting it.

taxpolicycenter.org/presentation...

taxpolicycenter.org/presentation...

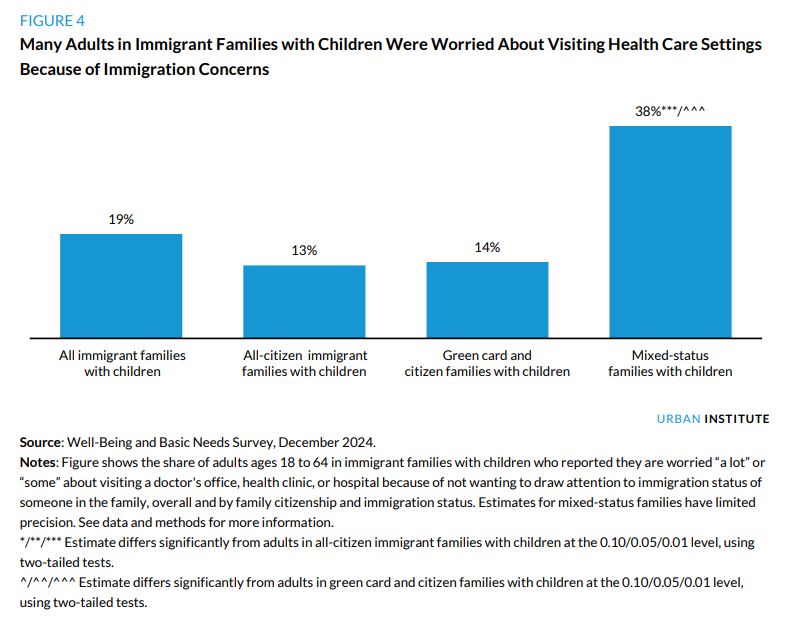

www.urban.org/urban-wire/h...

www.urban.org/urban-wire/h...

www.urban.org/urban-wire/f...

www.urban.org/urban-wire/f...

go.bsky.app/8vqjVD2

go.bsky.app/8vqjVD2