Setting aside the notion CBO does projections based on the party in power (they don't), growth has been on a clear downward trend for decades.

Setting aside the notion CBO does projections based on the party in power (they don't), growth has been on a clear downward trend for decades.

JCT finds that extension costs $4.1 trillion over 10 years, and $700 billion more tacked on due to the extra interest payments we'll have to make on our debt.

punchbowl.news/wyden_merkle...

JCT finds that extension costs $4.1 trillion over 10 years, and $700 billion more tacked on due to the extra interest payments we'll have to make on our debt.

punchbowl.news/wyden_merkle...

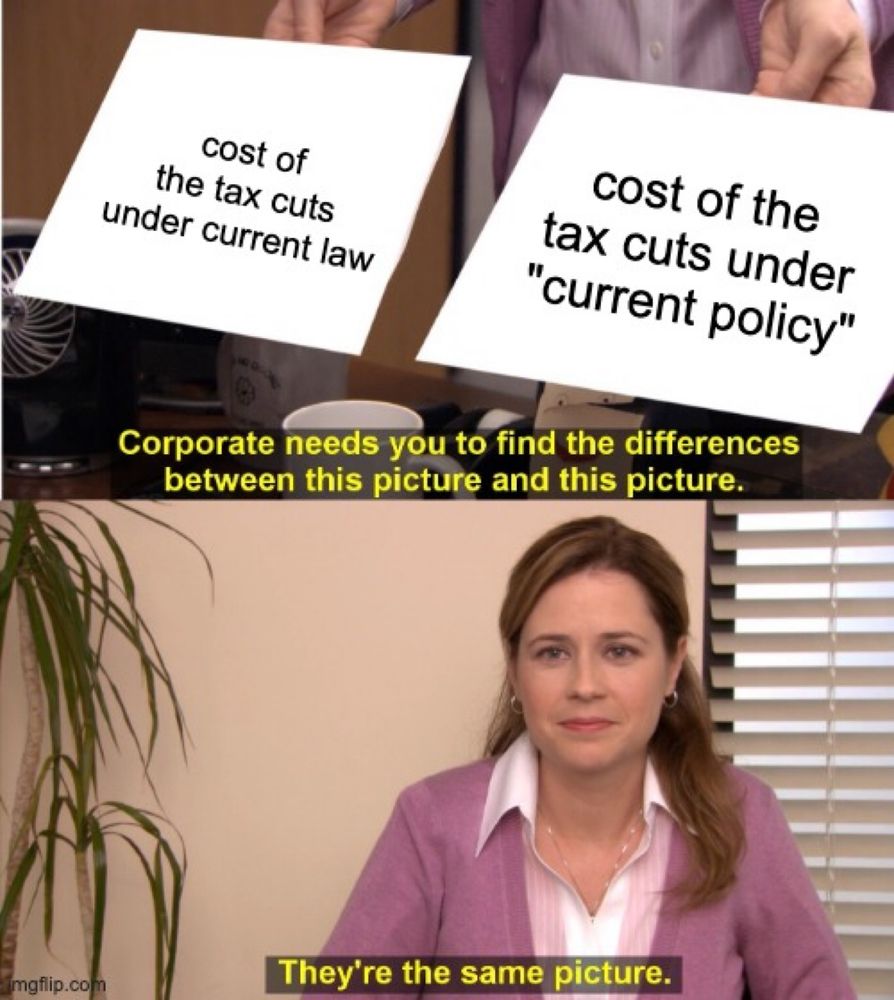

Current policy just obscures the cost from the public and breaks decades of precedent.

Current policy just obscures the cost from the public and breaks decades of precedent.

The baseline is a political choice, but it doesn't change that extending the tax cuts w/o paying for them adds trillions to debt.

www.cbo.gov/publication/...

The baseline is a political choice, but it doesn't change that extending the tax cuts w/o paying for them adds trillions to debt.

www.cbo.gov/publication/...

Currently, the agenda may exceed $7 trillion over 10 years before offsets.

Lawmakers need to pay for new tax cuts/spending to avoid increasing deficits by a third.

bipartisanpolicy.org/tcja-offsets/

Currently, the agenda may exceed $7 trillion over 10 years before offsets.

Lawmakers need to pay for new tax cuts/spending to avoid increasing deficits by a third.

bipartisanpolicy.org/tcja-offsets/

At Bipartisan Policy Center we have a new resource with options to pay for $4 trillion in expiring tax cuts.

One set of options out today. More next week.

bipartisanpolicy.org/tcja-offsets/

At Bipartisan Policy Center we have a new resource with options to pay for $4 trillion in expiring tax cuts.

One set of options out today. More next week.

bipartisanpolicy.org/tcja-offsets/

Of the overall $79.6 billion to the IRS, a larger portion remains ($27.1 billion or 34%).

Of the overall $79.6 billion to the IRS, a larger portion remains ($27.1 billion or 34%).