Political Economy, Monetary Policy, Central Banks (ECB & Federal Reserve // monetary politics, accountability, expertise)

https://uclouvain.academia.edu/AntoinedeCabanes

www.ft.com/content/0727...

www.ft.com/content/0727...

Pourquoi ? Afin d'être contrôlé par une autorité nationale de supervision qui applique "plus souplement" la réglementation européenne MiCA

Pourquoi ? Afin d'être contrôlé par une autorité nationale de supervision qui applique "plus souplement" la réglementation européenne MiCA

www.politico.com/news/2025/10...

www.politico.com/news/2025/10...

www.ft.com/content/b248...

papers.ssrn.com/sol3/papers....

www.ft.com/content/b248...

papers.ssrn.com/sol3/papers....

La Cour Suprême des États-Unis a rejeté la demande de la Maison Blanche d'application immédiate du limogeage de la gouverneure de la Fed annoncé par Trump le 25/8, et opté pour entendre les plaidoiries des deux parties en janvier avant de statuer

www.ft.com/content/0430...

La Cour Suprême des États-Unis a rejeté la demande de la Maison Blanche d'application immédiate du limogeage de la gouverneure de la Fed annoncé par Trump le 25/8, et opté pour entendre les plaidoiries des deux parties en janvier avant de statuer

www.ft.com/content/0430...

It shows the role of the social & political crisis caused by Macron (2023 pension reform, 2024 snap election and subsequent governmental instability) in the current cycle of downgrading.

It shows the role of the social & political crisis caused by Macron (2023 pension reform, 2024 snap election and subsequent governmental instability) in the current cycle of downgrading.

3/23

3/23

(comme @adamtooze.bsky.social le raconte dans Shutdown)

22/

(comme @adamtooze.bsky.social le raconte dans Shutdown)

22/

20/

20/

18/

18/

2/

2/

1/

1/

yalebooks.yale.edu/book/9780300...

yalebooks.yale.edu/book/9780300...

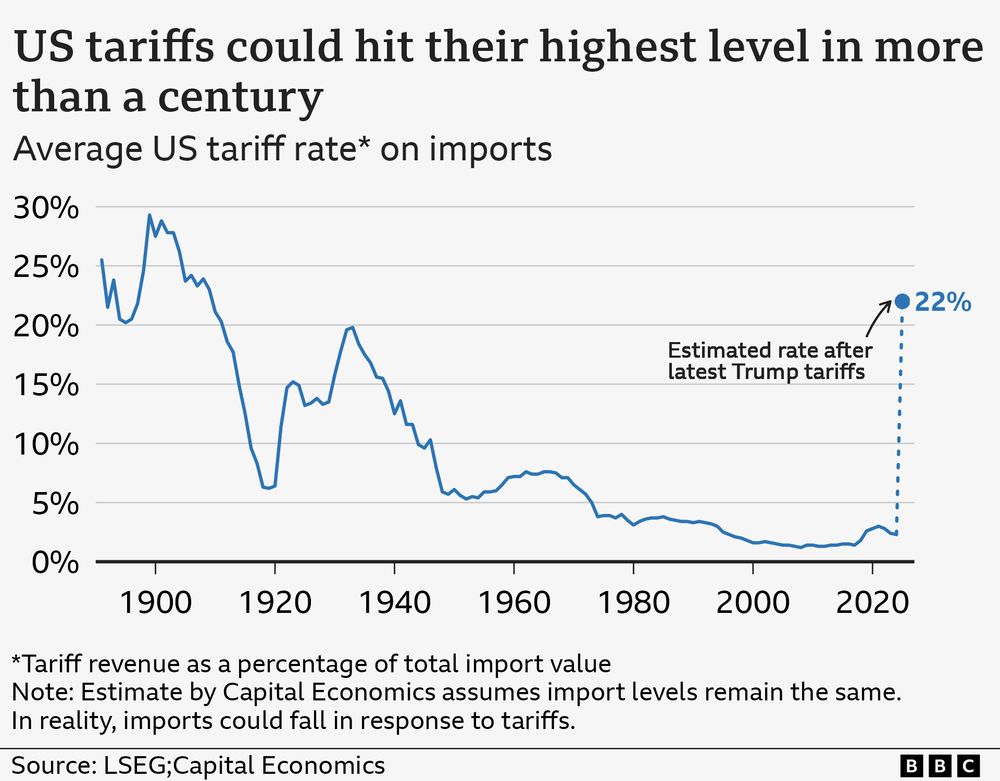

European markets are next, and then Wall Street

#HappyBlackMonday

European markets are next, and then Wall Street

#HappyBlackMonday

3/3

3/3

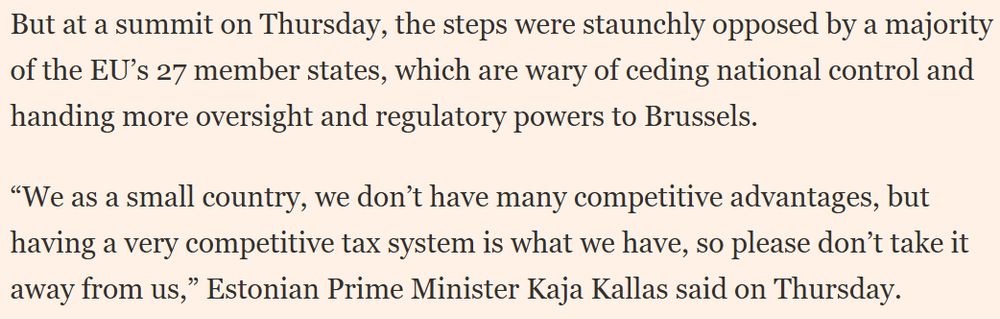

(Kallas' crystal clear quote is from last April, when Luxembourg Ireland and the Baltics objected to EU financial integration)

(Kallas' crystal clear quote is from last April, when Luxembourg Ireland and the Baltics objected to EU financial integration)

Sure, the rise of private credit & synthetic risk transfer isn't risky at all. Over-the-counter markets aren't risky. The lack of regulation of shadow banking as a whole isn't risky 🤬 (1/3)

www.ft.com/content/a0f8...

Sure, the rise of private credit & synthetic risk transfer isn't risky at all. Over-the-counter markets aren't risky. The lack of regulation of shadow banking as a whole isn't risky 🤬 (1/3)

www.ft.com/content/a0f8...

Unlike the rest of the agencies, the central bank’s independence is (so far) partially preserved.

4/4

Unlike the rest of the agencies, the central bank’s independence is (so far) partially preserved.

4/4

www.politico.eu/article/we-n...

www.politico.eu/article/we-n...