Between Jan 21, 1980 and June 30, 2008, gold underperformed the S&P 500 by 1,033% (2nd chart).

I am cherry picking dates, but this is so you are aware that gold isn't the safe haven you think it is. Cash flows win.

Between Jan 21, 1980 and June 30, 2008, gold underperformed the S&P 500 by 1,033% (2nd chart).

I am cherry picking dates, but this is so you are aware that gold isn't the safe haven you think it is. Cash flows win.

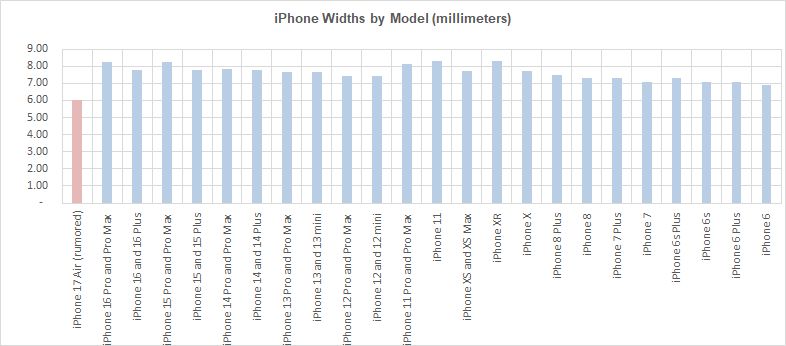

The rumored iPhone 17 "Air" will be 6.00mm thin. Not quite as thin as the new iPad Pro (5.1mm) or the last iPod Nano (5.4mm) but a welcome change after seeing the width increase to 8.0mm in the latest models

$AAPL

The rumored iPhone 17 "Air" will be 6.00mm thin. Not quite as thin as the new iPad Pro (5.1mm) or the last iPod Nano (5.4mm) but a welcome change after seeing the width increase to 8.0mm in the latest models

$AAPL

I just don't see the short thesis on GOOS at these levels.

Curious to hear any other takes and I hope you learned something!

NTM EBITDA 9.2x

CY23 EBITDA 9.9x

C24 EBITDA 8.2x

Will do a thread on brand surveys/buzz later (which are healthy)

I just don't see the short thesis on GOOS at these levels.

Curious to hear any other takes and I hope you learned something!

NTM EBITDA 9.2x

CY23 EBITDA 9.9x

C24 EBITDA 8.2x

Will do a thread on brand surveys/buzz later (which are healthy)

Lastly, short interest has always been high for GOOS because people pair trade it with MONC. Seeing as how the SI is high for the US float but not the Canadian float, this is likely true. However, the squeeze risk is very high now per S3 data (SQ + CS >85 is no bueno)

Lastly, short interest has always been high for GOOS because people pair trade it with MONC. Seeing as how the SI is high for the US float but not the Canadian float, this is likely true. However, the squeeze risk is very high now per S3 data (SQ + CS >85 is no bueno)

Operating Profit expectations have been revised lower many times already. Maybe they get revised lower yet again (this is $GOOS afterall lol), but it does feel like we are reaching trough expectations. We also have winter season just around the corner.

Operating Profit expectations have been revised lower many times already. Maybe they get revised lower yet again (this is $GOOS afterall lol), but it does feel like we are reaching trough expectations. We also have winter season just around the corner.

China soft/weak-reopening should help this quarter too at the margin. The company has one of the largest company-owned store mixes in the luxury space.

China soft/weak-reopening should help this quarter too at the margin. The company has one of the largest company-owned store mixes in the luxury space.

$GOOS earnings are out on Thursday.

For all the worries about sales in the US wholesale channel weakening, credit and debit card data points to better than last year sales in DTC (from a small sample set, admittedly). See chart.

$GOOS earnings are out on Thursday.

For all the worries about sales in the US wholesale channel weakening, credit and debit card data points to better than last year sales in DTC (from a small sample set, admittedly). See chart.

I also think that GOOS designers can be a bit boring when compared to other luxury brands.

Where are the collabs? Make this s**t sexy! A few quick prompts in Midjourney can yield great ideas. See example below of a Tiffany-Goose collab.

I also think that GOOS designers can be a bit boring when compared to other luxury brands.

Where are the collabs? Make this s**t sexy! A few quick prompts in Midjourney can yield great ideas. See example below of a Tiffany-Goose collab.

I think a lot of people see market share in the US, and assume that the same thing is happening in other countries.

But that’s not the case at all.

Here’s market share in every other country in which GOOS is big enough to show up in data.

All up and to the right ↗

I think a lot of people see market share in the US, and assume that the same thing is happening in other countries.

But that’s not the case at all.

Here’s market share in every other country in which GOOS is big enough to show up in data.

All up and to the right ↗

However, sales in the US continue to grow year after year (about 10% annually). They are not skyrocketing, but they're pretty steady and growing. See trend in the chart. Not a sign of a dying brand.

However, sales in the US continue to grow year after year (about 10% annually). They are not skyrocketing, but they're pretty steady and growing. See trend in the chart. Not a sign of a dying brand.

I think that perhaps people are over-focused on the US market, which indeed has stalled over the last two years.

I think that perhaps people are over-focused on the US market, which indeed has stalled over the last two years.

Canada Goose $GOOS

Lots of haters on FinTwit on the name but they bring a poor game. I just don't see it. Canada Goose is gaining market share globally and growing (see chart).

Would love to hear more bearish views please!

Canada Goose $GOOS

Lots of haters on FinTwit on the name but they bring a poor game. I just don't see it. Canada Goose is gaining market share globally and growing (see chart).

Would love to hear more bearish views please!