Hearing more whispers that even some of the 'true believer' cohort are starting to offload shares. With ongoing challenges in key markets like China adding to the pressure, reality seems to be catching up fast...

Hearing more whispers that even some of the 'true believer' cohort are starting to offload shares. With ongoing challenges in key markets like China adding to the pressure, reality seems to be catching up fast...

Feels like we're teetering on the edge of either a full-blown roaring 20s style melt-up or the mother of all bull traps. 📉📈

Feels like we're teetering on the edge of either a full-blown roaring 20s style melt-up or the mother of all bull traps. 📉📈

#QBTS #QuantumComputing

#QBTS #QuantumComputing

Big implications on the outcome between bulls and bears at this level.

#TSLA #Bulls #Bears #fightorflight

Big implications on the outcome between bulls and bears at this level.

#TSLA #Bulls #Bears #fightorflight

Payrolls grew a relatively uninteresting (and positive!) +177k in April, and unemployment was unchanged at 4.2%.

This economy is still humming along.

NOTE: This is a reading largely from the pre-tariff period. Still very foggy about what lies ahead.

Payrolls grew a relatively uninteresting (and positive!) +177k in April, and unemployment was unchanged at 4.2%.

This economy is still humming along.

NOTE: This is a reading largely from the pre-tariff period. Still very foggy about what lies ahead.

#Stocks #Market #Investing #Trading #WallStreet #Finance #DayTrading #StockMarket #FML

#Stocks #Market #Investing #Trading #WallStreet #Finance #DayTrading #StockMarket #FML

1st card: Enacted tariffs that threaten to tank the economy

2nd: Backs China into a corner.

3rd: Makes fed incapable of responding

4th: Tanks markets, bonds and the dollar

5th: no end game, no plan

1st card: Enacted tariffs that threaten to tank the economy

2nd: Backs China into a corner.

3rd: Makes fed incapable of responding

4th: Tanks markets, bonds and the dollar

5th: no end game, no plan

“.. The roar of Musk’s chainsaw has quieted to more of a hum.”

@politico.com

www.politico.com/newsletters/...

“.. The roar of Musk’s chainsaw has quieted to more of a hum.”

@politico.com

www.politico.com/newsletters/...

So refreshing to hear someone just saying it. This isn’t politics in the traditional sense, we’re blowing the whole economy up (don’t forget small businesses), for reasons that don’t make sense.

youtu.be/lhHMqIbFzaA?...

So refreshing to hear someone just saying it. This isn’t politics in the traditional sense, we’re blowing the whole economy up (don’t forget small businesses), for reasons that don’t make sense.

youtu.be/lhHMqIbFzaA?...

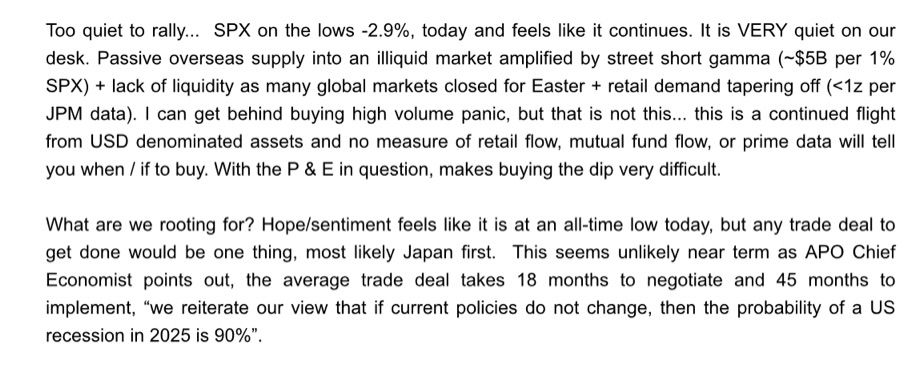

“.. It is VERY quiet on our desk .. I can get behind buying high volume panic, but that is not this... this is a continued flight from USD denominated assets and no measure of retail flow, mutual fund flow or prime data will tell you when / if to buy.”

“.. It is VERY quiet on our desk .. I can get behind buying high volume panic, but that is not this... this is a continued flight from USD denominated assets and no measure of retail flow, mutual fund flow or prime data will tell you when / if to buy.”

the reason Markets can stand up to bullies is that no individual can be singled out for retribution. By aggregating the Wisdom of the (investor) Crowd, it can stand in judgement of the mad king.

www.cityam.com/investors-se...

www.cityam.com/investors-se...

#QQQ #retailinvesting #marketpsychology #stocks

#QQQ #retailinvesting #marketpsychology #stocks

#SPY #options #marketSentiment

#SPY #options #marketSentiment