“These proposals are somewhat unserious. They lack the details, they're unclear on the mechanisms, they don't make policy sense.”

“These proposals are somewhat unserious. They lack the details, they're unclear on the mechanisms, they don't make policy sense.”

“These proposals are somewhat unserious. They lack the details, they're unclear on the mechanisms, they don't make policy sense.”

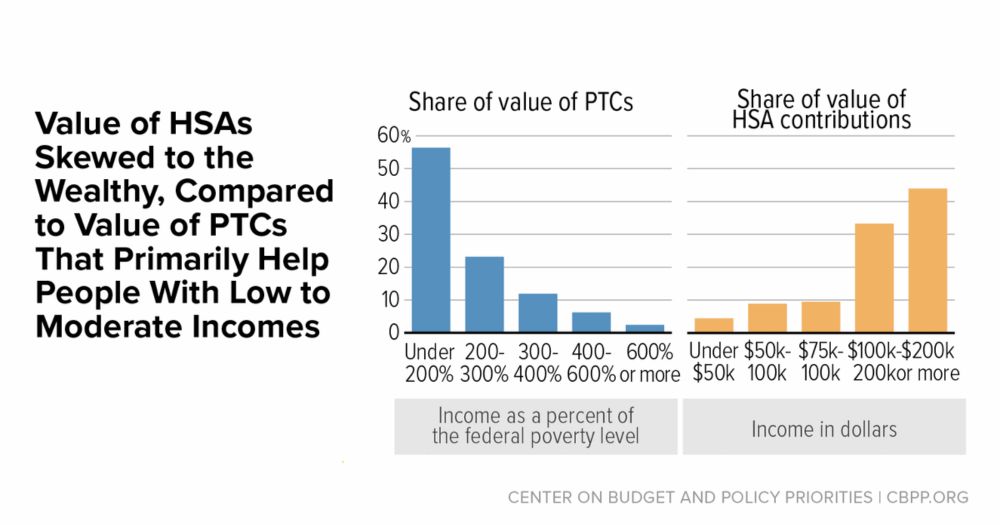

Instead, Congress should extend premium tax credit enhancements to ensure enrollees continue to have access to affordable health coverage.

Instead, Congress should extend premium tax credit enhancements to ensure enrollees continue to have access to affordable health coverage.

Read more from @nicolerapfogel.bsky.social: tinyurl.com/fh5rabhx

Read more from @nicolerapfogel.bsky.social: tinyurl.com/fh5rabhx

More on the details and major issues 👇

More on the details and major issues 👇

More from @nicolerapfogel.bsky.social: www.cbpp.org/research/fed...

More from @nicolerapfogel.bsky.social: www.cbpp.org/research/fed...

Disgraceful.

Disgraceful.

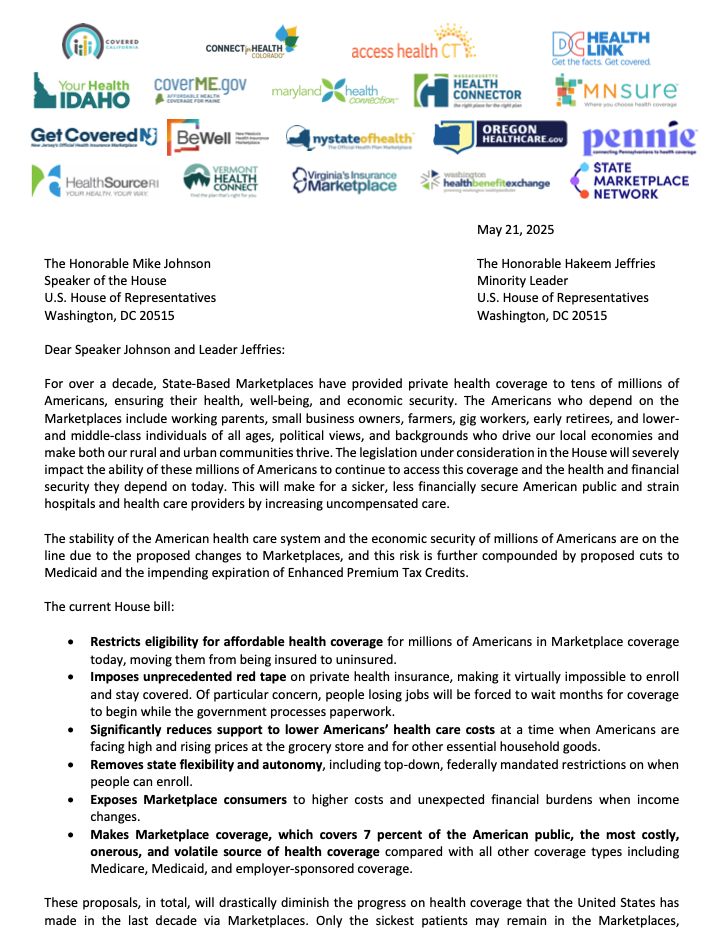

But 18 state-based marketplaces just sent a pretty blistering letter to the House about just how bad those policies are

But 18 state-based marketplaces just sent a pretty blistering letter to the House about just how bad those policies are

Plus the Trump admin 90% funding cut to Navigators means people can't get the support they need to wade through the red tape.

Glad they are being as transparent as possible about it!

Plus the Trump admin 90% funding cut to Navigators means people can't get the support they need to wade through the red tape.