Another thing pushing here is that the cuts to the poor phase in. So the cuts are deeper and the new tax cuts go away. Just a brutal law.

Another thing pushing here is that the cuts to the poor phase in. So the cuts are deeper and the new tax cuts go away. Just a brutal law.

That's about a third of all Americans who would be worse off while the rich get much richer. www.cbo.gov/publication/...

That's about a third of all Americans who would be worse off while the rich get much richer. www.cbo.gov/publication/...

It's really just one simple trick. Here's how it works.

1/

It's really just one simple trick. Here's how it works.

1/

A reminder that the tax code can help working families if lawmakers want it to.

A reminder that the tax code can help working families if lawmakers want it to.

This pulls crucial resources away from rooting out tax evasion by the wealthy and corporations while sowing distrust among undocumented immigrants.

itep.org/turning-irs-...

This pulls crucial resources away from rooting out tax evasion by the wealthy and corporations while sowing distrust among undocumented immigrants.

itep.org/turning-irs-...

These six states raised more than $1 billion each in tax revenue from undocumented immigrants living within their borders. itep.org/undocumented...

These six states raised more than $1 billion each in tax revenue from undocumented immigrants living within their borders. itep.org/undocumented...

www.dontmesswithtaxes.com/2025/01/irs-...

www.dontmesswithtaxes.com/2025/01/irs-...

BUT: if it was what he proposed on the campaign trail, here is the breakdown across income groups.

Tax hikes for all, with the impact getting larger the poorer you are.

1.) The permanent cut in the corporate tax rate from 2017

2.) Extending the 2017 law's temporary provisions

3.) Giant taxes on imported goods

Result: a tax cut for the top 1%, a tax hike for everyone else.

1.) The permanent cut in the corporate tax rate from 2017

2.) Extending the 2017 law's temporary provisions

3.) Giant taxes on imported goods

Result: a tax cut for the top 1%, a tax hike for everyone else.

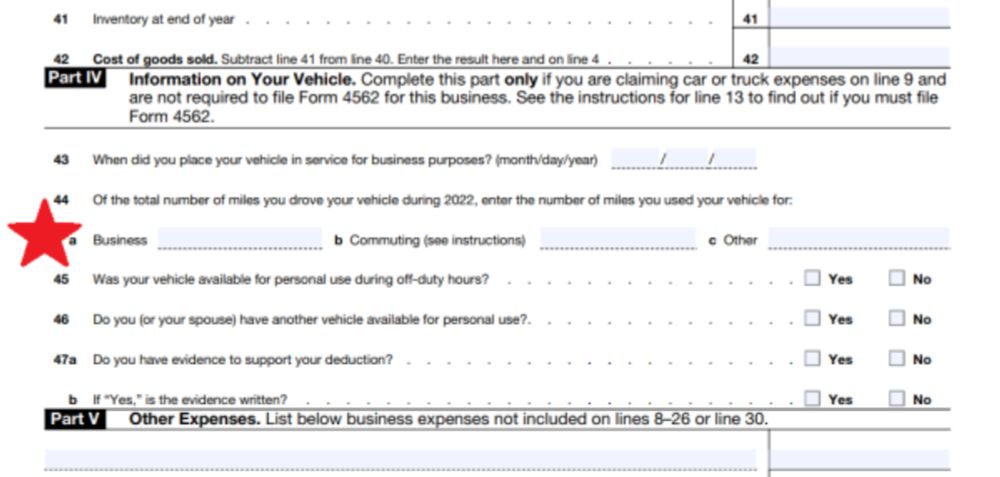

Shedding low-end 1040 work.

Increasing prices.

Only handling tax returns when bookkeeping is high quality, often in house.

Package/Value pricing.

Tax planning as a separate engagement.

#taxsky #taxtwitter

Shedding low-end 1040 work.

Increasing prices.

Only handling tax returns when bookkeeping is high quality, often in house.

Package/Value pricing.

Tax planning as a separate engagement.

#taxsky #taxtwitter