www.marketplace.org/story/2025/1...

www.marketplace.org/story/2025/1...

Overall: down from ~2.8% in Jan 2024 → ~1.5% now.

Lowest quartile: 3.0% → 0.9%.

HS-or-less: 2.9% → 1.1%.

The decline is hitting the least secure workers hardest.

Overall: down from ~2.8% in Jan 2024 → ~1.5% now.

Lowest quartile: 3.0% → 0.9%.

HS-or-less: 2.9% → 1.1%.

The decline is hitting the least secure workers hardest.

www.barrons.com/articles/wag...

www.barrons.com/articles/wag...

Spoiler: nominal wages are sticky and the vacancy-to-unemployment ratio shows workers moving to preserve real wages, not increased labor demand.

www.barrons.com/articles/une...

Spoiler: nominal wages are sticky and the vacancy-to-unemployment ratio shows workers moving to preserve real wages, not increased labor demand.

www.barrons.com/articles/une...

It was a great pleasure to chat with some of the best in the labor space.

www.linkedin.com/events/thepo...

It was a great pleasure to chat with some of the best in the labor space.

www.linkedin.com/events/thepo...

www.atlantafed.org/research/pub...

www.atlantafed.org/research/pub...

1) U-6, the most encompassing measure of unemployment has 3-month average not seen since Nov. 2021.

2) professional and business services employment has lost 271k jobs since May 2023.

139,000 new jobs

95,000 in downward revisions in March/April

Only 44k net new jobs this month

Ruh-roh Donald.

1) U-6, the most encompassing measure of unemployment has 3-month average not seen since Nov. 2021.

2) professional and business services employment has lost 271k jobs since May 2023.

www.bea.gov/news/2025/gr...

www.bea.gov/news/2025/gr...

-Continued rise in long-term unemployed, 1.7 m and nearly 1 in 4 of all unemployed

-9k fewer federal workers, deferred resignations cliff still looming

-Professional + business services stopped losses but big structural losses in past 2 years

At 8:30 am ET, BLS delivers one of the most-important signals abt how economy is changing.

Forecasts’ center:

+133K jobs

Unemployment rate (UR) stable at 4.2%

-Continued rise in long-term unemployed, 1.7 m and nearly 1 in 4 of all unemployed

-9k fewer federal workers, deferred resignations cliff still looming

-Professional + business services stopped losses but big structural losses in past 2 years

www.bea.gov/news/2025/gr...

www.bea.gov/news/2025/gr...

Our new essay collection brings together great minds to imagine how democracy can better deliver the economy Americans need and want. rooseveltinstitute.org/publications...

Join us in welcoming Paul 🙌 rooseveltinstitute.org/blog/doing-g...

-Shelter inflation slowed, finally but for how long.

-Food inflation still high, and being felt.

-Medical care inflation surged, red flag if it persists.

-Recreation and flight fare inflation dropped, consumer fears of downturn?

Stay tuned!

-Shelter inflation slowed, finally but for how long.

-Food inflation still high, and being felt.

-Medical care inflation surged, red flag if it persists.

-Recreation and flight fare inflation dropped, consumer fears of downturn?

Stay tuned!

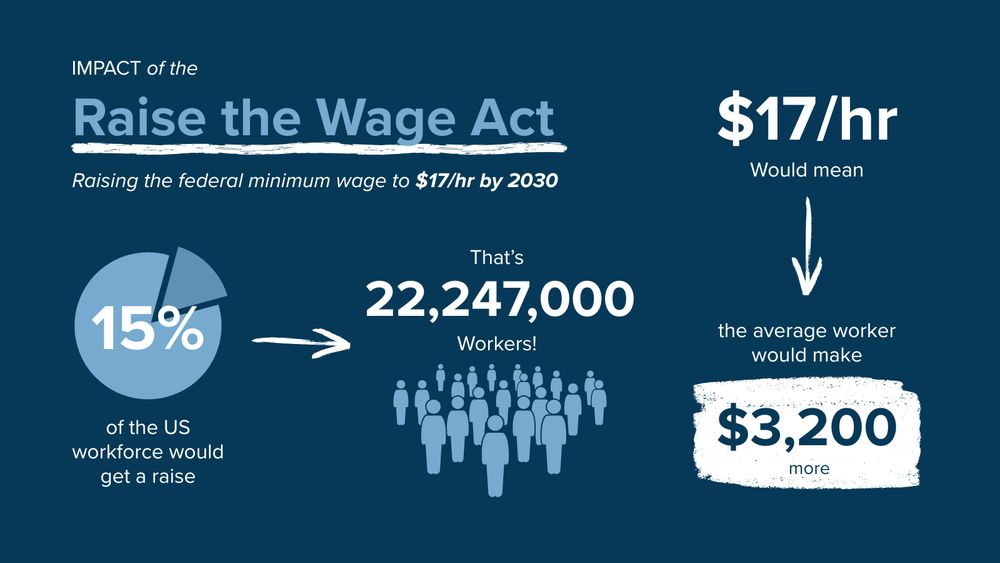

This increase would impact 15% of the US workforce—over 22 million people—and the average affected worker would make an additional $3,200/yr

www.epi.org/publication/...

-Professional + business services stopped ongoing losses

-Leisure +hospitality had a big rebound

-Red flag is the rise in long-term unemployed

-Tick up in the unemployment rate is largely due to new entrants (teenagers)

-4k fewer federal workers due to DOGE

Follow live updates.

-Professional + business services stopped ongoing losses

-Leisure +hospitality had a big rebound

-Red flag is the rise in long-term unemployed

-Tick up in the unemployment rate is largely due to new entrants (teenagers)

-4k fewer federal workers due to DOGE

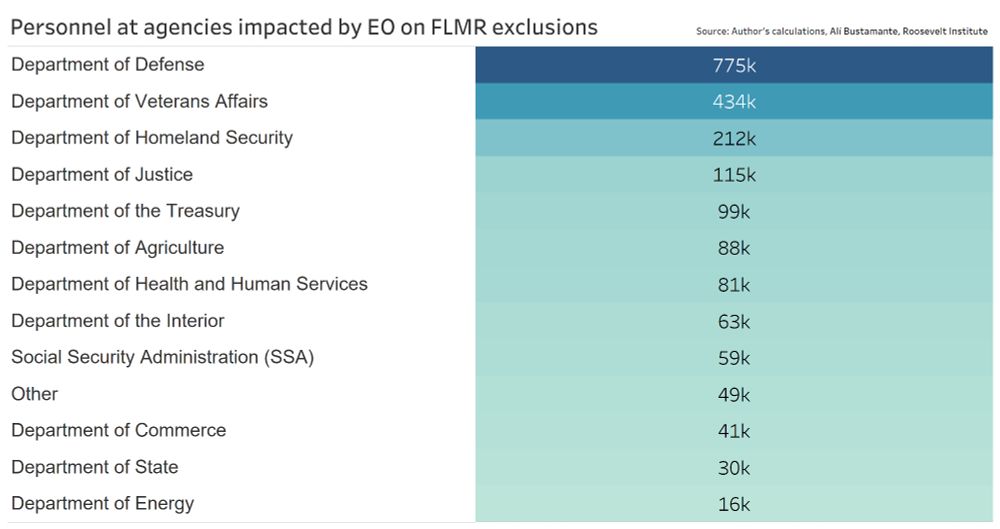

www.whitehouse.gov/presidential...

www.whitehouse.gov/presidential...