www.nytimes.com/2025/08/12/b...

www.nytimes.com/2025/08/12/b...

“We must enact measures to ensure more donations actually reach working charities,” says IPS scholar @bdevaan.bsky.social:

“We must enact measures to ensure more donations actually reach working charities,” says IPS scholar @bdevaan.bsky.social:

REPORT by @chuck77.bsky.social, @bdevaan.bsky.social, @helenofips.bsky.social and @dpetegorsky.bsky.social:

REPORT by @chuck77.bsky.social, @bdevaan.bsky.social, @helenofips.bsky.social and @dpetegorsky.bsky.social:

IPS @inequality.org scholars @bdevaan.bsky.social and @chuck77.bsky.social in @npquarterly.bsky.social:

IPS @inequality.org scholars @bdevaan.bsky.social and @chuck77.bsky.social in @npquarterly.bsky.social:

inequality.org/article/the-...

inequality.org/article/the-...

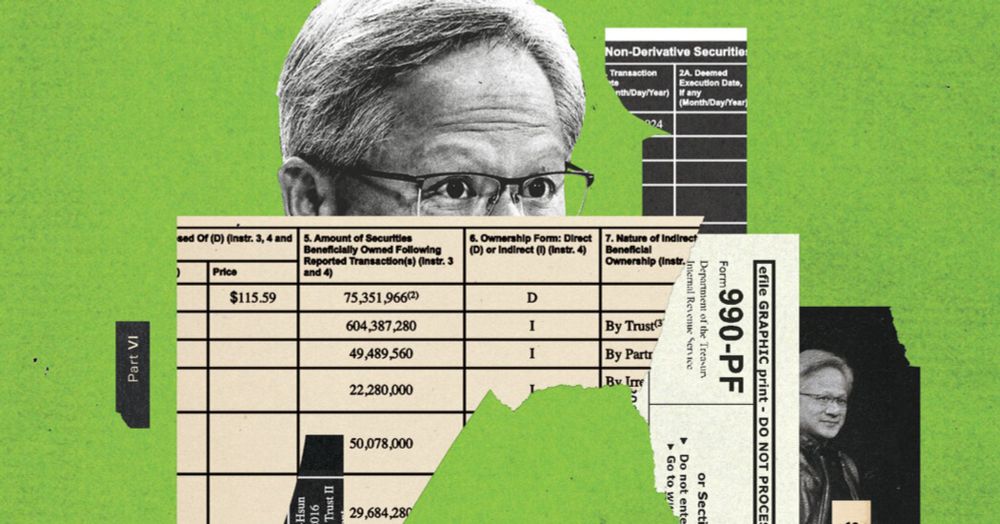

@chuck77.bsky.social @helenofips.bsky.social @dpetegorsky.bsky.social and I seek to shed a little more light on the flow of these tax-benefited billions...

@ips-dc.org @inequality.org

inequality.org/article/the-...

@chuck77.bsky.social @helenofips.bsky.social @dpetegorsky.bsky.social and I seek to shed a little more light on the flow of these tax-benefited billions...

@ips-dc.org @inequality.org

inequality.org/article/the-...

Our @inequality.org team looked at impacts on giving, fair taxation, and democracy itself.

KEY FINDINGS: 🧵

Our @inequality.org team looked at impacts on giving, fair taxation, and democracy itself.

KEY FINDINGS: 🧵

Part one:

Part one:

We’re the campaign that’s going to stop them 🧵

We’re the campaign that’s going to stop them 🧵

inequality.org/article/daf-...

inequality.org/article/daf-...

He is not alone.

Read @michaelmechanic.bsky.social’s investigation into the widespread practice from earlier this year.

He is not alone.

Read @michaelmechanic.bsky.social’s investigation into the widespread practice from earlier this year.

Musk is taking advantage of the tax benefits while not giving away his money

This year he’s $421 million short of the minimum

Musk is taking advantage of the tax benefits while not giving away his money

This year he’s $421 million short of the minimum

IPS @inequality.bsky.social scholars Chuck Collins and @bdevaan.bsky.social: #nonprofitsky

IPS @inequality.bsky.social scholars Chuck Collins and @bdevaan.bsky.social: #nonprofitsky

www.nytimes.com/2024/12/05/b...

www.nytimes.com/2024/12/05/b...

www.forbes.com/sites/mariag...

www.forbes.com/sites/mariag...

@thelever.bsky.social @countingcharity.bsky.social @ips-dc.bsky.social 🤝

@thelever.bsky.social @countingcharity.bsky.social @ips-dc.bsky.social 🤝

www.nytimes.com/2024/11/24/u...

www.latimes.com/business/sto...