climatecommunityinstitute.substack.com/p/insurers-c...

climatecommunityinstitute.substack.com/p/insurers-c...

Article: www.citizen.org/article/clim...

datawrapper.dwcdn.net/LkvOl/3/

Article: www.citizen.org/article/clim...

datawrapper.dwcdn.net/LkvOl/3/

www.citizen.org/news/why-we-...

Our @kennystancil.bsky.social spoke with KTVU about his new analysis of record home insurance profits (more below).

thirdact.org/nyc/events/lt-gov-delgado-bill-mckibben-in-conversation-30-minutes/

thirdact.org/nyc/events/lt-gov-delgado-bill-mckibben-in-conversation-30-minutes/

Check out these new interactive maps we released, with incredible work from @kennystancil.bsky.social

A collaboration with @publiccitizen.bsky.social.

🧵 ⬇️

Check out these new interactive maps we released, with incredible work from @kennystancil.bsky.social

www.theinsurer.com/ti/news/naic...

www.theinsurer.com/ti/news/naic...

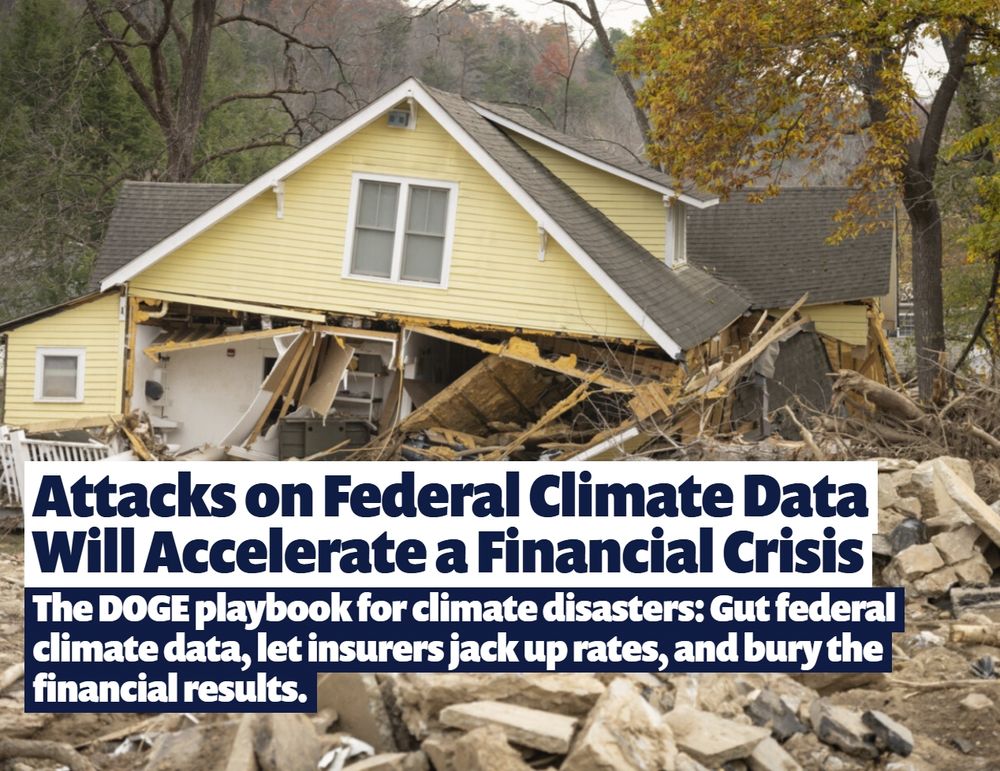

🏘️ Insurers abandon states like California to protect profits from wildfire risk

📢 Who should shoulder the costs of climate disasters?

👉 Read our new analysis: bit.ly/4kpTKil

As homeowners lose coverage, banks could “force-place” expensive backup insurance, with little incentive to keep the price reasonable.

Without oversight from the CFPB, this could be ripe for abuse.

thehill.com/business/513...

As homeowners lose coverage, banks could “force-place” expensive backup insurance, with little incentive to keep the price reasonable.

Without oversight from the CFPB, this could be ripe for abuse.

thehill.com/business/513...

finance.yahoo.com/news/powell-...

That’s a recipe for financial disaster.

That’s a recipe for financial disaster.

While insurers will surely find ways to profit, there's a real question about whether vulnerable people can pay higher costs indefinitely.

And what happens to the economy if they can't?

While insurers will surely find ways to profit, there's a real question about whether vulnerable people can pay higher costs indefinitely.

And what happens to the economy if they can't?