Yonatan Berman

@yonatanberman.com

Associate Professor in Economics, King's College London

Also @iza.org, @lseinequalities.bsky.social, @stone-lis.bsky.social

Economics, inequality, mobility, politics

https://www.yonatanberman.com/

Also @iza.org, @lseinequalities.bsky.social, @stone-lis.bsky.social

Economics, inequality, mobility, politics

https://www.yonatanberman.com/

Two points missing in recent Wealth Tax debates:

- If we measure total taxes as a % of wealth (not income), the system is highly regressive

- The wealthiest pay 3%-4% of their wealth annually in taxes. Wealth Tax shouldn't be seen as starting from zero (see US data from @gabrielzucman.bsky.social)

- If we measure total taxes as a % of wealth (not income), the system is highly regressive

- The wealthiest pay 3%-4% of their wealth annually in taxes. Wealth Tax shouldn't be seen as starting from zero (see US data from @gabrielzucman.bsky.social)

October 21, 2025 at 12:12 PM

Two points missing in recent Wealth Tax debates:

- If we measure total taxes as a % of wealth (not income), the system is highly regressive

- The wealthiest pay 3%-4% of their wealth annually in taxes. Wealth Tax shouldn't be seen as starting from zero (see US data from @gabrielzucman.bsky.social)

- If we measure total taxes as a % of wealth (not income), the system is highly regressive

- The wealthiest pay 3%-4% of their wealth annually in taxes. Wealth Tax shouldn't be seen as starting from zero (see US data from @gabrielzucman.bsky.social)

Also, if anyone wants to reform stamp duty, we can start by making it truly progressive in house price (data from assets.publishing.service.gov.uk/media/674db6... ):

October 8, 2025 at 4:17 PM

Also, if anyone wants to reform stamp duty, we can start by making it truly progressive in house price (data from assets.publishing.service.gov.uk/media/674db6... ):

Definition of a good airport

@StockholmArlandaAirport

@StockholmArlandaAirport

June 27, 2025 at 6:18 PM

Definition of a good airport

@StockholmArlandaAirport

@StockholmArlandaAirport

May 15, 2025 at 12:23 PM

Just a reminder: the last time we saw welfare cuts of this magnitude, life expectancy dropped by 3-5 months. That's tens of thousands of excess deaths over the course of a decade.

March 27, 2025 at 4:28 PM

Just a reminder: the last time we saw welfare cuts of this magnitude, life expectancy dropped by 3-5 months. That's tens of thousands of excess deaths over the course of a decade.

These things are obviously there, but yeah, different statistics tell different stories. The top 1% wealth share isn't saying much about the bottom of the distribution. There are other useful stats about housing affordability declining, like this one from the ONS:

January 25, 2025 at 9:41 PM

These things are obviously there, but yeah, different statistics tell different stories. The top 1% wealth share isn't saying much about the bottom of the distribution. There are other useful stats about housing affordability declining, like this one from the ONS:

To add to tonight's discourse on UK wealth inequality: the most reliable source is probably these estimates by Alvaredo, Atkinson, and Morelli. They only go up to 2012 but still worth considering, especially if discussing long-term trends.

@chrisgiles.bsky.social @liambyrnemp.bsky.social

@chrisgiles.bsky.social @liambyrnemp.bsky.social

January 25, 2025 at 8:59 PM

To add to tonight's discourse on UK wealth inequality: the most reliable source is probably these estimates by Alvaredo, Atkinson, and Morelli. They only go up to 2012 but still worth considering, especially if discussing long-term trends.

@chrisgiles.bsky.social @liambyrnemp.bsky.social

@chrisgiles.bsky.social @liambyrnemp.bsky.social

Does anyone know what's the deal with 'Invalid Handle'?

What did I do wrong?

What did I do wrong?

November 14, 2024 at 3:25 PM

Does anyone know what's the deal with 'Invalid Handle'?

What did I do wrong?

What did I do wrong?

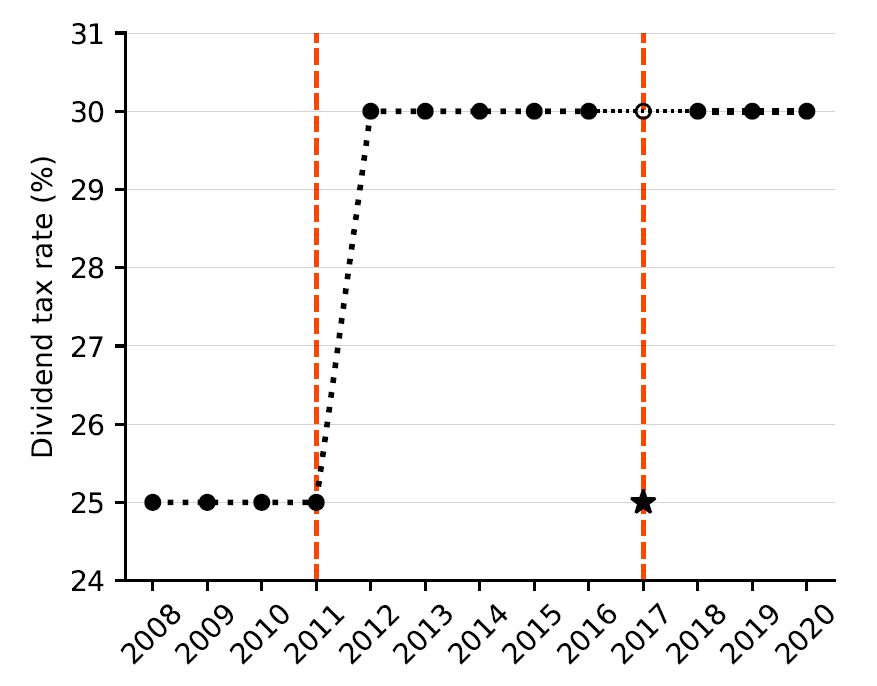

While both reforms triggered similar short-term responses, long-term effects differed. The permanent tax increase didn't reduce reported dividends in later years. However, the 2017 one-year cut led to a large decline in withdrawals, reflecting an increase in retained earnings

4/5

4/5

October 23, 2024 at 2:20 PM

While both reforms triggered similar short-term responses, long-term effects differed. The permanent tax increase didn't reduce reported dividends in later years. However, the 2017 one-year cut led to a large decline in withdrawals, reflecting an increase in retained earnings

4/5

4/5

Both reforms incentivized shareholders to withdraw dividends, leading to a significant impact on dividend tax revenue. In both cases, revenue doubled or more, reaching 1%-1.5% of national income.

3/5

3/5

October 23, 2024 at 2:20 PM

Both reforms incentivized shareholders to withdraw dividends, leading to a significant impact on dividend tax revenue. In both cases, revenue doubled or more, reaching 1%-1.5% of national income.

3/5

3/5

In the 2010s, Israel implemented two major dividend tax reforms: a permanent 5pp rate increase in 2012, and a one-year 5pp tax relief in 2017.

2/5

2/5

October 23, 2024 at 2:20 PM

In the 2010s, Israel implemented two major dividend tax reforms: a permanent 5pp rate increase in 2012, and a one-year 5pp tax relief in 2017.

2/5

2/5

🚨🚨🚨

New Working Paper (with Esteban Klor)!

We study how dividend tax reforms affect dividend payments, tax revenue, and the retention of earnings.

1/5

New Working Paper (with Esteban Klor)!

We study how dividend tax reforms affect dividend payments, tax revenue, and the retention of earnings.

1/5

October 23, 2024 at 2:19 PM

🚨🚨🚨

New Working Paper (with Esteban Klor)!

We study how dividend tax reforms affect dividend payments, tax revenue, and the retention of earnings.

1/5

New Working Paper (with Esteban Klor)!

We study how dividend tax reforms affect dividend payments, tax revenue, and the retention of earnings.

1/5

Absurd proposal. The lost revenue will have to come from somewhere, so higher income tax for workers.

Who is the electorate this proposal seeks to attract? Is it perhaps just a case of self-interested politicians like in our models?

Who is the electorate this proposal seeks to attract? Is it perhaps just a case of self-interested politicians like in our models?

September 24, 2023 at 1:45 PM

Absurd proposal. The lost revenue will have to come from somewhere, so higher income tax for workers.

Who is the electorate this proposal seeks to attract? Is it perhaps just a case of self-interested politicians like in our models?

Who is the electorate this proposal seeks to attract? Is it perhaps just a case of self-interested politicians like in our models?