bsky.app/profile/vram...

When does inflation increase slowly ("hump-shaped") vs rapidly? When do different drivers (wages, markups, etc) play bigger roles?

My #JMP explores these Qs by bringing a key variable back to the center of the debate: capacity utilization

A thread 🧵👇

bsky.app/profile/vram...

@Nacho2G

and PhD advisors for their support.

More on my profile: vasudeva-ram.github.io

Full paper and other research: vasudeva-ram.github.io/research/

Comments welcome!

@Nacho2G

and PhD advisors for their support.

More on my profile: vasudeva-ram.github.io

Full paper and other research: vasudeva-ram.github.io/research/

Comments welcome!

Markups, wages, profits are state-dependent on rate of capacity utilization. This has implications for

→ Wealth and income inequality over cycle

→ Optimal tax & transfer design over cycle

Future work: optimal monetary & tax policy in this framework

Markups, wages, profits are state-dependent on rate of capacity utilization. This has implications for

→ Wealth and income inequality over cycle

→ Optimal tax & transfer design over cycle

Future work: optimal monetary & tax policy in this framework

Provides framework to study key trade-off for monetary policy when capacity is tight:

⭐️Textbook: R ⬆️ → demand ⬇️ →inflation ⬇️ 😀

⭐️But also: R ⬆️ → slow capacity expansion → markups ⬆️ →inflation ⬆️ 😡

Echoes recent analysis by

@employamerica.bsky.social

Provides framework to study key trade-off for monetary policy when capacity is tight:

⭐️Textbook: R ⬆️ → demand ⬇️ →inflation ⬇️ 😀

⭐️But also: R ⬆️ → slow capacity expansion → markups ⬆️ →inflation ⬆️ 😡

Echoes recent analysis by

@employamerica.bsky.social

We estimate our model using Bayesian IRF matching and find a very good fit for key variables to MP shocks.

Bottom line: NK models with capacity utilization can potentially explain both recent as well as historical inflation behavior

We estimate our model using Bayesian IRF matching and find a very good fit for key variables to MP shocks.

Bottom line: NK models with capacity utilization can potentially explain both recent as well as historical inflation behavior

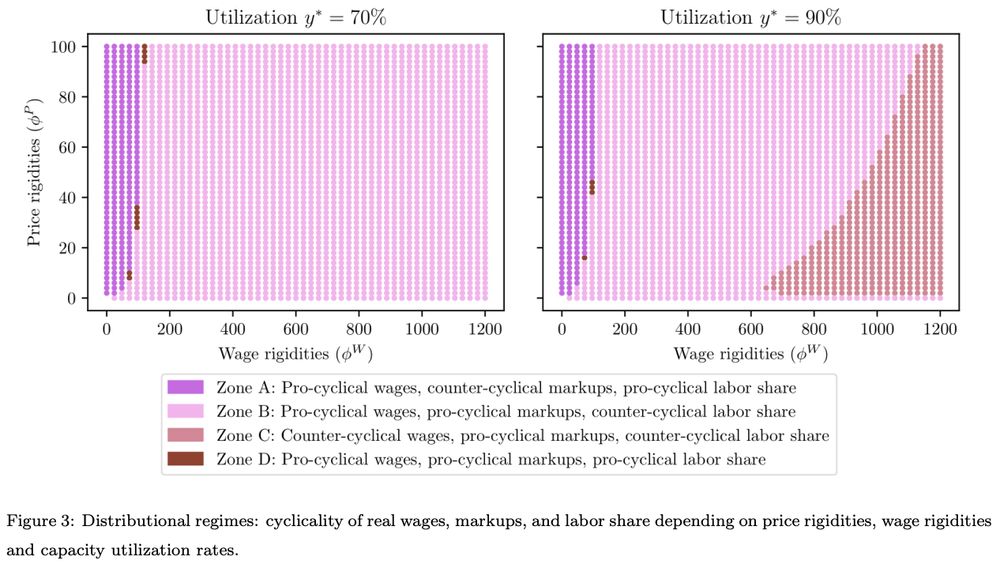

Procyclical markups are more likely when:

➡️ High utilization rate y* when shock occurs

➡️ Prices have relatively lower nominal rigidities than wages

Procyclical markups are more likely when:

➡️ High utilization rate y* when shock occurs

➡️ Prices have relatively lower nominal rigidities than wages

⭐️ Capacity utilization rate y* appears as a state variable in the linearized PC

⭐️ Reflects nonlinearities due to *product market* tightness

⭐️ Capacity utilization rate y* appears as a state variable in the linearized PC

⭐️ Reflects nonlinearities due to *product market* tightness

⭐️When y* is high → inflation responds immediately, driven primarily by higher markups and muted productivity effects (right panel)

⭐️When y* is high → inflation responds immediately, driven primarily by higher markups and muted productivity effects (right panel)

⭐️Higher markups + wages → upward pressure

⭐️Higher productivity → downward pressure

Final inflation response therefore depends on which effects dominate and depends nonlinearly on utilization rate (y*).

⭐️Higher markups + wages → upward pressure

⭐️Higher productivity → downward pressure

Final inflation response therefore depends on which effects dominate and depends nonlinearly on utilization rate (y*).

1️⃣ Firms have higher productivity due to higher worker effort and utilizing idle capacity

2️⃣ Firms raise prices thru higher markups to manage excess demand & maintain precautionary capacity

1️⃣ Firms have higher productivity due to higher worker effort and utilizing idle capacity

2️⃣ Firms raise prices thru higher markups to manage excess demand & maintain precautionary capacity

Firms set capacity before observing variable demand → optimal to hold some "precautionary" capacity

When demand manifests, firms produce by utilizing capacity (ala labor effort in Burnside 93)-*upto max capacity*!

Firms set capacity before observing variable demand → optimal to hold some "precautionary" capacity

When demand manifests, firms produce by utilizing capacity (ala labor effort in Burnside 93)-*upto max capacity*!

1️⃣ Typical inflation response to shocks is sluggish & hump-shaped. But sometimes (eg post-Covid) inflation rises sharply

2️⃣ After MP shocks markups⬆️ when GDP⬆️ ("procyclical"), but New Keynesian (NK) models predict opposite

This paper: reconciling 👆

1️⃣ Typical inflation response to shocks is sluggish & hump-shaped. But sometimes (eg post-Covid) inflation rises sharply

2️⃣ After MP shocks markups⬆️ when GDP⬆️ ("procyclical"), but New Keynesian (NK) models predict opposite

This paper: reconciling 👆

After demand (~mon policy) shocks, when demand ⬆️

• if high slack: idle capacity ⬇️ → firm productivity ⬆️ → slow inflation

• if low slack: precautionary capacity ⬇️ → markups ⬆️ (to manage excess demand) → sharp inflation

After demand (~mon policy) shocks, when demand ⬆️

• if high slack: idle capacity ⬇️ → firm productivity ⬆️ → slow inflation

• if low slack: precautionary capacity ⬇️ → markups ⬆️ (to manage excess demand) → sharp inflation