https://valuelytica.substack.com/

share.google/o0yd79T0HrFc...

valuelytica.substack.com/p/continuati...

valuelytica.substack.com/p/continuati...

share.google/o0yd79T0HrFc...

share.google/o0yd79T0HrFc...

valuelytica.substack.com/p/portfolio-...

valuelytica.substack.com/p/portfolio-...

valuelytica.substack.com/p/portfolio-...

valuelytica.substack.com/p/portfolio-...

valuelytica.substack.com/p/screening-...

valuelytica.substack.com/p/screening-...

valuelytica.substack.com/p/screening-...

valuelytica.substack.com/p/screening-...

valuelytica.substack.com/p/screening-...

valuelytica.substack.com/p/screening-...

valuelytica.substack.com/p/f-score-vs...

valuelytica.substack.com/p/f-score-vs...

valuelytica.substack.com/p/f-score-vs...

valuelytica.substack.com/p/f-score-vs...

valuelytica.substack.com/p/holy-trini...

valuelytica.substack.com/p/holy-trini...

valuelytica.substack.com/p/holy-trini...

valuelytica.substack.com/p/holy-trini...

Substack:

valueandopportunity.substack.com/p/some-links...

Wordpress:

valueandopportunity.com/2025/03/30/s...

Substack:

valueandopportunity.substack.com/p/some-links...

Wordpress:

valueandopportunity.com/2025/03/30/s...

Wordpress

valueandopportunity.com/2025/03/17/s...

and Substack

open.substack.com/pub/valueand...

Wordpress

valueandopportunity.com/2025/03/17/s...

and Substack

open.substack.com/pub/valueand...

A quick thread but the basic TLDR is that some customers are getting insanely screwed with APR going from the advertised 17% to a real APR of 34%....

@martinlewis.moneysavingexpert.com

A quick thread but the basic TLDR is that some customers are getting insanely screwed with APR going from the advertised 17% to a real APR of 34%....

@martinlewis.moneysavingexpert.com

valuelytica.substack.com/p/holy-trini...

valuelytica.substack.com/p/holy-trini...

valuelytica.substack.com/p/introducti...

valuelytica.substack.com/p/introducti...

valuelytica.substack.com/p/vorstellun...

valuelytica.substack.com/p/vorstellun...

valuelytica.substack.com/p/ausflug-in...

valuelytica.substack.com/p/ausflug-in...

Ziemlich smarter move, aber eben lipstick on a 🐷

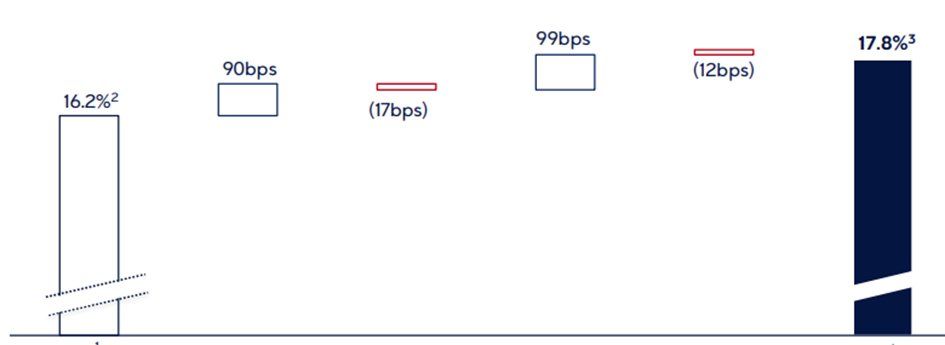

How did Eurobank achieve such an increase in capital ratios, in Q3 24? The trick is in the +99bps.

Which comes from a mysterious decrease of 2.4bn€ in RWA. But how? Deleveraging?

Oh no, that would be hard work. I’ve got a better idea.

Thread.

Ziemlich smarter move, aber eben lipstick on a 🐷

valueandopportunity.com/2025/01/10/p...

and Substack:

open.substack.com/pub/valueand...

valueandopportunity.com/2025/01/10/p...

and Substack:

open.substack.com/pub/valueand...