Todd Phillips

@tphillips.bsky.social

Banking and administrative law. Independent policy consultant. Future Robinson College. Fellow Roosevelt Institute. Fmr CAP, FDIC, ACUS.

Politico really undersells how legally bonkers this argument is.

RIFing employees is agencies' individual decisions, but is pursuant to the President's inherent constitutional authority.

RIFing employees is agencies' individual decisions, but is pursuant to the President's inherent constitutional authority.

October 2, 2025 at 9:42 PM

Politico really undersells how legally bonkers this argument is.

RIFing employees is agencies' individual decisions, but is pursuant to the President's inherent constitutional authority.

RIFing employees is agencies' individual decisions, but is pursuant to the President's inherent constitutional authority.

To be clear, we need not choose between progressive policies and independent regulators; independence does not mean serving the interests of regulated industries over those of the public. It simply means being able to act without fear or favor.

September 29, 2025 at 5:09 PM

To be clear, we need not choose between progressive policies and independent regulators; independence does not mean serving the interests of regulated industries over those of the public. It simply means being able to act without fear or favor.

Very interesting that the Administration's application to the Supreme Court makes clear it is not challenging the constitutionality of the Fed's for cause removal protections. This won't be a chance to directly overrule Humphrey's.

September 18, 2025 at 4:42 PM

Very interesting that the Administration's application to the Supreme Court makes clear it is not challenging the constitutionality of the Fed's for cause removal protections. This won't be a chance to directly overrule Humphrey's.

I'm up in @bloomberglaw.com arguing that the recent push to reshape bank supervision, and Matters Requiring Attention in particular, "is the wrong remedy, resulting from [a] misdiagnosis of MRAs’ problems."

September 12, 2025 at 12:49 PM

I'm up in @bloomberglaw.com arguing that the recent push to reshape bank supervision, and Matters Requiring Attention in particular, "is the wrong remedy, resulting from [a] misdiagnosis of MRAs’ problems."

This WSJ op-ed is misleading. The Constitution gave Congress the right to regulate the value of money, and to regulate interstate commerce. There's no good reason a delegation of the first can have removal restrictions but the other (used for FTC, NLRB, etc) cannot.

www.wsj.com/opinion/trum...

www.wsj.com/opinion/trum...

September 5, 2025 at 1:38 PM

This WSJ op-ed is misleading. The Constitution gave Congress the right to regulate the value of money, and to regulate interstate commerce. There's no good reason a delegation of the first can have removal restrictions but the other (used for FTC, NLRB, etc) cannot.

www.wsj.com/opinion/trum...

www.wsj.com/opinion/trum...

September 3, 2025 at 12:41 PM

@warren.senate.gov rightly criticizes the OCC for failing to protect the stablecoin market from presidential interference.

If the OCC preferences stablecoin issuers with ties to the President, it would be opening up stablecoin holders, other issuers, and the real economy to real risks.

If the OCC preferences stablecoin issuers with ties to the President, it would be opening up stablecoin holders, other issuers, and the real economy to real risks.

September 3, 2025 at 12:40 PM

@warren.senate.gov rightly criticizes the OCC for failing to protect the stablecoin market from presidential interference.

If the OCC preferences stablecoin issuers with ties to the President, it would be opening up stablecoin holders, other issuers, and the real economy to real risks.

If the OCC preferences stablecoin issuers with ties to the President, it would be opening up stablecoin holders, other issuers, and the real economy to real risks.

DOJ says that "The President’s judgment about what constitutes 'cause' [for removing a Fed governor] is not subject to judicial second-guessing."

If that's true, then the Federal Reserve Act's removal clause offers absolutely zero protection.

That just cannot be the case.

If that's true, then the Federal Reserve Act's removal clause offers absolutely zero protection.

That just cannot be the case.

August 29, 2025 at 1:05 PM

DOJ says that "The President’s judgment about what constitutes 'cause' [for removing a Fed governor] is not subject to judicial second-guessing."

If that's true, then the Federal Reserve Act's removal clause offers absolutely zero protection.

That just cannot be the case.

If that's true, then the Federal Reserve Act's removal clause offers absolutely zero protection.

That just cannot be the case.

An excellent observation by Adam Levitin: No one would tolerate the IRS commissioner acting like Bill Pulte is.

Pulte is using his office to go after political opponents.

www.creditslips.org/creditslips/...

Pulte is using his office to go after political opponents.

www.creditslips.org/creditslips/...

August 20, 2025 at 11:32 PM

An excellent observation by Adam Levitin: No one would tolerate the IRS commissioner acting like Bill Pulte is.

Pulte is using his office to go after political opponents.

www.creditslips.org/creditslips/...

Pulte is using his office to go after political opponents.

www.creditslips.org/creditslips/...

Then, there are risks for competitors, who may have to compete on an unlevel playing field. Finally, there are risks to financial stability. If the presidentially-connected firm must quickly liquidate treasuries to meet redemption requests, it could disrupt the treasuries market. 7/

August 11, 2025 at 7:03 PM

Then, there are risks for competitors, who may have to compete on an unlevel playing field. Finally, there are risks to financial stability. If the presidentially-connected firm must quickly liquidate treasuries to meet redemption requests, it could disrupt the treasuries market. 7/

Who's at risk? First, customers of the presidentially-connected firm. Customers have no private right of action under the GENIUS Act, and if the OCC doesn't effectively regulate the firm, no one can. 6/

August 11, 2025 at 7:03 PM

Who's at risk? First, customers of the presidentially-connected firm. Customers have no private right of action under the GENIUS Act, and if the OCC doesn't effectively regulate the firm, no one can. 6/

The risks posed by presidential control of regulators with oversight of presidentially-connected firms are huge. The president could direct that the law not be enforced against his firms, or direct the law be overly-enforced against his competitors. 5/

August 11, 2025 at 7:02 PM

The risks posed by presidential control of regulators with oversight of presidentially-connected firms are huge. The president could direct that the law not be enforced against his firms, or direct the law be overly-enforced against his competitors. 5/

I've posed a new essay on SSRN discussing what I call presidentially-connected firms and the importance of independent regulators. I also guesstimate that President Trump is receiving about $13 million annually from the USD1 stablecoin.

Here's the link: papers.ssrn.com/sol3/papers....

Here's the link: papers.ssrn.com/sol3/papers....

August 11, 2025 at 7:01 PM

I've posed a new essay on SSRN discussing what I call presidentially-connected firms and the importance of independent regulators. I also guesstimate that President Trump is receiving about $13 million annually from the USD1 stablecoin.

Here's the link: papers.ssrn.com/sol3/papers....

Here's the link: papers.ssrn.com/sol3/papers....

I don't normally post about personal stuff, but...

WHOOOOO!!!

WHOOOOO!!!

August 7, 2025 at 3:17 PM

I don't normally post about personal stuff, but...

WHOOOOO!!!

WHOOOOO!!!

Are you interested in reading a draft law review essay about the risks that OCC regulation presidentially-connected stablecoin issuers could pose to token-holders, competitors, and the financial system?

It's not yet ready for prime time, but I'd love to get comments on it!

It's not yet ready for prime time, but I'd love to get comments on it!

August 5, 2025 at 7:36 PM

Are you interested in reading a draft law review essay about the risks that OCC regulation presidentially-connected stablecoin issuers could pose to token-holders, competitors, and the financial system?

It's not yet ready for prime time, but I'd love to get comments on it!

It's not yet ready for prime time, but I'd love to get comments on it!

I'm pleased to announce that my essay, When Siri Becomes a Deposit Broker, is now forthcoming in @finandsoc.bsky.social!

The most recent version is available here: papers.ssrn.com/sol3/papers....

The most recent version is available here: papers.ssrn.com/sol3/papers....

August 5, 2025 at 12:15 PM

I'm pleased to announce that my essay, When Siri Becomes a Deposit Broker, is now forthcoming in @finandsoc.bsky.social!

The most recent version is available here: papers.ssrn.com/sol3/papers....

The most recent version is available here: papers.ssrn.com/sol3/papers....

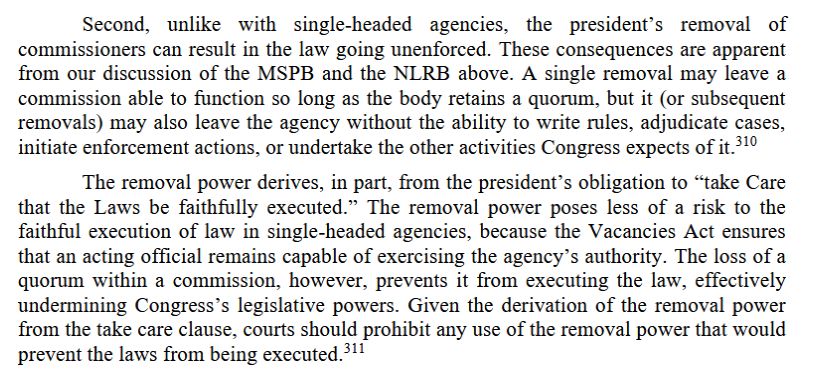

Fourth, because the Constitution obliges the president

“take Care that the Laws be faithfully executed,” we argue that the president should not be permitted to removal commissioners when doing so would result in commissions being unable to enforce the law when they are below a quorum. 5/

“take Care that the Laws be faithfully executed,” we argue that the president should not be permitted to removal commissioners when doing so would result in commissions being unable to enforce the law when they are below a quorum. 5/

July 11, 2025 at 12:04 PM

Fourth, because the Constitution obliges the president

“take Care that the Laws be faithfully executed,” we argue that the president should not be permitted to removal commissioners when doing so would result in commissions being unable to enforce the law when they are below a quorum. 5/

“take Care that the Laws be faithfully executed,” we argue that the president should not be permitted to removal commissioners when doing so would result in commissions being unable to enforce the law when they are below a quorum. 5/

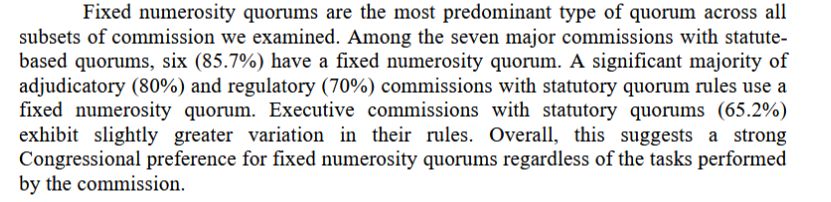

Third, our analysis of statutory and regulatory quorum requirements reveals that Congress prefers the common-law rules, protecting majoritarianism and deliberative decision-making, but commissions adopt rules that preserve their flexibility. 4/

July 11, 2025 at 12:04 PM

Third, our analysis of statutory and regulatory quorum requirements reveals that Congress prefers the common-law rules, protecting majoritarianism and deliberative decision-making, but commissions adopt rules that preserve their flexibility. 4/

Second, common-law quorum rules, which apply in the absence of statutory provisions to the contrary, can be summed up by the following principles.

(Note, we think that federal courts not following these principles has enabled President Trump's removals!) 3/

(Note, we think that federal courts not following these principles has enabled President Trump's removals!) 3/

July 11, 2025 at 12:04 PM

Second, common-law quorum rules, which apply in the absence of statutory provisions to the contrary, can be summed up by the following principles.

(Note, we think that federal courts not following these principles has enabled President Trump's removals!) 3/

(Note, we think that federal courts not following these principles has enabled President Trump's removals!) 3/

We know the paper is long, so here are four key takeaways.

First, quorum requirements (combined with voting rules) seek to balance three risks to collective decision-making: counter-majoritarian errors, deliberative errors, and absenteeism. 2/

First, quorum requirements (combined with voting rules) seek to balance three risks to collective decision-making: counter-majoritarian errors, deliberative errors, and absenteeism. 2/

July 11, 2025 at 12:04 PM

We know the paper is long, so here are four key takeaways.

First, quorum requirements (combined with voting rules) seek to balance three risks to collective decision-making: counter-majoritarian errors, deliberative errors, and absenteeism. 2/

First, quorum requirements (combined with voting rules) seek to balance three risks to collective decision-making: counter-majoritarian errors, deliberative errors, and absenteeism. 2/

🚨@nicholasbednar.bsky.social and I have a new article titled Commission Quorums.

In light of firings rendering the NLRB and MSPB quorum-less, we review caselaw, common law principles, and the quorum rules of 76 commissions to understand the law of quorums. 1/

papers.ssrn.com/sol3/papers....

In light of firings rendering the NLRB and MSPB quorum-less, we review caselaw, common law principles, and the quorum rules of 76 commissions to understand the law of quorums. 1/

papers.ssrn.com/sol3/papers....

July 11, 2025 at 12:04 PM

🚨@nicholasbednar.bsky.social and I have a new article titled Commission Quorums.

In light of firings rendering the NLRB and MSPB quorum-less, we review caselaw, common law principles, and the quorum rules of 76 commissions to understand the law of quorums. 1/

papers.ssrn.com/sol3/papers....

In light of firings rendering the NLRB and MSPB quorum-less, we review caselaw, common law principles, and the quorum rules of 76 commissions to understand the law of quorums. 1/

papers.ssrn.com/sol3/papers....

Does Marco Rubio get two votes when the Board of the International Development Finance Corporation has a vote, or just one?

www.dfc.gov/who-we-are/o...

www.dfc.gov/who-we-are/o...

July 2, 2025 at 3:23 PM

Does Marco Rubio get two votes when the Board of the International Development Finance Corporation has a vote, or just one?

www.dfc.gov/who-we-are/o...

www.dfc.gov/who-we-are/o...

A pedantic note on Kavanaugh's concurrence in Consumers' Research.

I thought it was the Constitution that permits or prohibits independent agencies, and the Court just interprets the Constitution. Guess I was wrong. (cc @kexelchabot.bsky.social)

I thought it was the Constitution that permits or prohibits independent agencies, and the Court just interprets the Constitution. Guess I was wrong. (cc @kexelchabot.bsky.social)

June 27, 2025 at 8:06 PM

A pedantic note on Kavanaugh's concurrence in Consumers' Research.

I thought it was the Constitution that permits or prohibits independent agencies, and the Court just interprets the Constitution. Guess I was wrong. (cc @kexelchabot.bsky.social)

I thought it was the Constitution that permits or prohibits independent agencies, and the Court just interprets the Constitution. Guess I was wrong. (cc @kexelchabot.bsky.social)

I spoke with American Banker about the need for independence of the financial regulators: In short, it's about applying the law without fear or favor.

www.americanbanker.com/news/is-regu...

www.americanbanker.com/news/is-regu...

June 27, 2025 at 7:09 PM

I spoke with American Banker about the need for independence of the financial regulators: In short, it's about applying the law without fear or favor.

www.americanbanker.com/news/is-regu...

www.americanbanker.com/news/is-regu...

Supreme Court holds the banking agencies' funding mechanisms are constitutional.

www.supremecourt.gov/opinions/24p... at 14.

www.supremecourt.gov/opinions/24p... at 14.

June 27, 2025 at 2:44 PM

Supreme Court holds the banking agencies' funding mechanisms are constitutional.

www.supremecourt.gov/opinions/24p... at 14.

www.supremecourt.gov/opinions/24p... at 14.