Tim Latimer

@timlatimer.bsky.social

Geothermal 🌋⚡️

CEO @ Fervo Energy

HTX

CEO @ Fervo Energy

HTX

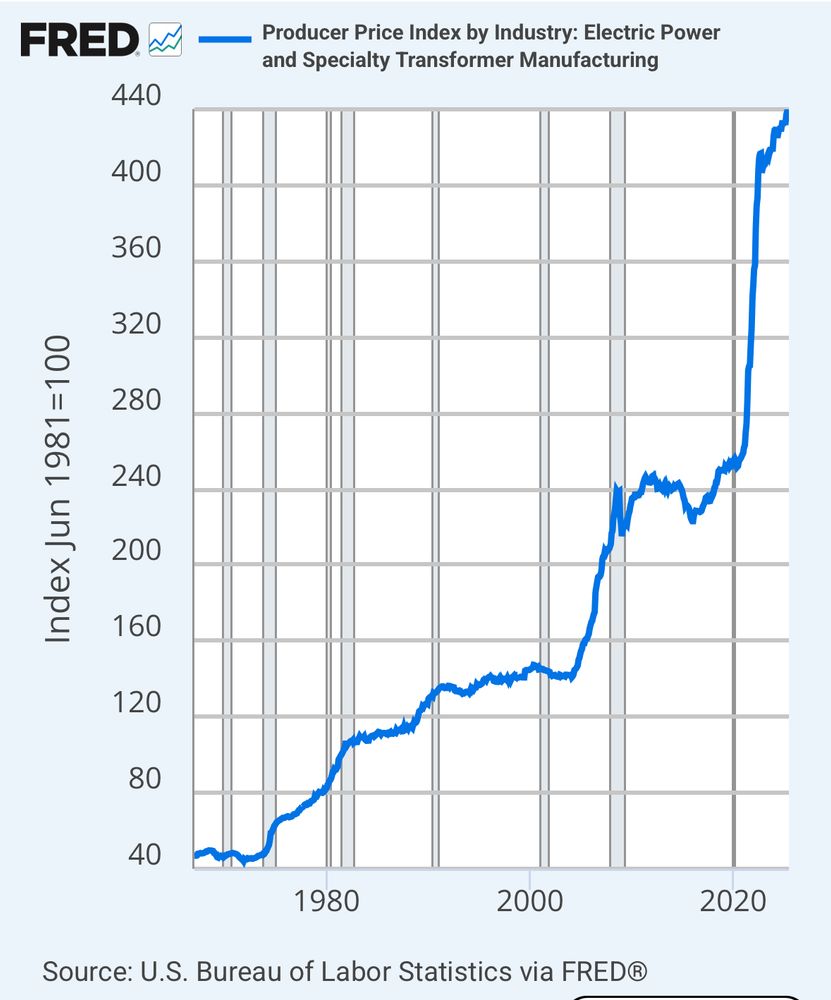

A lot of folks still have 2000-2010s era power prices in their heads as “normal” with an expectation that we will return to “normal” at some point.

There are many reasons that isn’t true, but this is probably the biggest among them. We are in a new era of power prices.

There are many reasons that isn’t true, but this is probably the biggest among them. We are in a new era of power prices.

July 30, 2025 at 4:36 PM

A lot of folks still have 2000-2010s era power prices in their heads as “normal” with an expectation that we will return to “normal” at some point.

There are many reasons that isn’t true, but this is probably the biggest among them. We are in a new era of power prices.

There are many reasons that isn’t true, but this is probably the biggest among them. We are in a new era of power prices.

It was a great week this week at Fervo.

July 20, 2025 at 4:58 PM

It was a great week this week at Fervo.

It’s wild that just a few years ago there were zero $1 trillion companies and now there are several in the $2, $3 and even now $4 trillion range.

July 11, 2025 at 12:59 AM

It’s wild that just a few years ago there were zero $1 trillion companies and now there are several in the $2, $3 and even now $4 trillion range.

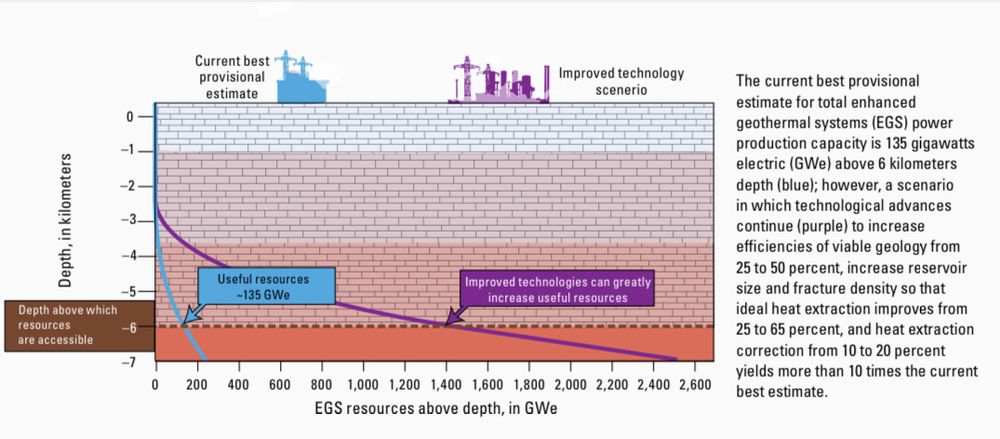

The latest USGS geothermal is a great example of something people outside the resource industry often miss—how much of something there is is a function of how good the tech is.

For just the Great Basin in the US:

Base scenario: 135 GW

Improved tech: 1400 GW

pubs.usgs.gov/fs/2025/3027...

For just the Great Basin in the US:

Base scenario: 135 GW

Improved tech: 1400 GW

pubs.usgs.gov/fs/2025/3027...

May 24, 2025 at 4:49 PM

The latest USGS geothermal is a great example of something people outside the resource industry often miss—how much of something there is is a function of how good the tech is.

For just the Great Basin in the US:

Base scenario: 135 GW

Improved tech: 1400 GW

pubs.usgs.gov/fs/2025/3027...

For just the Great Basin in the US:

Base scenario: 135 GW

Improved tech: 1400 GW

pubs.usgs.gov/fs/2025/3027...

This is my philosophy of project development in a nutshell. www.deseret.com/environment/...

May 14, 2025 at 3:14 AM

This is my philosophy of project development in a nutshell. www.deseret.com/environment/...

There aren’t enough public companies (yet!) to have a true index of geothermal, but you can sometimes gain insights by looking at Ormat’s performance.

It’s one of few companies in energy up this year. Make sense as geothermal has a more secure and domestic supply chain than other options.

It’s one of few companies in energy up this year. Make sense as geothermal has a more secure and domestic supply chain than other options.

April 26, 2025 at 3:24 PM

There aren’t enough public companies (yet!) to have a true index of geothermal, but you can sometimes gain insights by looking at Ormat’s performance.

It’s one of few companies in energy up this year. Make sense as geothermal has a more secure and domestic supply chain than other options.

It’s one of few companies in energy up this year. Make sense as geothermal has a more secure and domestic supply chain than other options.

April 22, 2025 at 12:13 AM

Fun history fact I learned on a recent @dkthomp.bsky.social Plain English podcast: over 1000 economists signed an open letter to Congress in 1930 urging them to not pass the Smoot Hawley Tariffs because it would increase prices and cause major job losses. econjwatch.org/File+downloa...

April 19, 2025 at 10:49 PM

Fun history fact I learned on a recent @dkthomp.bsky.social Plain English podcast: over 1000 economists signed an open letter to Congress in 1930 urging them to not pass the Smoot Hawley Tariffs because it would increase prices and cause major job losses. econjwatch.org/File+downloa...

Imagine taking this approach to other safety items.

“Just take a look at that bullet proof vest with all the marks on it where it stopped the bullets”

“Just look at the dent in that motorcycle helmet”

“Just take a look at that bullet proof vest with all the marks on it where it stopped the bullets”

“Just look at the dent in that motorcycle helmet”

April 16, 2025 at 1:25 AM

Imagine taking this approach to other safety items.

“Just take a look at that bullet proof vest with all the marks on it where it stopped the bullets”

“Just look at the dent in that motorcycle helmet”

“Just take a look at that bullet proof vest with all the marks on it where it stopped the bullets”

“Just look at the dent in that motorcycle helmet”

Wow that’s not even the craziest quote.

“It’s unsafe. Just take a stroll down 11th and look at the scuff marks on the barriers.”

Literally the barriers to protect people have evidence that if they weren’t there cars would just be crossing through all the time!

It’s this but for pedestrian safety

“It’s unsafe. Just take a stroll down 11th and look at the scuff marks on the barriers.”

Literally the barriers to protect people have evidence that if they weren’t there cars would just be crossing through all the time!

It’s this but for pedestrian safety

April 16, 2025 at 1:21 AM

Wow that’s not even the craziest quote.

“It’s unsafe. Just take a stroll down 11th and look at the scuff marks on the barriers.”

Literally the barriers to protect people have evidence that if they weren’t there cars would just be crossing through all the time!

It’s this but for pedestrian safety

“It’s unsafe. Just take a stroll down 11th and look at the scuff marks on the barriers.”

Literally the barriers to protect people have evidence that if they weren’t there cars would just be crossing through all the time!

It’s this but for pedestrian safety

An iconic example of the silly debate about safe streets and media’s need to both sides it.

On the one hand, data definitively shows 11th St. improvements led to a big safety improvement.

On the other hand, some guy says “people speed everywhere.”

www.houstonchronicle.com/news/houston...

On the one hand, data definitively shows 11th St. improvements led to a big safety improvement.

On the other hand, some guy says “people speed everywhere.”

www.houstonchronicle.com/news/houston...

April 16, 2025 at 1:17 AM

An iconic example of the silly debate about safe streets and media’s need to both sides it.

On the one hand, data definitively shows 11th St. improvements led to a big safety improvement.

On the other hand, some guy says “people speed everywhere.”

www.houstonchronicle.com/news/houston...

On the one hand, data definitively shows 11th St. improvements led to a big safety improvement.

On the other hand, some guy says “people speed everywhere.”

www.houstonchronicle.com/news/houston...

And progress is happening fast. Here is a recent photo from site. We are on track for delivery of first electrons in 2026. Geothermal is winning the race on clean, firm power and will enable huge improvements in grid reliability, affordability and sustainability.

April 15, 2025 at 2:17 PM

And progress is happening fast. Here is a recent photo from site. We are on track for delivery of first electrons in 2026. Geothermal is winning the race on clean, firm power and will enable huge improvements in grid reliability, affordability and sustainability.

The application of learning curves to geothermal, based on benchmarking from the oil and gas industry, was the insight upon which Fervo was founded. Here’s a paper I wrote on the topic in 2017. pangea.stanford.edu/ERE/pdf/IGAs...

April 14, 2025 at 4:15 PM

The application of learning curves to geothermal, based on benchmarking from the oil and gas industry, was the insight upon which Fervo was founded. Here’s a paper I wrote on the topic in 2017. pangea.stanford.edu/ERE/pdf/IGAs...

We shared this slide at the end of Fervo Tech Day 2024 as a roadmap for how we see geothermal technology evolving. We’ve made a lot of progress since then. I’m gonna be excited to share even more breakthroughs from Fervo throughout the year. Stay tuned, progress is happening faster than ever.

April 14, 2025 at 12:55 AM

We shared this slide at the end of Fervo Tech Day 2024 as a roadmap for how we see geothermal technology evolving. We’ve made a lot of progress since then. I’m gonna be excited to share even more breakthroughs from Fervo throughout the year. Stay tuned, progress is happening faster than ever.

It’s a game of technology vs. geology and tech has won pretty resoundingly over the last two decades. I’m sure you’ve got some anecdotes of past times, but that steep slope at the end shows pretty clearly that the economic wells are far from done.

April 11, 2025 at 8:50 PM

It’s a game of technology vs. geology and tech has won pretty resoundingly over the last two decades. I’m sure you’ve got some anecdotes of past times, but that steep slope at the end shows pretty clearly that the economic wells are far from done.

This afternoon’s headline right on cue. (Or not, the baker Hughes numbers are notoriously noisy)

finance.yahoo.com/news/us-oil-...

finance.yahoo.com/news/us-oil-...

April 11, 2025 at 8:34 PM

This afternoon’s headline right on cue. (Or not, the baker Hughes numbers are notoriously noisy)

finance.yahoo.com/news/us-oil-...

finance.yahoo.com/news/us-oil-...

One thing to note about this that I’m seeing misreported in the media a lot this week: oil breakeven prices have a huge range. People keep quoting the below Dallas Fed survey to say prices are below the breakeven. Prices are below some breakevens, Tier 1 acreage is still profitable. It’s a curve.

April 11, 2025 at 1:55 PM

One thing to note about this that I’m seeing misreported in the media a lot this week: oil breakeven prices have a huge range. People keep quoting the below Dallas Fed survey to say prices are below the breakeven. Prices are below some breakevens, Tier 1 acreage is still profitable. It’s a curve.

This is a number where you will start to see declines in drilling activity pretty quickly if it sticks around.

April 9, 2025 at 4:47 PM

This is a number where you will start to see declines in drilling activity pretty quickly if it sticks around.

Fascinating industry by industry rundown of how the tariffs would affect clean energy and climatetech in today’s CTVC newsletter. This point, on how reliant the nuclear fuel supply chain is reliant on imports, is under appreciated.

April 8, 2025 at 5:11 AM

Fascinating industry by industry rundown of how the tariffs would affect clean energy and climatetech in today’s CTVC newsletter. This point, on how reliant the nuclear fuel supply chain is reliant on imports, is under appreciated.

I’ve found that checking the employee count data feature on LinkedIn is one of the most reliable ways of figuring out what’s really going on at a startup. Every shape tells a story.

April 5, 2025 at 3:39 AM

I’ve found that checking the employee count data feature on LinkedIn is one of the most reliable ways of figuring out what’s really going on at a startup. Every shape tells a story.

A quick check in on oil field services stocks. Generally down ~50% YoY, with about ~20% decline in the last week.

April 4, 2025 at 6:41 PM

A quick check in on oil field services stocks. Generally down ~50% YoY, with about ~20% decline in the last week.

Mentions of “uncertainty” in the Fed Beige Book at an all time high. Chart from @nathanielbullard.com.

March 20, 2025 at 1:28 PM

Mentions of “uncertainty” in the Fed Beige Book at an all time high. Chart from @nathanielbullard.com.

A big story in energy currently is the diverging fates of oil and gas prices. Oil price has been in steady decline, with a clear recent trend downward driven by all the macro uncertainty. For natural gas the power demand thesis is overriding all other concerns. Feels like we are in a new era.

March 14, 2025 at 2:41 PM

A big story in energy currently is the diverging fates of oil and gas prices. Oil price has been in steady decline, with a clear recent trend downward driven by all the macro uncertainty. For natural gas the power demand thesis is overriding all other concerns. Feels like we are in a new era.

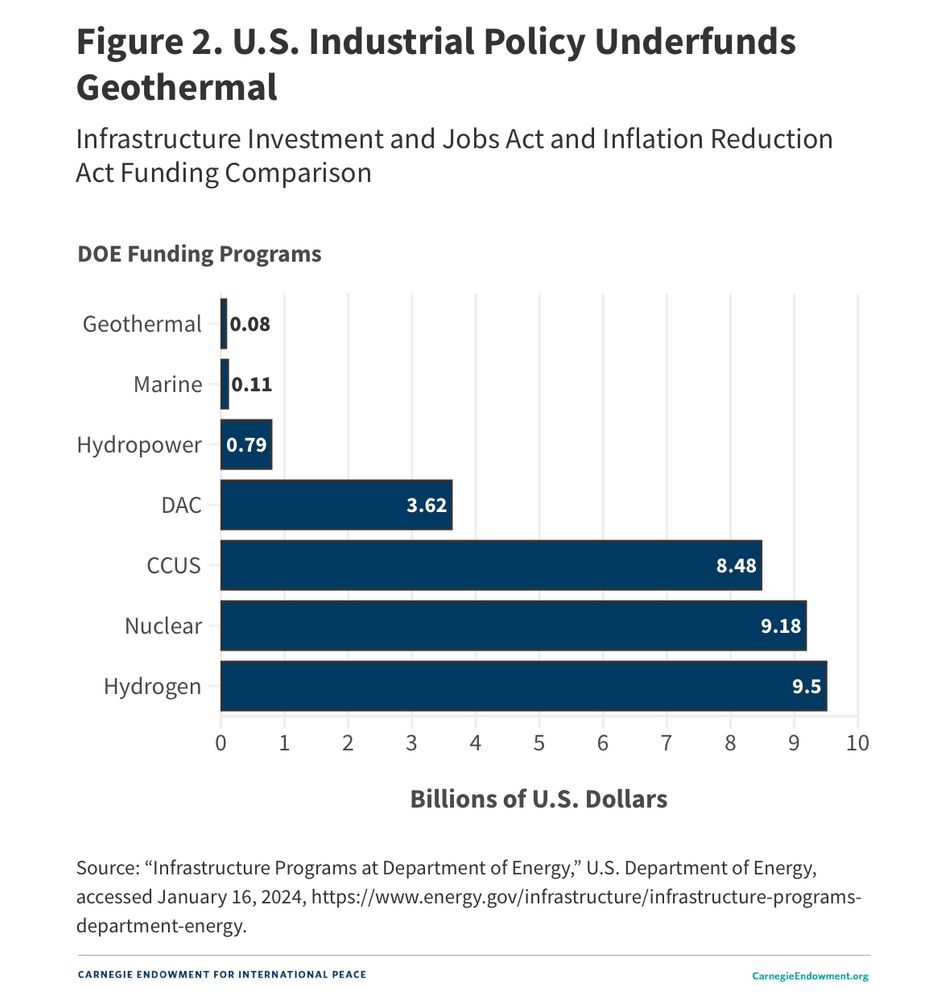

Whenever you think about the remarkable progress of geothermal, remember that this has been the level of public funding supporting the sector. In coming years I expect support to catch up with technologies like hydrogen and CCS and it will be transformational. carnegieendowment.orgundefined?lang=en

March 13, 2025 at 6:45 PM

Whenever you think about the remarkable progress of geothermal, remember that this has been the level of public funding supporting the sector. In coming years I expect support to catch up with technologies like hydrogen and CCS and it will be transformational. carnegieendowment.orgundefined?lang=en

Found a chart with 2024 data. The trend continues. www.canarymedia.com/articles/cle...

March 2, 2025 at 8:30 PM

Found a chart with 2024 data. The trend continues. www.canarymedia.com/articles/cle...