A third of people in arrears are living below the poverty line, and 79% are households in the bottom half of earners. People aren't avoiding tax, they're just broke.

A third of people in arrears are living below the poverty line, and 79% are households in the bottom half of earners. People aren't avoiding tax, they're just broke.

Collection rates remain high, but have never fully recovered to pre-pandemic levels.

Collection rates remain high, but have never fully recovered to pre-pandemic levels.

However, Wales has seen the biggest increase - 15% yoy; 170% over 5 years.

However, Wales has seen the biggest increase - 15% yoy; 170% over 5 years.

Huge 11% increase in amount of council tax debt across Britain, standing now at £8.3bn. An increase of 11% since last year, and up 79% over the last 5 years.

Huge 11% increase in amount of council tax debt across Britain, standing now at £8.3bn. An increase of 11% since last year, and up 79% over the last 5 years.

The case for reform couldn't be clearer. But as long as this treatment is only of concern when someone is mistakenly on the receiving end, nothing will change.

The case for reform couldn't be clearer. But as long as this treatment is only of concern when someone is mistakenly on the receiving end, nothing will change.

That means they are paying 50% MORE than their original debt just in servicing fees.

That means they are paying 50% MORE than their original debt just in servicing fees.

www.ft.com/content/8022...

www.ft.com/content/8022...

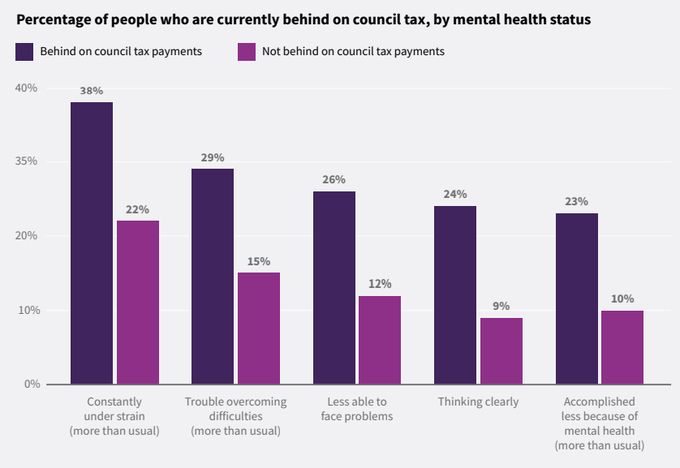

This is true even if we control for having a diagnosed mental health condition.

This is true even if we control for having a diagnosed mental health condition.

These cost councils just 50p in fees. They'll charge you up to £155 for the pleasure.

graph credit: CSJ

These cost councils just 50p in fees. They'll charge you up to £155 for the pleasure.

graph credit: CSJ

91% OF PEOPLE IN COUNCIL TAX ARREARS CAN'T AFFORD A BILL OF £1000. Even if they borrowed money.

91% OF PEOPLE IN COUNCIL TAX ARREARS CAN'T AFFORD A BILL OF £1000. Even if they borrowed money.

Our research found that a quarter of people in council tax arrears have an income of under £9,500 a year. 82% have an income of less than £30,000.

Our research found that a quarter of people in council tax arrears have an income of under £9,500 a year. 82% have an income of less than £30,000.

We found that 3.3m people are behind on council tax debts. People w/ mental health probs are twice as likely to be behind.

We found that 3.3m people are behind on council tax debts. People w/ mental health probs are twice as likely to be behind.