Coming up with 61.8% good ideas, 38.2% bad. Energy analyst, meme enthusiast, sock wearer. Ex-U.S. EIA, Dept. of Energy, International Energy Forum. Tweets and views my own. Have a nice day.

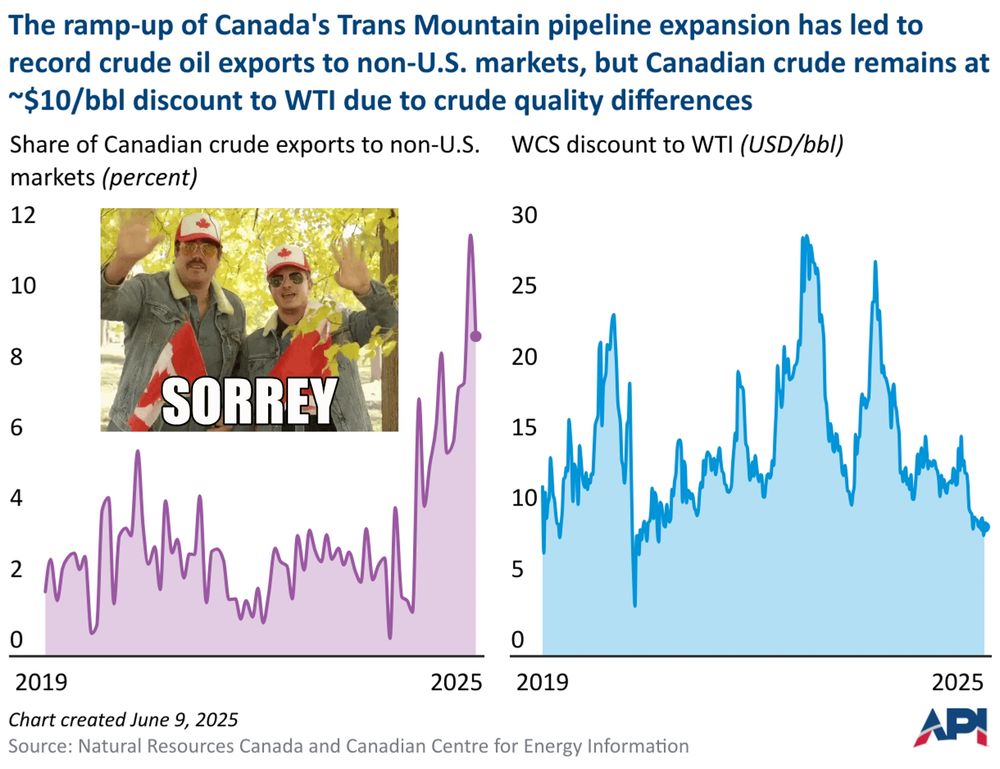

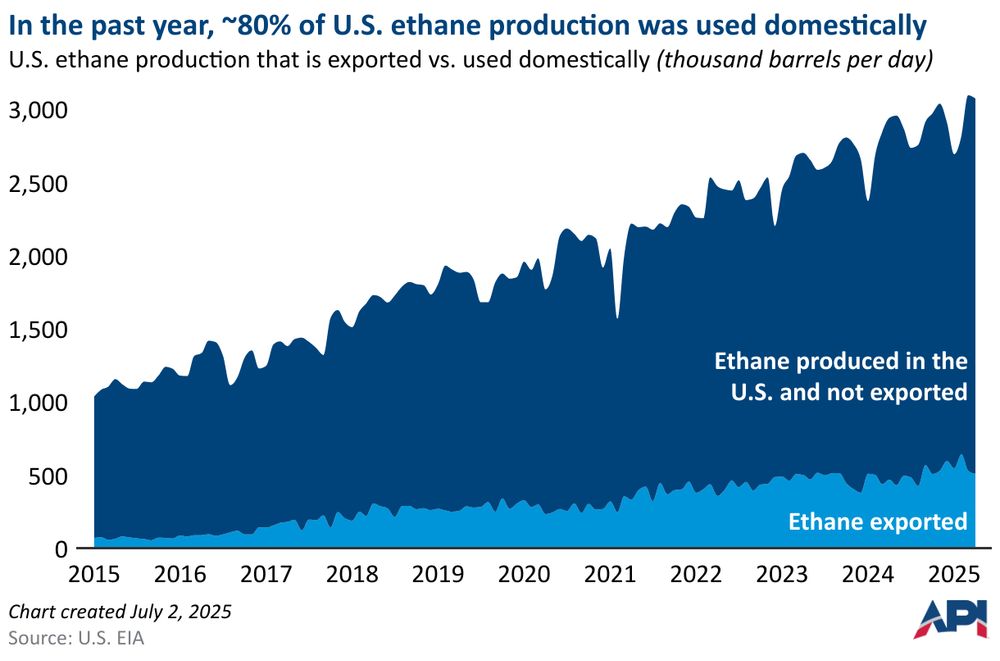

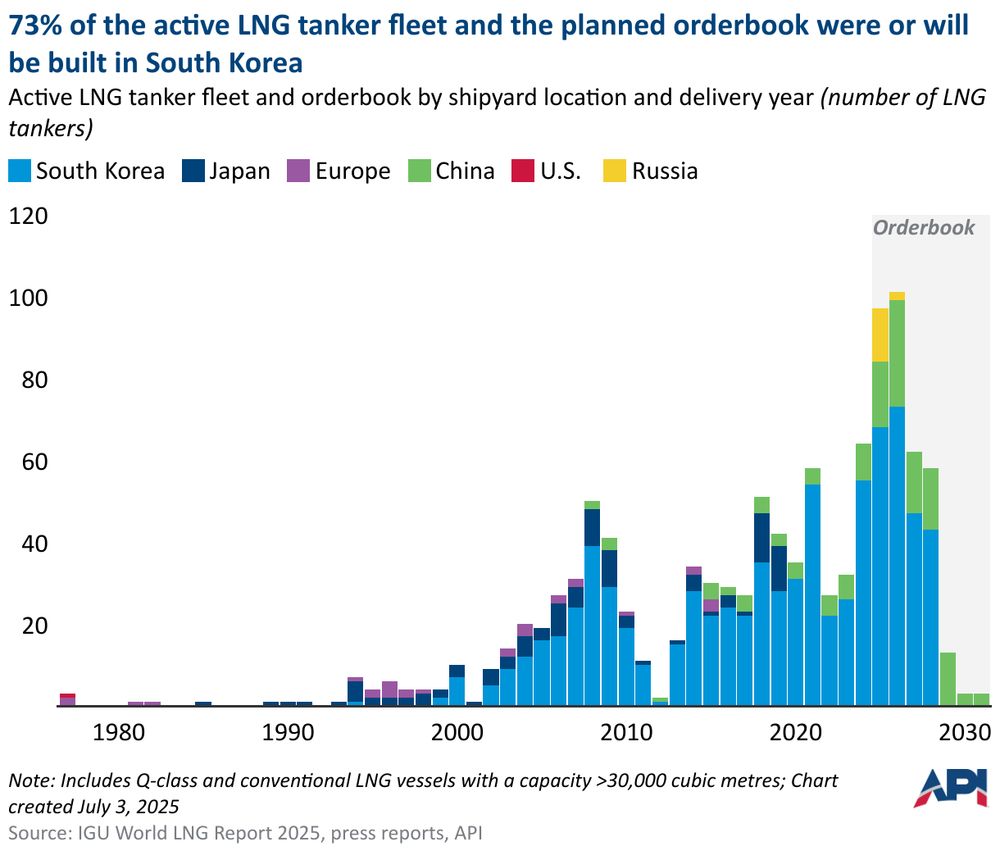

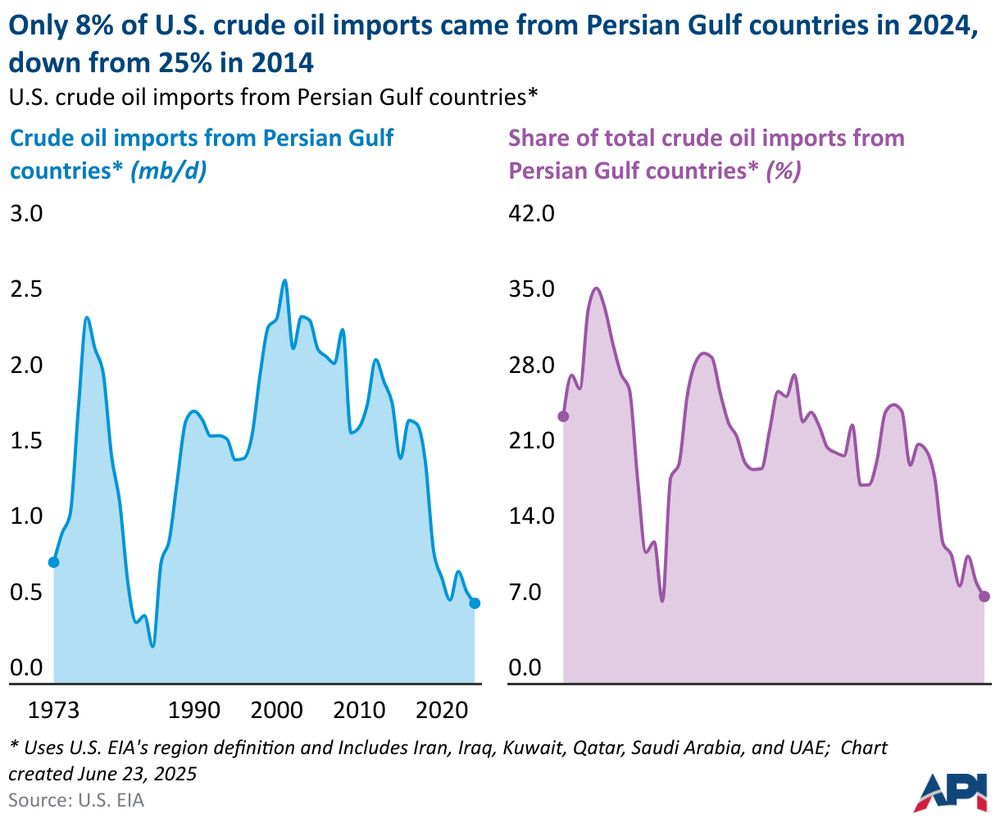

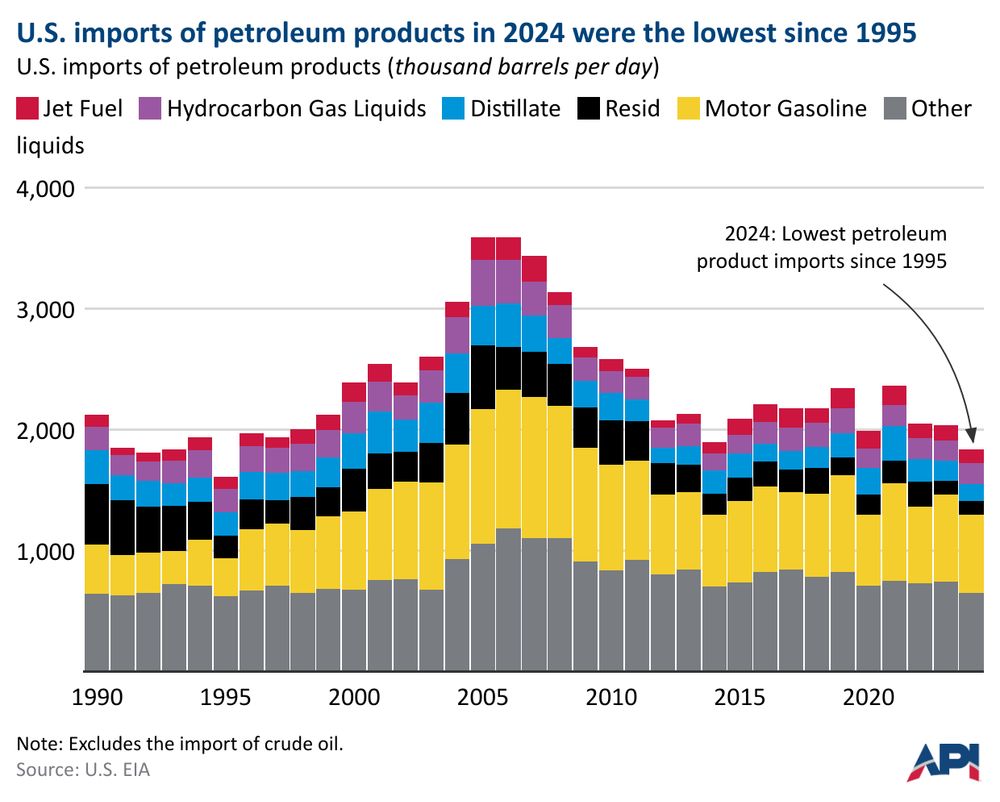

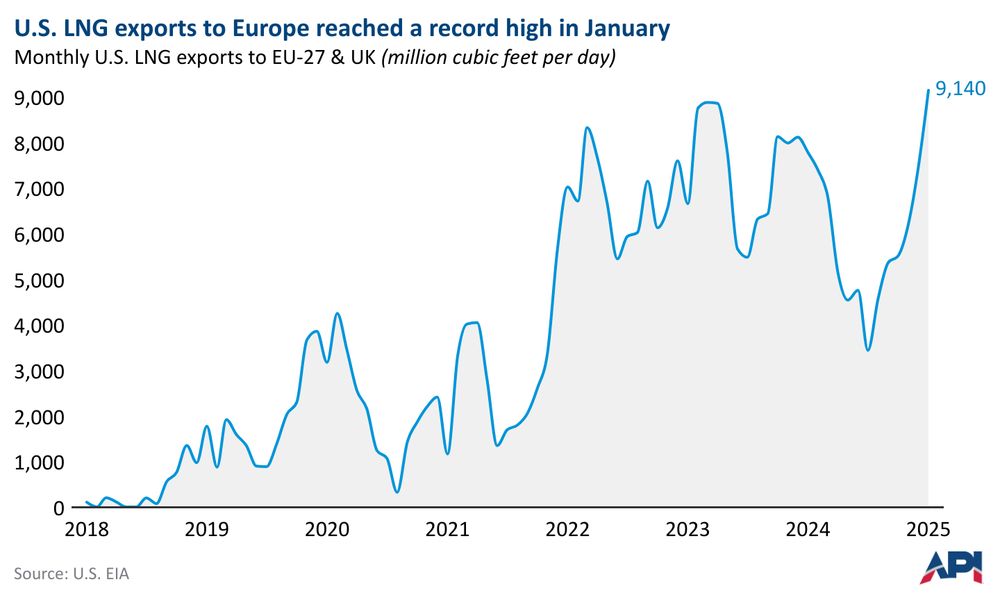

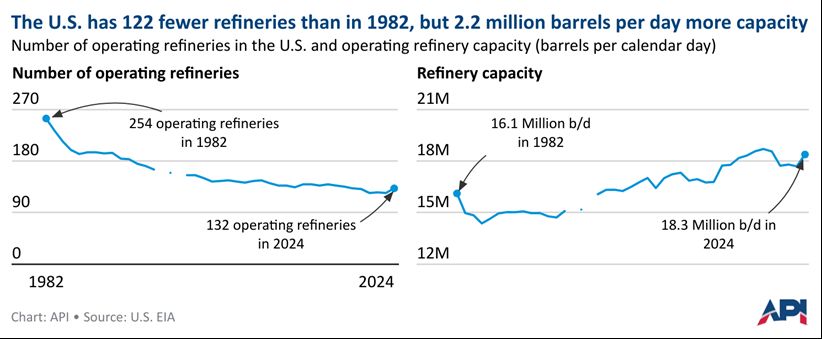

www.api.org/products-and...

www.api.org/products-and...

Bye Houston!

Bye Houston!

“Here’s one federal building we could - and should - be scrapped”

www.washingtonpost.com/opinions/202...

“Here’s one federal building we could - and should - be scrapped”

www.washingtonpost.com/opinions/202...

On brand.

On brand.

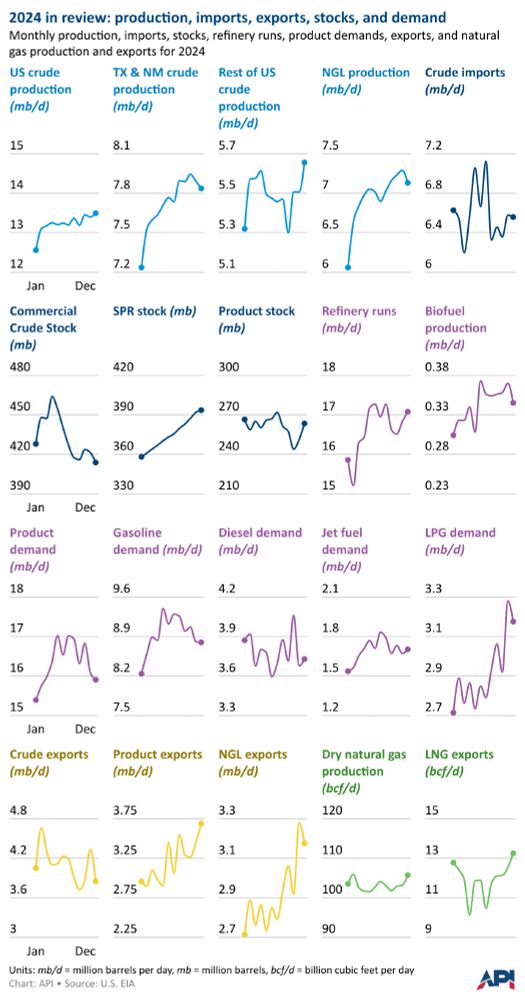

@ API has in store.

@ API has in store.