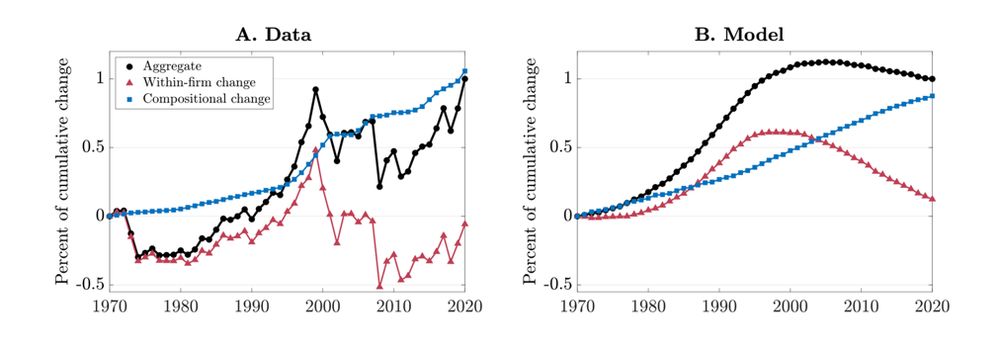

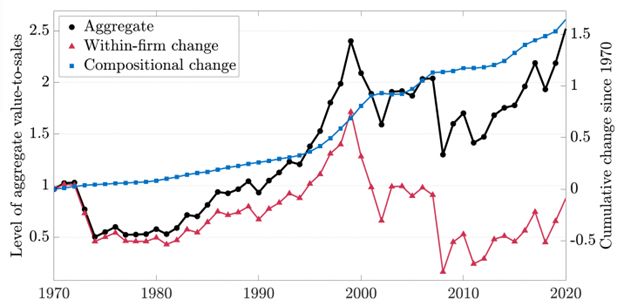

As in the data, all of the market boom comes from a reallocation to high-valuation firms.

Why? High-valuation firms shift from R&D to M&A, concentrating production in their hands

As in the data, all of the market boom comes from a reallocation to high-valuation firms.

Why? High-valuation firms shift from R&D to M&A, concentrating production in their hands

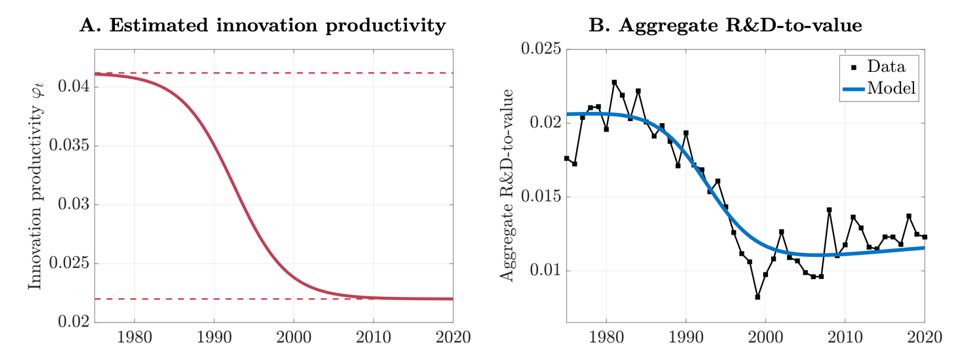

In other words, it is half as easy to come up with a new idea today as it was 50 years ago.

In other words, it is half as easy to come up with a new idea today as it was 50 years ago.

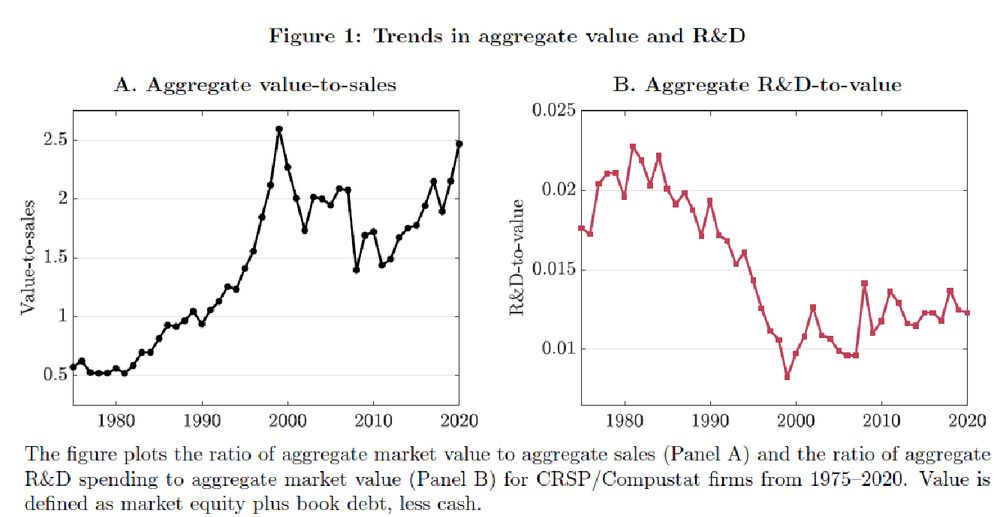

– Aggregate R&D fell relative to value

– Aggregate M&A doubled relative to R&D

– A compositional change explains the rise in aggregate valuation ratios: markets are more and more dominated by firms high valuation ratios

– Aggregate R&D fell relative to value

– Aggregate M&A doubled relative to R&D

– A compositional change explains the rise in aggregate valuation ratios: markets are more and more dominated by firms high valuation ratios

🧩How do we reconcile stagnating growth (and R&D) with a booming stock market?

James solves this puzzle using micro data and a Schumpeterian growth model.

🧩How do we reconcile stagnating growth (and R&D) with a booming stock market?

James solves this puzzle using micro data and a Schumpeterian growth model.

His paper reconciles apparently contradictory trends since 1970:

📉declining economic growth

📈rising stock market valuations

His explanation: Innovation got harder➡️ R&D fell, M&A rose ➡️ top firms pushed the aggregate stock market up

His paper reconciles apparently contradictory trends since 1970:

📉declining economic growth

📈rising stock market valuations

His explanation: Innovation got harder➡️ R&D fell, M&A rose ➡️ top firms pushed the aggregate stock market up