For in depth information see stocksectorscout.substack.com

Correlation matrix of closing prices over the last 6 days attached.

Correlation matrix of closing prices over the last 6 days attached.

Some are very recent, so a bounce here wouldn't be shocking.

Some are very recent, so a bounce here wouldn't be shocking.

hehehe someone made a mistake somewhere

hehehe someone made a mistake somewhere

Investors should pay zero attention to directory sells. And 50 shares? If you are an investor, you ignore that nonsense.

Investors should pay zero attention to directory sells. And 50 shares? If you are an investor, you ignore that nonsense.

I hope it continues to provide value and investment ideas. I've truly enjoyed putting my thoughts down and sharing them with this amazing community. Here's to many more! 🎉

I hope it continues to provide value and investment ideas. I've truly enjoyed putting my thoughts down and sharing them with this amazing community. Here's to many more! 🎉

Look at that "news" flow in the screenshot, compared to the price action

Look at that "news" flow in the screenshot, compared to the price action

#gold #copper #silver

#gold #copper #silver

$WMT $COST $DLTR

$WMT $COST $DLTR

Agricultural Inputs in particular have been weak for a long time.

stocksectorscout.substack.com/i/139704265/...

Agricultural Inputs in particular have been weak for a long time.

stocksectorscout.substack.com/i/139704265/...

stocksectorscout.substack.com/i/139704265/...

stocksectorscout.substack.com/i/139704265/...

The chatter is increasing of the upcoming pause or pullback, but it's best when you don't need to be right, what is high can get higher.

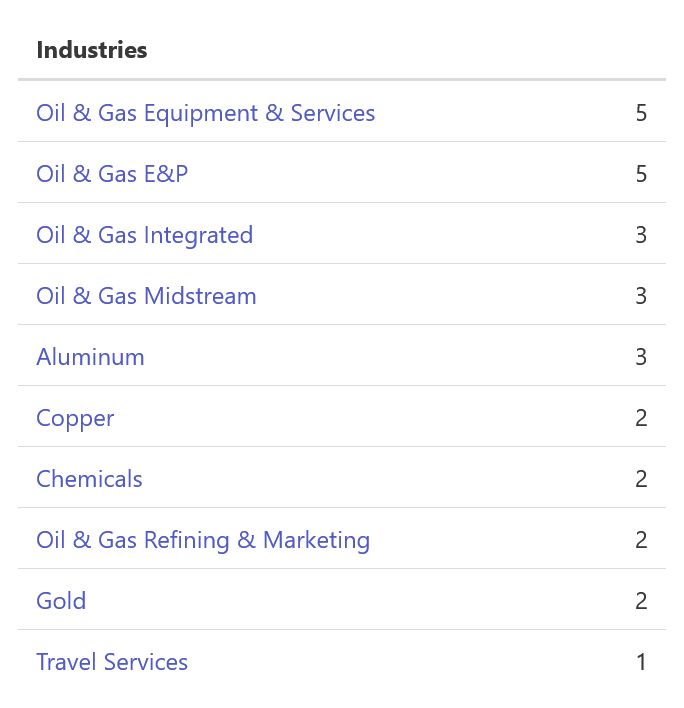

One new bottoming: Aluminum

The chatter is increasing of the upcoming pause or pullback, but it's best when you don't need to be right, what is high can get higher.

One new bottoming: Aluminum