Steven Kelly

@stevenkelly49.bsky.social

Financial crises & how to fight them. steven.kelly@yale.edu

Substacking on financial stability topics at www.withoutwarningresearch.com (free)

Substacking on financial stability topics at www.withoutwarningresearch.com (free)

4/ Second: Bank balance sheets are remarkable pieces of technology for bearing interest-rate risk.

Could household, corporate, or nonbank financial companies pull this off?

Could household, corporate, or nonbank financial companies pull this off?

June 27, 2025 at 3:15 AM

4/ Second: Bank balance sheets are remarkable pieces of technology for bearing interest-rate risk.

Could household, corporate, or nonbank financial companies pull this off?

Could household, corporate, or nonbank financial companies pull this off?

3/ First: Perhaps unrealized losses weren’t a good explanation for the Banking Crisis of 2023. (Apologies to those who’ve listened to me beat this drum since SVB’s failure.)

There’s lots of evidence on this in the piece, drawing heavily from this paper with Jonathan Rose:

There’s lots of evidence on this in the piece, drawing heavily from this paper with Jonathan Rose:

New paper: "Rushing to Judgement and the Banking Crisis of 2023"

At the two-year anniversary of the crisis, Jonathan Rose and I present 7 facts that are overlooked in the standard account of the crisis: www.chicagofed.org/publications...

At the two-year anniversary of the crisis, Jonathan Rose and I present 7 facts that are overlooked in the standard account of the crisis: www.chicagofed.org/publications...

June 27, 2025 at 3:15 AM

3/ First: Perhaps unrealized losses weren’t a good explanation for the Banking Crisis of 2023. (Apologies to those who’ve listened to me beat this drum since SVB’s failure.)

There’s lots of evidence on this in the piece, drawing heavily from this paper with Jonathan Rose:

There’s lots of evidence on this in the piece, drawing heavily from this paper with Jonathan Rose:

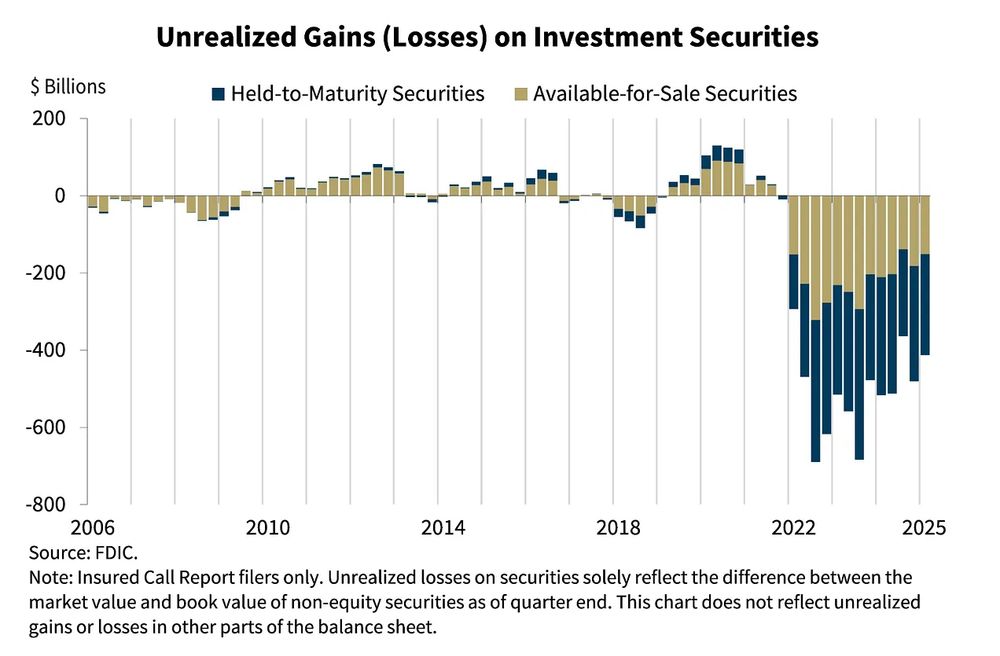

2/ The scale of unrealized interest-rate losses got a lot of attention around the failure of SVB, but they have persisted longer than anyone expected—without another banking crisis.

High-level, this indicates two things.

High-level, this indicates two things.

June 27, 2025 at 3:12 AM

2/ The scale of unrealized interest-rate losses got a lot of attention around the failure of SVB, but they have persisted longer than anyone expected—without another banking crisis.

High-level, this indicates two things.

High-level, this indicates two things.

Proponents of each model often cite purported financial stability benefits—which are often correct—but each nonbank model comes with financial *instability* risks that are missing from the discourse.

The bank regulatory/support framework has mostly addressed these in banks.

The bank regulatory/support framework has mostly addressed these in banks.

June 16, 2025 at 7:15 PM

Proponents of each model often cite purported financial stability benefits—which are often correct—but each nonbank model comes with financial *instability* risks that are missing from the discourse.

The bank regulatory/support framework has mostly addressed these in banks.

The bank regulatory/support framework has mostly addressed these in banks.

Too kind, Paul! Glad you found it valuable

June 16, 2025 at 3:42 PM

Too kind, Paul! Glad you found it valuable

"Lend freely, against good collateral, at a penalty rate"?

When rescuing an individual institution, only "lend freely" survives as good advice:

When rescuing an individual institution, only "lend freely" survives as good advice:

June 15, 2025 at 5:38 PM

"Lend freely, against good collateral, at a penalty rate"?

When rescuing an individual institution, only "lend freely" survives as good advice:

When rescuing an individual institution, only "lend freely" survives as good advice:

Reposted by Steven Kelly

Expanding financing has allowed banks to benefit from these trends

The pivot reflects a broader industry trend that ppl like

@stevenkelly49.bsky.social + Huw van Steenis have dubbed the "re-tranching" of the banking system post 2008

This has seen banks act more as financiers than investors

The pivot reflects a broader industry trend that ppl like

@stevenkelly49.bsky.social + Huw van Steenis have dubbed the "re-tranching" of the banking system post 2008

This has seen banks act more as financiers than investors

June 9, 2025 at 1:07 PM

Expanding financing has allowed banks to benefit from these trends

The pivot reflects a broader industry trend that ppl like

@stevenkelly49.bsky.social + Huw van Steenis have dubbed the "re-tranching" of the banking system post 2008

This has seen banks act more as financiers than investors

The pivot reflects a broader industry trend that ppl like

@stevenkelly49.bsky.social + Huw van Steenis have dubbed the "re-tranching" of the banking system post 2008

This has seen banks act more as financiers than investors

“The regulatory scrutiny may indirectly dampen [private credit/equity] growth in Europe, according to bankers”

“This bank has had to turn down business with private credit players, also as a result of the lengthy interactions that are needed with the ECB”

“This bank has had to turn down business with private credit players, also as a result of the lengthy interactions that are needed with the ECB”

ECB Intensifies Scrutiny of Banks’ Exposure to Private Markets

The European Central Bank is escalating its scrutiny of lenders’ exposures to private markets amid concerns that the fast ascent of related asset classes raises substantial new risks.

www.bloomberg.com

June 3, 2025 at 5:02 PM

“The regulatory scrutiny may indirectly dampen [private credit/equity] growth in Europe, according to bankers”

“This bank has had to turn down business with private credit players, also as a result of the lengthy interactions that are needed with the ECB”

“This bank has had to turn down business with private credit players, also as a result of the lengthy interactions that are needed with the ECB”

“Some bankers fear the BoE’s intervention could increase the cost of financing for investors in SRTs, slow the growth of the market and reduce lenders’ ability to use them to free up capital to support extra lending.”

UK lenders fret over risk-transfer market after BoE warning

Officials zeroing in on $1.1tn SRT market between banks and private capital investors

www.ft.com

June 3, 2025 at 5:01 PM

“Some bankers fear the BoE’s intervention could increase the cost of financing for investors in SRTs, slow the growth of the market and reduce lenders’ ability to use them to free up capital to support extra lending.”

Will read asap!! Thanks for flagging, Iñaki! You are missed on the other site 💔

May 29, 2025 at 6:05 AM

Will read asap!! Thanks for flagging, Iñaki! You are missed on the other site 💔