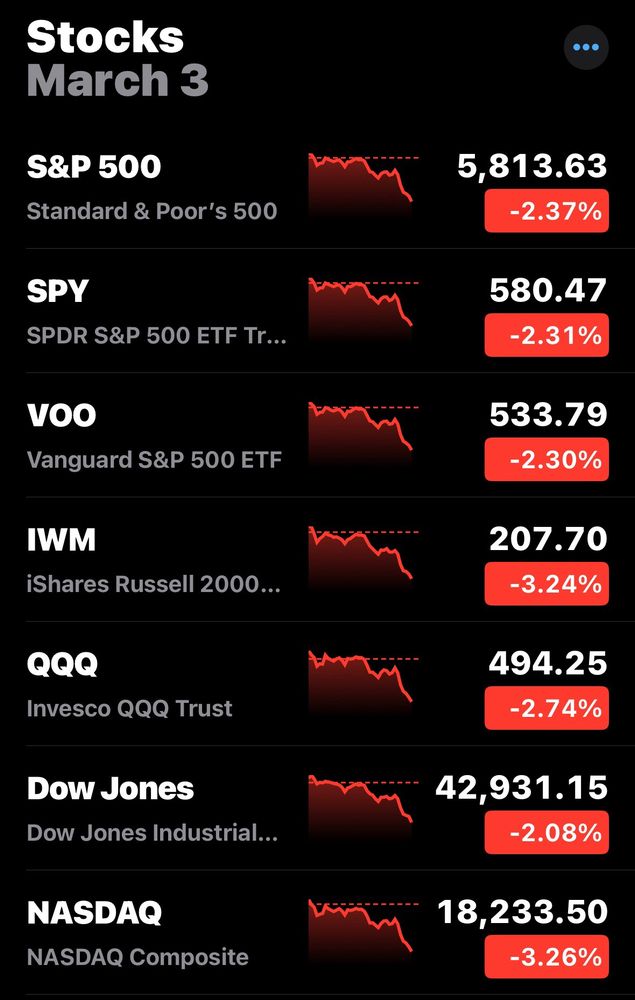

There is no new revenue entering this space.@edzitron.com

There is no new revenue entering this space.@edzitron.com

www.bloomberg.com/news/article...

www.bloomberg.com/news/article...

Tariffs are a federal tax

Federal taxes destroy US dollars.

The government doesn't "raise revenue." It is the sole issuer of US dollars.

Tariffs are a federal tax

Federal taxes destroy US dollars.

The government doesn't "raise revenue." It is the sole issuer of US dollars.

To reiterate:

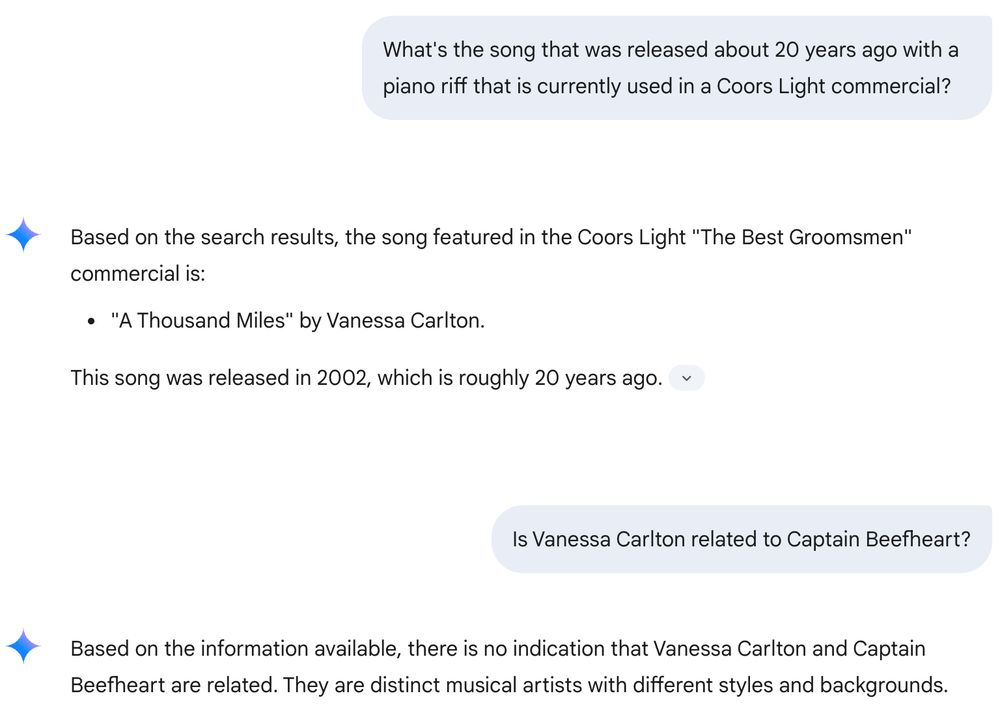

"NOBODY CAN DEFINE an AI 'product' or service that anyone will pay for."

Please define an AI product.

I swear this is a reboot of circa 2022 when I was begging the bitcoiners to explain its intrinsic value to me.

Nobody could

To reiterate:

"NOBODY CAN DEFINE an AI 'product' or service that anyone will pay for."

Please define an AI product.

I swear this is a reboot of circa 2022 when I was begging the bitcoiners to explain its intrinsic value to me.

Nobody could

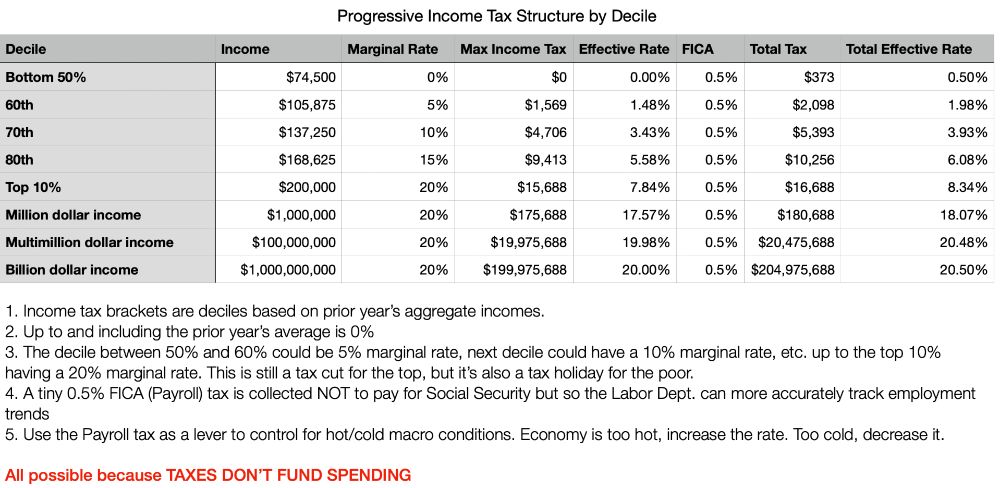

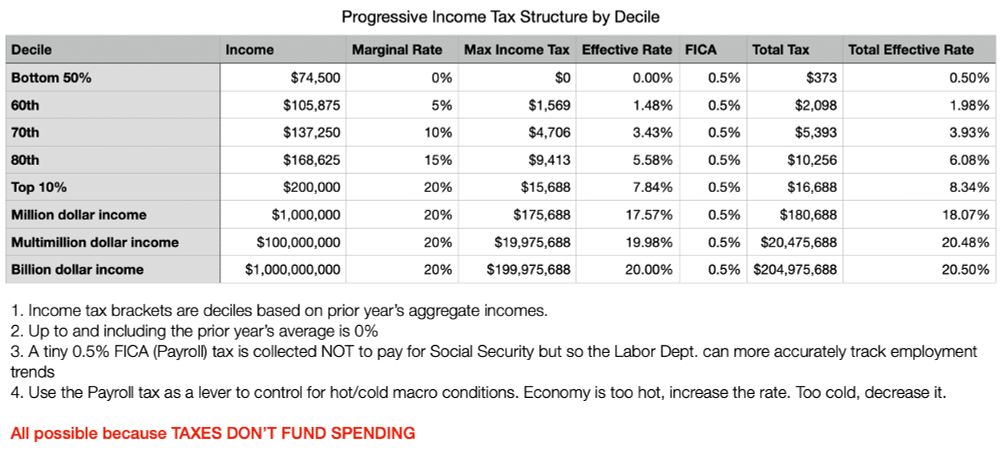

If the Establishment Left wants to re-gain power in a meaningful way the liberal parties should go all-in on a massive working class tax cut. Here is how it could happen in the U.S.

If the Establishment Left wants to re-gain power in a meaningful way the liberal parties should go all-in on a massive working class tax cut. Here is how it could happen in the U.S.

We should be pushing for a tax cut

NO TAX ON THE WORKING CLASS

0% on the first $74K

Progressive marginal rates by decile up to peaking at 20% above $200K. Tax cut for all.

Once you decouple federal taxes from federal spending you see how simple it is.

We should be pushing for a tax cut

NO TAX ON THE WORKING CLASS

0% on the first $74K

Progressive marginal rates by decile up to peaking at 20% above $200K. Tax cut for all.

Once you decouple federal taxes from federal spending you see how simple it is.

Marginal income tax rates using deciles based on prior year’s incomes, for example:

First $74,500 (bottom 50th): 0%

Anything over $200,000: 20%

$74K - $106K: 5%

106K - $169K: 10%

$169K - $200K: 15%

No deductions.

Marginal income tax rates using deciles based on prior year’s incomes, for example:

First $74,500 (bottom 50th): 0%

Anything over $200,000: 20%

$74K - $106K: 5%

106K - $169K: 10%

$169K - $200K: 15%

No deductions.

It would vastly empower the working class, which is why the Democrats will never promote it. The donors they work for (the same donors who fund the RNC) installed them to ensure the working class remains the underclass.

It would vastly empower the working class, which is why the Democrats will never promote it. The donors they work for (the same donors who fund the RNC) installed them to ensure the working class remains the underclass.

Taxes don’t fund spending.

Taxes don’t fund spending.

Here's one example. If they simplified the tax code the IRS could be reduced to a hundred or so.

Here's one example. If they simplified the tax code the IRS could be reduced to a hundred or so.

Every dollar in the economy was deficit spent by the federal government. Our money supply is on the government's books as "debt."

They are the exclusive currency issuer of the US dollar.

We are all currency users of the US dollar.

Every dollar in the economy was deficit spent by the federal government. Our money supply is on the government's books as "debt."

They are the exclusive currency issuer of the US dollar.

We are all currency users of the US dollar.

1. Big Money donates to campaigns

2. Policy benefits Big Money

Doesn't matter who's in charge, it's always pay-to-play. The current guy is dumb enough to assume crypto has any real value.

GOP Congress: Too dumb to know they are the monopoly issuer of US dollars.

1. Big Money donates to campaigns

2. Policy benefits Big Money

Doesn't matter who's in charge, it's always pay-to-play. The current guy is dumb enough to assume crypto has any real value.

GOP Congress: Too dumb to know they are the monopoly issuer of US dollars.