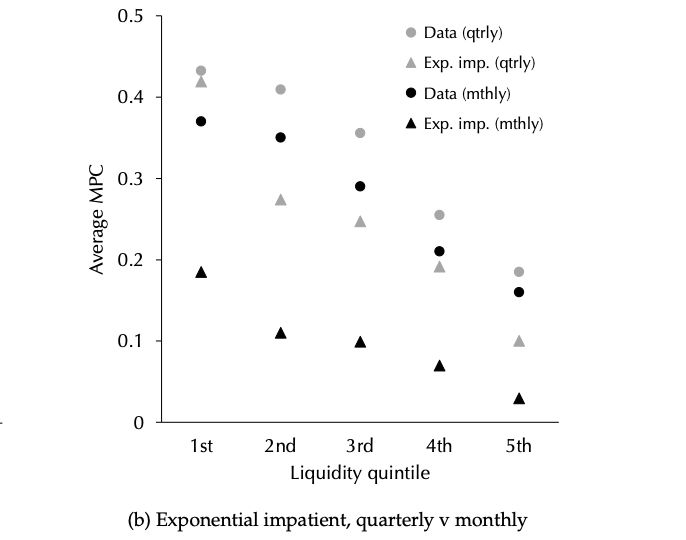

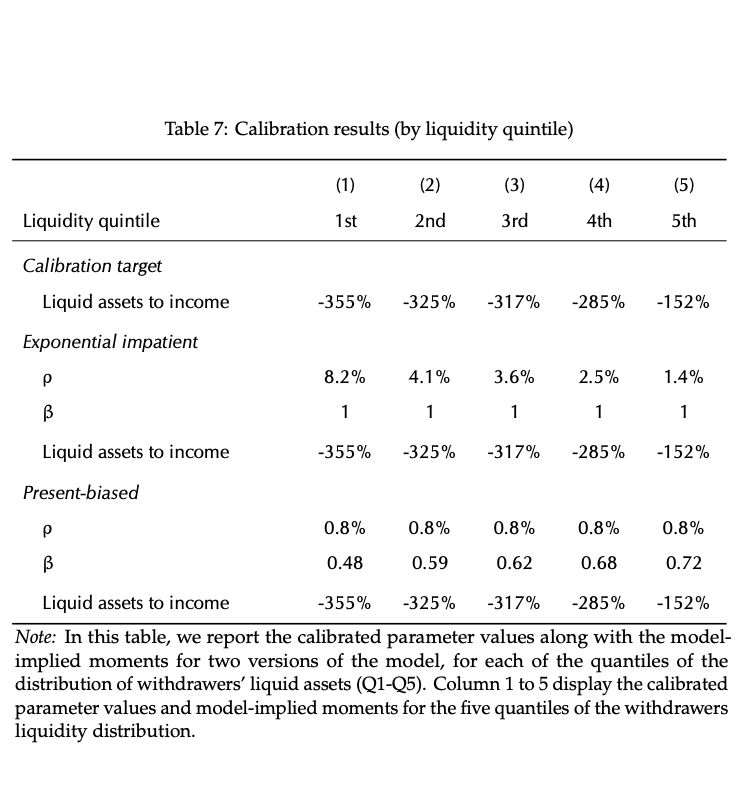

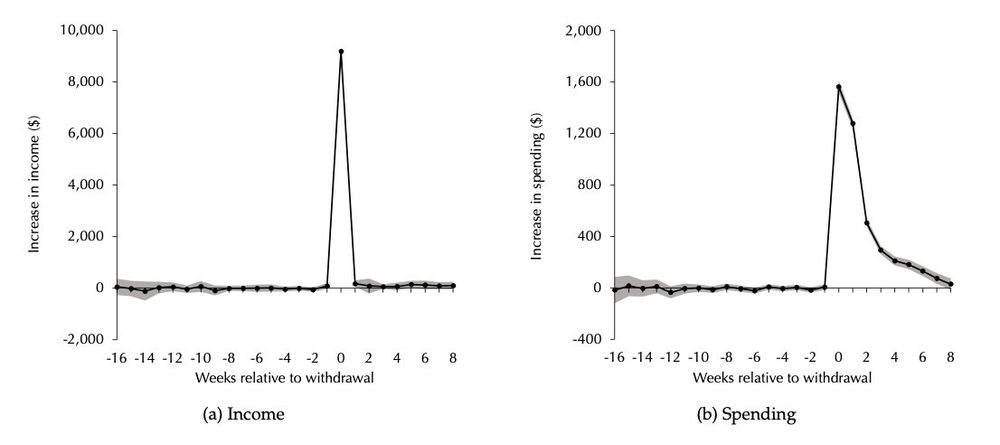

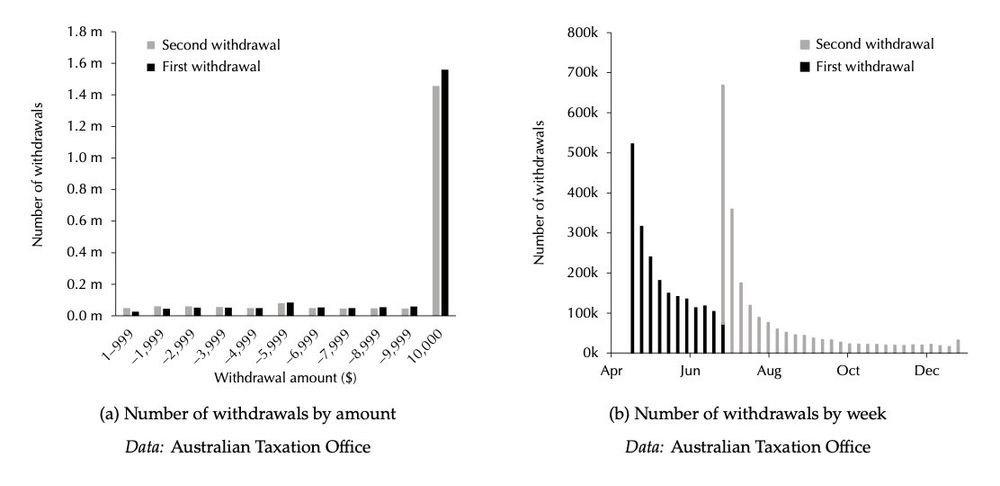

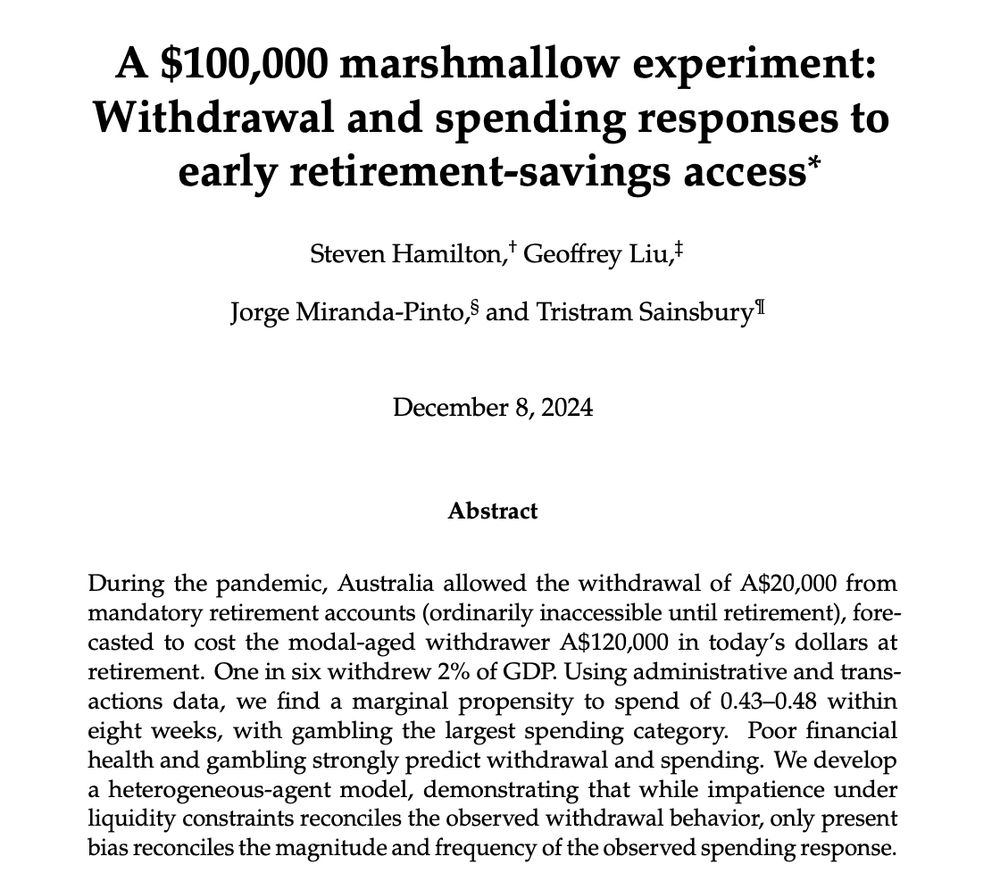

1) strong selection into withdrawing retirement savings on the basis of poor financial health; and

2) a very large and sharp spending response, positively correlated with selection.

1) strong selection into withdrawing retirement savings on the basis of poor financial health; and

2) a very large and sharp spending response, positively correlated with selection.

static1.squarespace.com/static/59b0b...

static1.squarespace.com/static/59b0b...

www.afr.com/policy/econo...

www.afr.com/policy/econo...

https://www.instagram.com/p/CgIO8EMvPdm/?igshid=YmMyMTA2M2Y=

https://www.instagram.com/p/CgIO8EMvPdm/?igshid=YmMyMTA2M2Y=