More about me at

https://www.eaqub.com/

Thoughts over at LinkedIn: www.linkedin.com/posts/eaqub_...

Thoughts over at LinkedIn: www.linkedin.com/posts/eaqub_...

@Stats_NZ

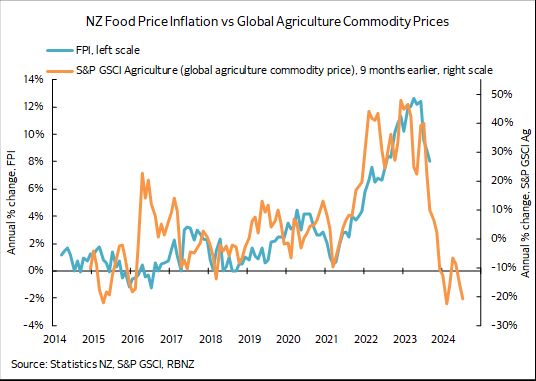

shows prices have been going sideways since mid-year. But not really getting cheaper. (1/3)

@Stats_NZ

shows prices have been going sideways since mid-year. But not really getting cheaper. (1/3)