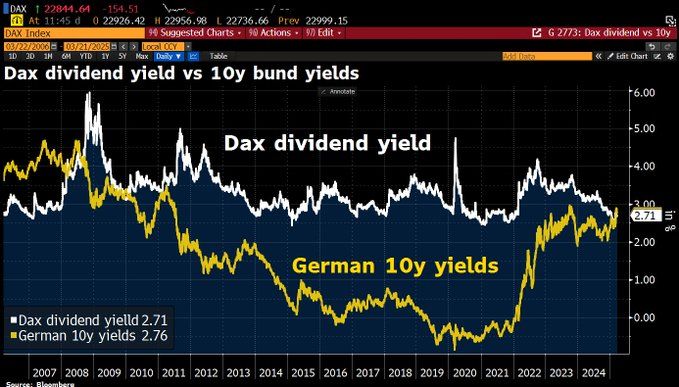

JPM=14x DB (vs 28x in 2019)

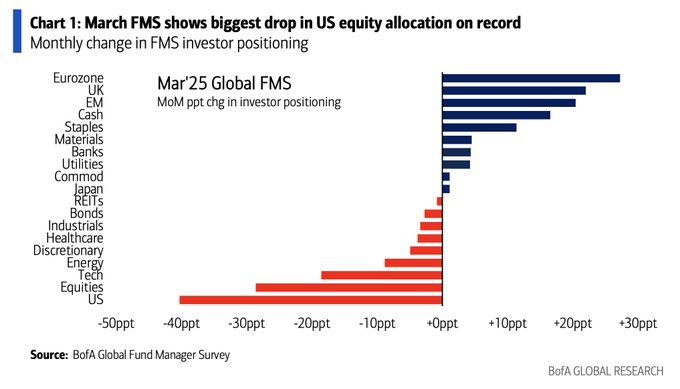

➡️ US Drama: Trump deregulation may backfire: market chaos slows IPOs/M&A 🎢

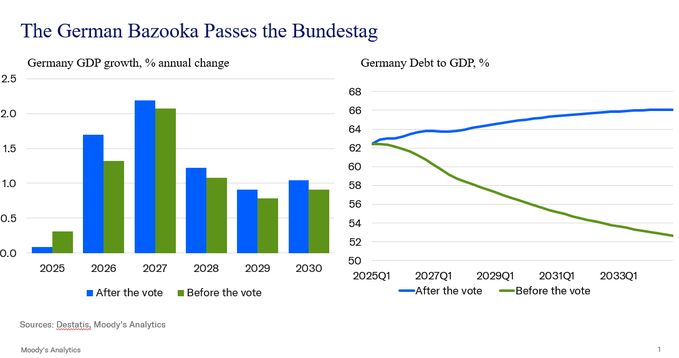

➡️ EU Edge: Debt-powered infrastructure boom fuels DB bets

Real shift or just noise? #BankingWars #Markets

JPM=14x DB (vs 28x in 2019)

➡️ US Drama: Trump deregulation may backfire: market chaos slows IPOs/M&A 🎢

➡️ EU Edge: Debt-powered infrastructure boom fuels DB bets

Real shift or just noise? #BankingWars #Markets

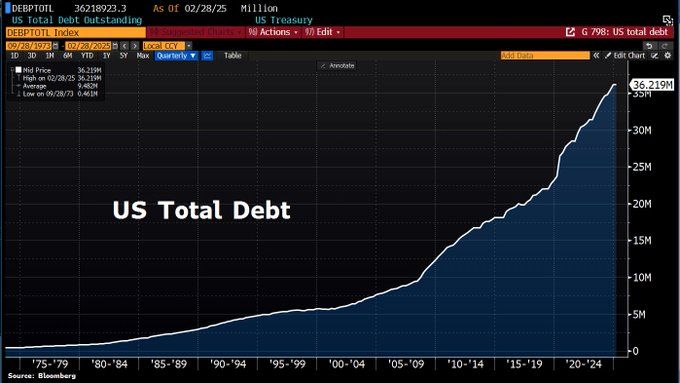

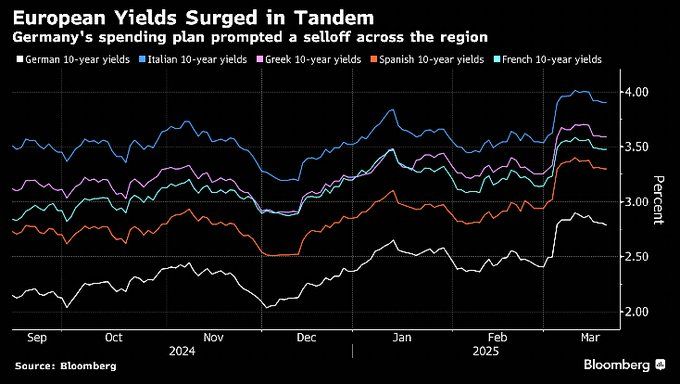

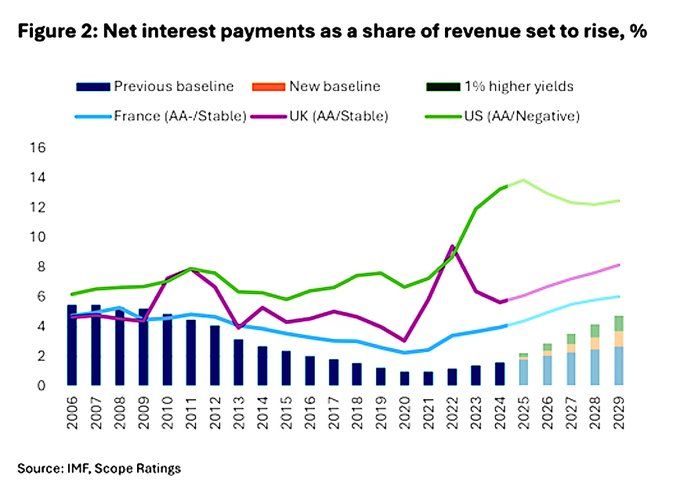

Bundesrat approved spending bill (53 vs. 46 required votes), triggering higher debt/interest. But:

2024 interest/revenue: 1.6% (Scope: vs FR 4%, UK 5.7%, US 13.2%)

2029 forecast: 3.7% (↑ to 4.4% if yields +1%)

#DebtBrake #InterestCosts

Bundesrat approved spending bill (53 vs. 46 required votes), triggering higher debt/interest. But:

2024 interest/revenue: 1.6% (Scope: vs FR 4%, UK 5.7%, US 13.2%)

2029 forecast: 3.7% (↑ to 4.4% if yields +1%)

#DebtBrake #InterestCosts

Bundesrat approved spending bill (53 vs. 46 required votes), triggering higher debt/interest. But:

2024 interest/revenue: 1.6% (Scope: vs FR 4%, UK 5.7%, US 13.2%)

2029 forecast: 3.7% (↑ to 4.4% if yields +1%)

#DebtBrake #InterestCosts

Bundesrat approved spending bill (53 vs. 46 required votes), triggering higher debt/interest. But:

2024 interest/revenue: 1.6% (Scope: vs FR 4%, UK 5.7%, US 13.2%)

2029 forecast: 3.7% (↑ to 4.4% if yields +1%)

#DebtBrake #InterestCosts

Sure, European stocks might narrow the valuation gap w/US stocks a bit, but true European exceptionalism isn’t happening. ft.com/content/012a...

Sure, European stocks might narrow the valuation gap w/US stocks a bit, but true European exceptionalism isn’t happening. ft.com/content/012a...

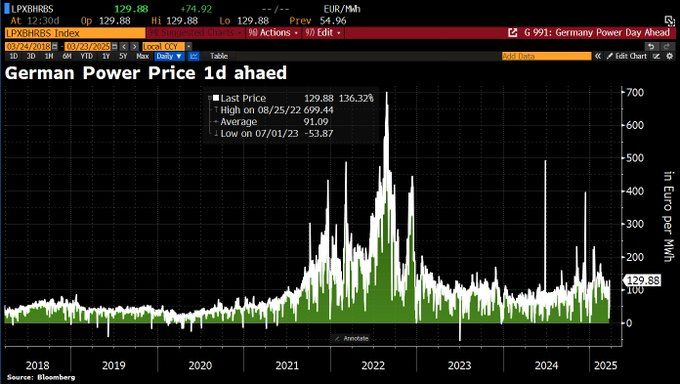

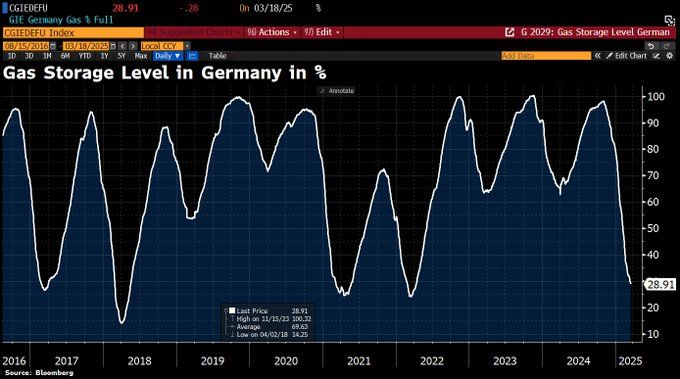

Trotz kritischer Lage sinken Spotpreise – dank EU-Zielanpassung & möglichem Gas-Rückfluss. 🎯 Neue Deadline: 1.12. (bedingt), Ziel bleibt 90% bis 1.11. 🏭 Haushalte & Industrie zahlen weiter Speicherumlage.

#Energiekrise #EUEnergie

Trotz kritischer Lage sinken Spotpreise – dank EU-Zielanpassung & möglichem Gas-Rückfluss. 🎯 Neue Deadline: 1.12. (bedingt), Ziel bleibt 90% bis 1.11. 🏭 Haushalte & Industrie zahlen weiter Speicherumlage.

#Energiekrise #EUEnergie