I know historic performance is no indicator for future performance. But if I look at the last 5 years VDIV has delivered ~110% while XACT Norden Högutelande is at ~50%.

I know historic performance is no indicator for future performance. But if I look at the last 5 years VDIV has delivered ~110% while XACT Norden Högutelande is at ~50%.

Sometimes you have ETFs with high direktavkastning but the top holdings are companies that I have never heard of.

If you look at the top 10 holdings for VDIV, it is all large & well known banks / pharma / energy etc.

Sometimes you have ETFs with high direktavkastning but the top holdings are companies that I have never heard of.

If you look at the top 10 holdings for VDIV, it is all large & well known banks / pharma / energy etc.

100 global companies and US weight is ~20%

Maybe too little US? I personally would want high US exposure for Tech, for Dividends like a good spread.

100 global companies and US weight is ~20%

Maybe too little US? I personally would want high US exposure for Tech, for Dividends like a good spread.

Source: justetf.com/en/etf-profi...

(My favorite website for finding and comparing ETFs)

Source: justetf.com/en/etf-profi...

(My favorite website for finding and comparing ETFs)

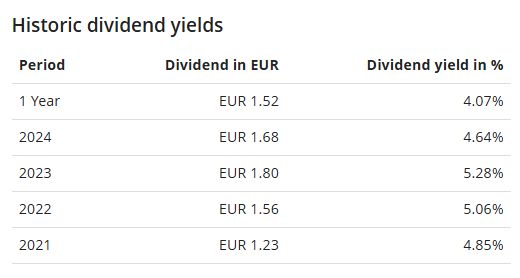

1. High direktavkastning (4%-5%) + quarterly dividend

2. Good global diversification (not US heavy)

3. Solid companies not just high direktavkastning

4. Strong historic performance (on top of dividends)

1. High direktavkastning (4%-5%) + quarterly dividend

2. Good global diversification (not US heavy)

3. Solid companies not just high direktavkastning

4. Strong historic performance (on top of dividends)

As always:

- Min Courtage: 1kr (vs often 10-20kr) 💸

- Low fee for valutaväxling: 0.19%

As always:

- Min Courtage: 1kr (vs often 10-20kr) 💸

- Low fee for valutaväxling: 0.19%