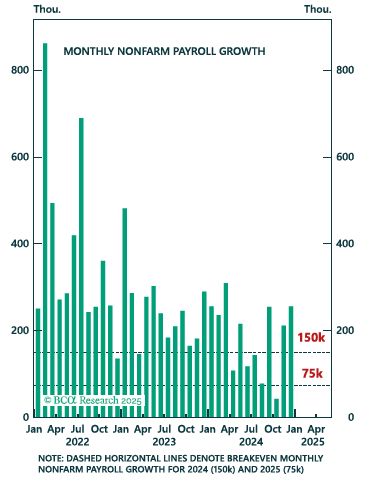

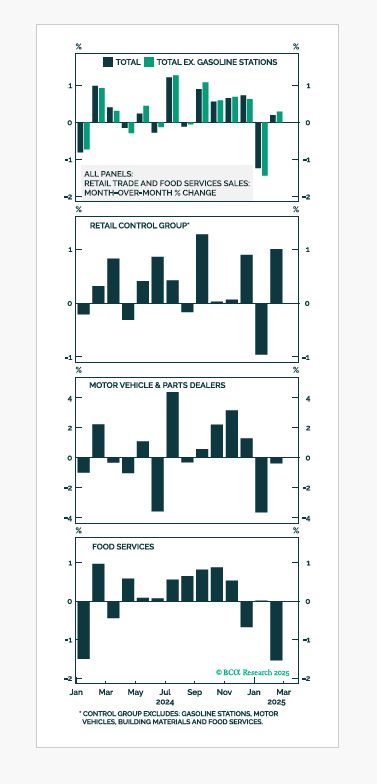

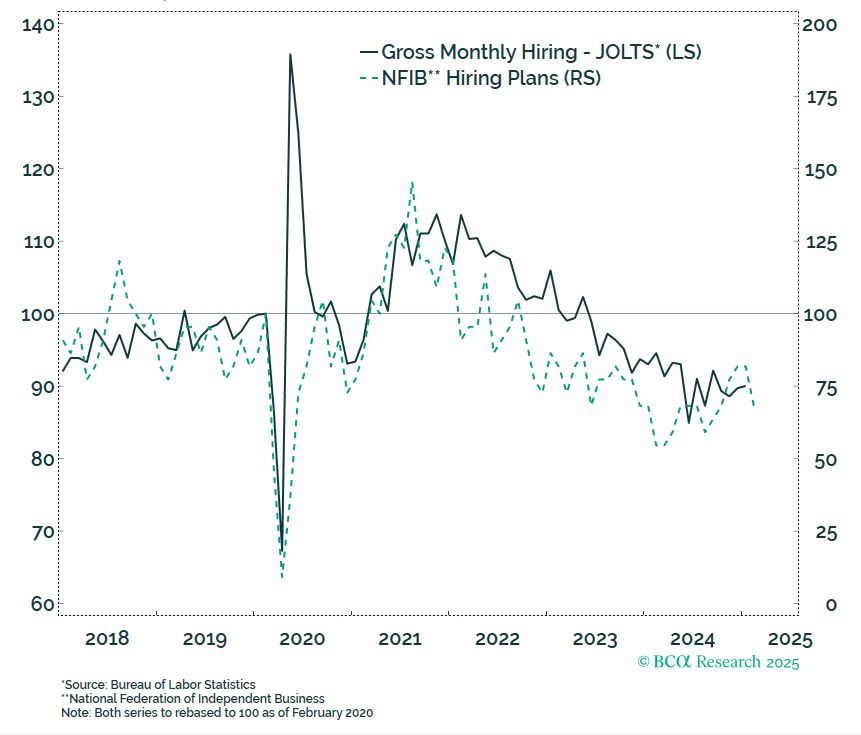

Still just February data, but all indications are that the US consumer is struggling. And this is before we even see an impact from tariffs. We'll get our first look at March data next week with vehicle sales on Tuesday and Payrolls on Friday.

Still just February data, but all indications are that the US consumer is struggling. And this is before we even see an impact from tariffs. We'll get our first look at March data next week with vehicle sales on Tuesday and Payrolls on Friday.

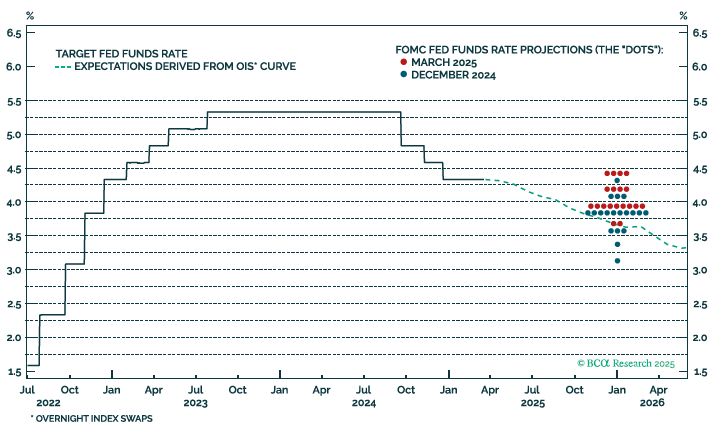

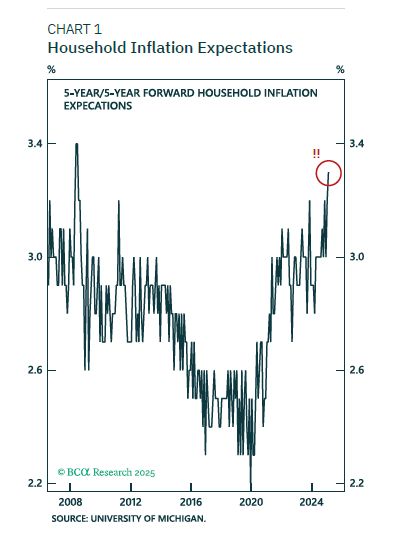

With inflation expectations as high as they are, I'm skeptical about the idea that the Fed will be cutting rates as tariffs cause CPI to jump.

With inflation expectations as high as they are, I'm skeptical about the idea that the Fed will be cutting rates as tariffs cause CPI to jump.

1) Does he give further insight into how the Fed is thinking about the economic impact of tariffs.

2) Does he shift forward guidance goalposts away from needing to see progress on inflation to needing to see labor market weakness.

1) Does he give further insight into how the Fed is thinking about the economic impact of tariffs.

2) Does he shift forward guidance goalposts away from needing to see progress on inflation to needing to see labor market weakness.