Richard Jones

@richardaljones.bsky.social

Retired, former Professor of Materials Physics and Innovation Policy, University of Manchester. Science & innovation policy, regional economic growth, polymer physics.

www.softmachines.org

www.softmachines.org

Should be a familiar story, but the rise of China, over just twenty years, as the world's dominant manufacturing superpower is an event of truly world-historical significance.

(This plot from @IfMCambridge's 2025 Innovation report)

www.ciip.group.cam.ac.uk/innovation/u...

(This plot from @IfMCambridge's 2025 Innovation report)

www.ciip.group.cam.ac.uk/innovation/u...

November 11, 2025 at 5:11 PM

Should be a familiar story, but the rise of China, over just twenty years, as the world's dominant manufacturing superpower is an event of truly world-historical significance.

(This plot from @IfMCambridge's 2025 Innovation report)

www.ciip.group.cam.ac.uk/innovation/u...

(This plot from @IfMCambridge's 2025 Innovation report)

www.ciip.group.cam.ac.uk/innovation/u...

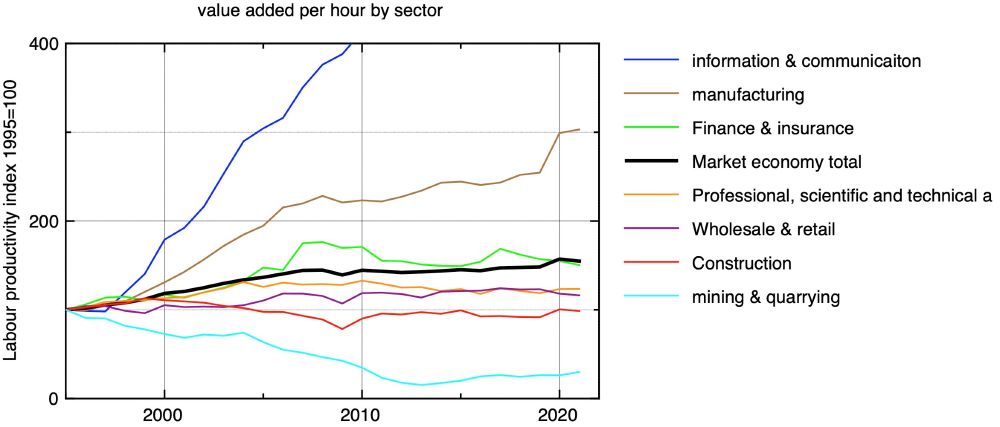

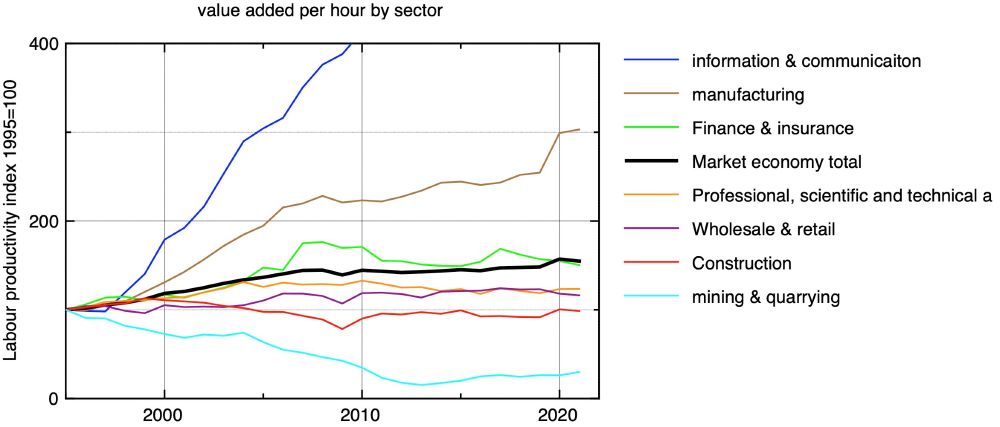

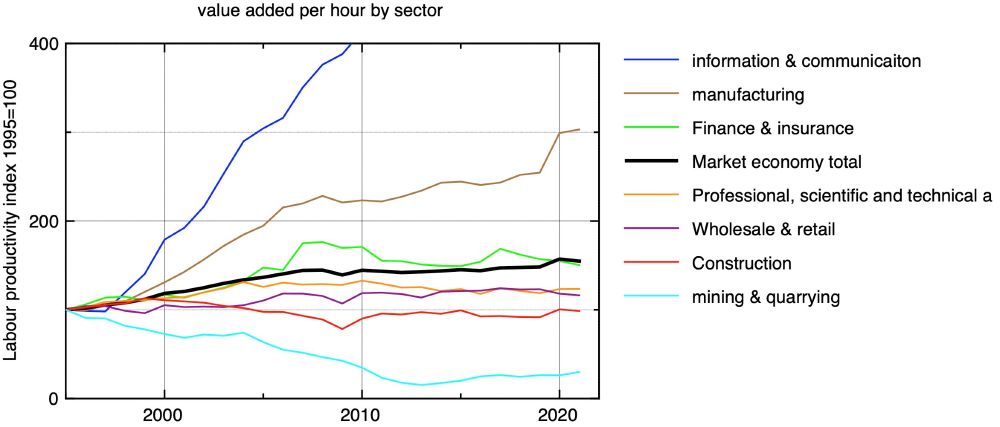

Preparations for November budget once again dominated by discussions of UK's dismal productivity performance, with a threatened OBR growth forecast downgrade.

Only two sectors showed any overall increase in total factor productivity between 1995 & 2020:

manufacturing, & information/communication

Only two sectors showed any overall increase in total factor productivity between 1995 & 2020:

manufacturing, & information/communication

November 10, 2025 at 9:18 AM

Preparations for November budget once again dominated by discussions of UK's dismal productivity performance, with a threatened OBR growth forecast downgrade.

Only two sectors showed any overall increase in total factor productivity between 1995 & 2020:

manufacturing, & information/communication

Only two sectors showed any overall increase in total factor productivity between 1995 & 2020:

manufacturing, & information/communication

Good post, and I think plausible to think an impressive focus on innovation led growth in LCR is bearing fruit.

I'd add, though, there are big differences in LCR across sub-regions, & the inclusion of Halton (really a bit of Cheshire!) makes a big difference...

I'd add, though, there are big differences in LCR across sub-regions, & the inclusion of Halton (really a bit of Cheshire!) makes a big difference...

November 6, 2025 at 10:13 AM

Good post, and I think plausible to think an impressive focus on innovation led growth in LCR is bearing fruit.

I'd add, though, there are big differences in LCR across sub-regions, & the inclusion of Halton (really a bit of Cheshire!) makes a big difference...

I'd add, though, there are big differences in LCR across sub-regions, & the inclusion of Halton (really a bit of Cheshire!) makes a big difference...

To state what should be painfully obvious, if you want to increase productivity in an environment that's close to full employment, you need fewer people working in hospitality, not more

October 9, 2025 at 9:20 AM

To state what should be painfully obvious, if you want to increase productivity in an environment that's close to full employment, you need fewer people working in hospitality, not more

The big decline in manufacturing GVA share was in the 90's & 2000's, stabilising thereafter. High FX rate probably a big part of that.

In terms of govt policy, I think Mandelson's "New Industry New Jobs" was a significant shift in rhetoric around manufacturing...

In terms of govt policy, I think Mandelson's "New Industry New Jobs" was a significant shift in rhetoric around manufacturing...

September 28, 2025 at 5:03 PM

The big decline in manufacturing GVA share was in the 90's & 2000's, stabilising thereafter. High FX rate probably a big part of that.

In terms of govt policy, I think Mandelson's "New Industry New Jobs" was a significant shift in rhetoric around manufacturing...

In terms of govt policy, I think Mandelson's "New Industry New Jobs" was a significant shift in rhetoric around manufacturing...

Since I have some TFP data to hand...

September 28, 2025 at 11:40 AM

Since I have some TFP data to hand...

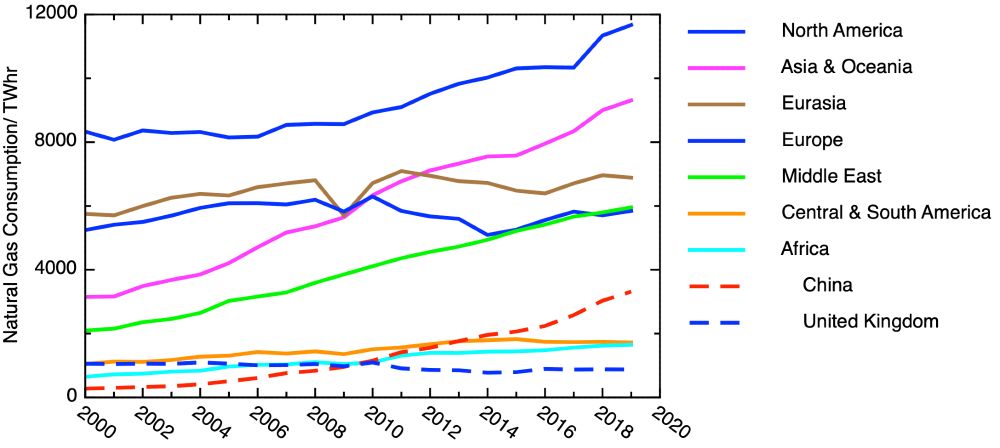

What sector of UK's market economy showed largest productivity fall since 1995?

Mining & quarrying (includes oil & gas). Shouldn't be a surprise, but too many forget how much the apparent success of UK economy in 80's & 90's due to North Sea oil & gas, & how much its decline since 2000 is a headwind

Mining & quarrying (includes oil & gas). Shouldn't be a surprise, but too many forget how much the apparent success of UK economy in 80's & 90's due to North Sea oil & gas, & how much its decline since 2000 is a headwind

September 28, 2025 at 7:49 AM

What sector of UK's market economy showed largest productivity fall since 1995?

Mining & quarrying (includes oil & gas). Shouldn't be a surprise, but too many forget how much the apparent success of UK economy in 80's & 90's due to North Sea oil & gas, & how much its decline since 2000 is a headwind

Mining & quarrying (includes oil & gas). Shouldn't be a surprise, but too many forget how much the apparent success of UK economy in 80's & 90's due to North Sea oil & gas, & how much its decline since 2000 is a headwind

What sub-sector of manufacturing showed the largest increase in productivity since 1995.

It's a relatively small one, but the answer surprised me!

It's a relatively small one, but the answer surprised me!

September 28, 2025 at 7:49 AM

What sub-sector of manufacturing showed the largest increase in productivity since 1995.

It's a relatively small one, but the answer surprised me!

It's a relatively small one, but the answer surprised me!

What sector of the UK's market economy showed the 2nd largest productivity growth since 1995?

Promoters of the importance of manufacturing in the economy won't be surprised, others might be...

Promoters of the importance of manufacturing in the economy won't be surprised, others might be...

September 28, 2025 at 7:49 AM

What sector of the UK's market economy showed the 2nd largest productivity growth since 1995?

Promoters of the importance of manufacturing in the economy won't be surprised, others might be...

Promoters of the importance of manufacturing in the economy won't be surprised, others might be...

What sector of the UK's market economy showed the largest productivity growth since 1995?

The answer probably won't surprise you...

The answer probably won't surprise you...

September 28, 2025 at 7:49 AM

What sector of the UK's market economy showed the largest productivity growth since 1995?

The answer probably won't surprise you...

The answer probably won't surprise you...

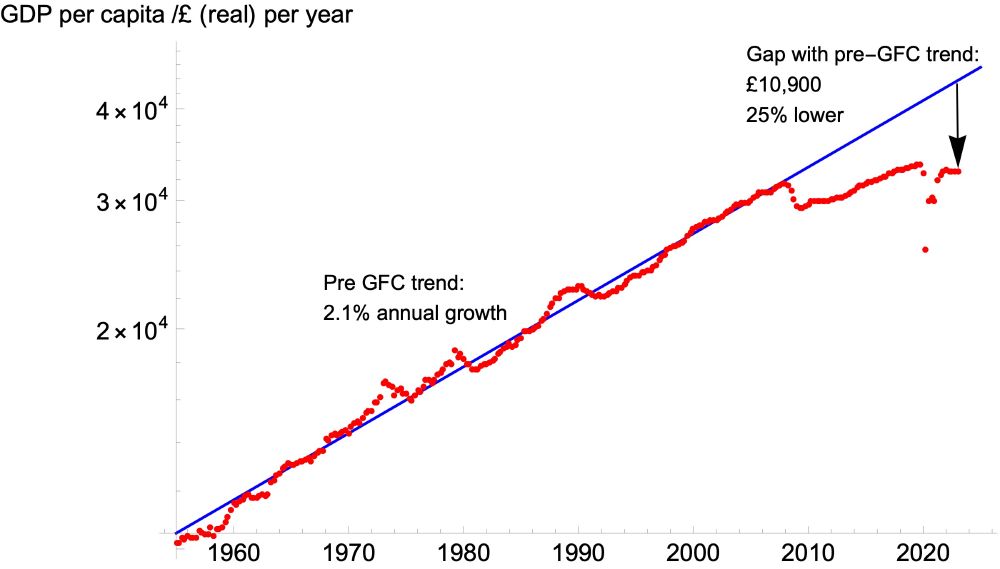

UK's fiscal difficulties arise, as much because we don't earn enough, as because govt spends too much.

Cause is the productivity slowdown - without that we'd all be 36% richer

Maybe there's something to learn from Greater Manchester's outperformance in productivity growth

Cause is the productivity slowdown - without that we'd all be 36% richer

Maybe there's something to learn from Greater Manchester's outperformance in productivity growth

September 27, 2025 at 7:34 AM

UK's fiscal difficulties arise, as much because we don't earn enough, as because govt spends too much.

Cause is the productivity slowdown - without that we'd all be 36% richer

Maybe there's something to learn from Greater Manchester's outperformance in productivity growth

Cause is the productivity slowdown - without that we'd all be 36% richer

Maybe there's something to learn from Greater Manchester's outperformance in productivity growth

Getting GDP growing again would work too, which needs a return to productivity growth.

There is a genuinely strong story to tell about GM's relative performance here (though still some way to go in absolute terms). It's by no means all down to AB, but he certainly appreciates its significance.

There is a genuinely strong story to tell about GM's relative performance here (though still some way to go in absolute terms). It's by no means all down to AB, but he certainly appreciates its significance.

September 25, 2025 at 10:01 AM

Getting GDP growing again would work too, which needs a return to productivity growth.

There is a genuinely strong story to tell about GM's relative performance here (though still some way to go in absolute terms). It's by no means all down to AB, but he certainly appreciates its significance.

There is a genuinely strong story to tell about GM's relative performance here (though still some way to go in absolute terms). It's by no means all down to AB, but he certainly appreciates its significance.

We should value manufacturing because it has delivered higher long term productivity growth than any other sector except ICT (more in high value subsectors like auto & aerospace, chemicals & pharma)

Corollary is that we should value manufacturing for the value it creates, not the numbers employed

Corollary is that we should value manufacturing for the value it creates, not the numbers employed

September 22, 2025 at 8:24 AM

We should value manufacturing because it has delivered higher long term productivity growth than any other sector except ICT (more in high value subsectors like auto & aerospace, chemicals & pharma)

Corollary is that we should value manufacturing for the value it creates, not the numbers employed

Corollary is that we should value manufacturing for the value it creates, not the numbers employed

Bit of a magical misty autumnal atmosphere in the birch woods & moors above Froggatt this morning

September 20, 2025 at 10:54 AM

Bit of a magical misty autumnal atmosphere in the birch woods & moors above Froggatt this morning

That all-important judgement- is G'=G'' yet?

Soft matter physics is everywhere - but especially making plum jam

Soft matter physics is everywhere - but especially making plum jam

August 31, 2025 at 1:56 PM

That all-important judgement- is G'=G'' yet?

Soft matter physics is everywhere - but especially making plum jam

Soft matter physics is everywhere - but especially making plum jam

Excited at arrival of this book - anyone who has followed Dan Wang's work will be expecting from it exceptional insights on China's recent economic growth, as well as on the importance of manufacturing and infrastructure for innovation and growth more generally

August 26, 2025 at 1:59 PM

Excited at arrival of this book - anyone who has followed Dan Wang's work will be expecting from it exceptional insights on China's recent economic growth, as well as on the importance of manufacturing and infrastructure for innovation and growth more generally

V good on long term effect of the 2008 global financial crisis - plausibly at root of pretty much everything that has gone wrong with our politics & economy, but importance under appreciated

"Events as dramatic as the 2008 crash don’t emerge from nowhere" - understanding its origins important too

"Events as dramatic as the 2008 crash don’t emerge from nowhere" - understanding its origins important too

August 26, 2025 at 1:53 PM

V good on long term effect of the 2008 global financial crisis - plausibly at root of pretty much everything that has gone wrong with our politics & economy, but importance under appreciated

"Events as dramatic as the 2008 crash don’t emerge from nowhere" - understanding its origins important too

"Events as dramatic as the 2008 crash don’t emerge from nowhere" - understanding its origins important too

Eyam, Derbyshire - plague memorial service at Cucklet Church. Hathersage Band accompanying.

August 24, 2025 at 2:45 PM

Eyam, Derbyshire - plague memorial service at Cucklet Church. Hathersage Band accompanying.

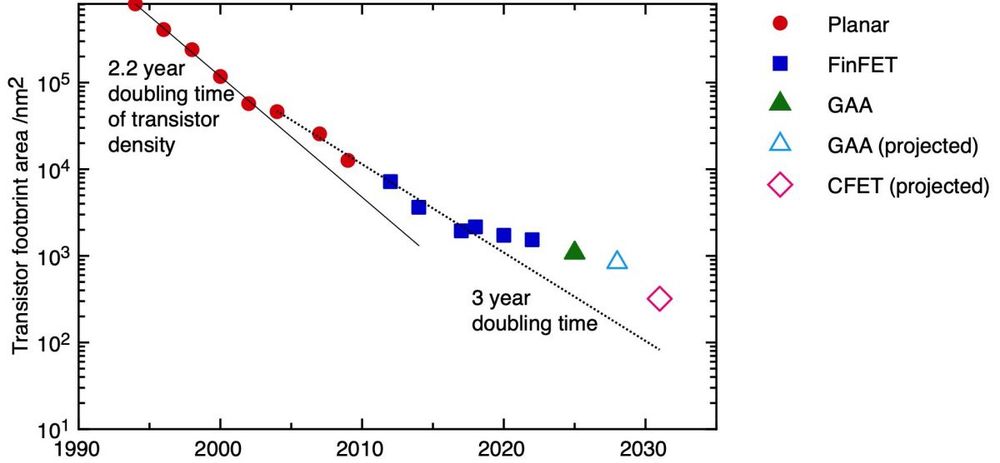

We’ve had 50 years in which the *supply* of computer power has been growing exponentially, and new tech has been developed that can exploit this supply.

We’re in a new world now; it’s *demand* for computer power from AI that is growing exponentially, at the moment when supply is stalling

We’re in a new world now; it’s *demand* for computer power from AI that is growing exponentially, at the moment when supply is stalling

August 15, 2025 at 7:31 AM

We’ve had 50 years in which the *supply* of computer power has been growing exponentially, and new tech has been developed that can exploit this supply.

We’re in a new world now; it’s *demand* for computer power from AI that is growing exponentially, at the moment when supply is stalling

We’re in a new world now; it’s *demand* for computer power from AI that is growing exponentially, at the moment when supply is stalling

Generative AI is 1st new tech marketed in post-Moore's Law era.

In previous decades, if new digital tech needed more or cheaper computing power to work & make economic sense, a few more years of Moore's law would solve.

But exponential growth in transistor density is stalling now...

In previous decades, if new digital tech needed more or cheaper computing power to work & make economic sense, a few more years of Moore's law would solve.

But exponential growth in transistor density is stalling now...

August 15, 2025 at 7:31 AM

Generative AI is 1st new tech marketed in post-Moore's Law era.

In previous decades, if new digital tech needed more or cheaper computing power to work & make economic sense, a few more years of Moore's law would solve.

But exponential growth in transistor density is stalling now...

In previous decades, if new digital tech needed more or cheaper computing power to work & make economic sense, a few more years of Moore's law would solve.

But exponential growth in transistor density is stalling now...

If we're looking for the source of our current economic woes, the plot makes clear the pivotal event was the late 2000s financial crisis

Understandable & correct to identify suboptimal & counterproductive fiscal, monetary & political responses since then, but they weren't the primary cause...

Understandable & correct to identify suboptimal & counterproductive fiscal, monetary & political responses since then, but they weren't the primary cause...

August 3, 2025 at 5:42 PM

If we're looking for the source of our current economic woes, the plot makes clear the pivotal event was the late 2000s financial crisis

Understandable & correct to identify suboptimal & counterproductive fiscal, monetary & political responses since then, but they weren't the primary cause...

Understandable & correct to identify suboptimal & counterproductive fiscal, monetary & political responses since then, but they weren't the primary cause...

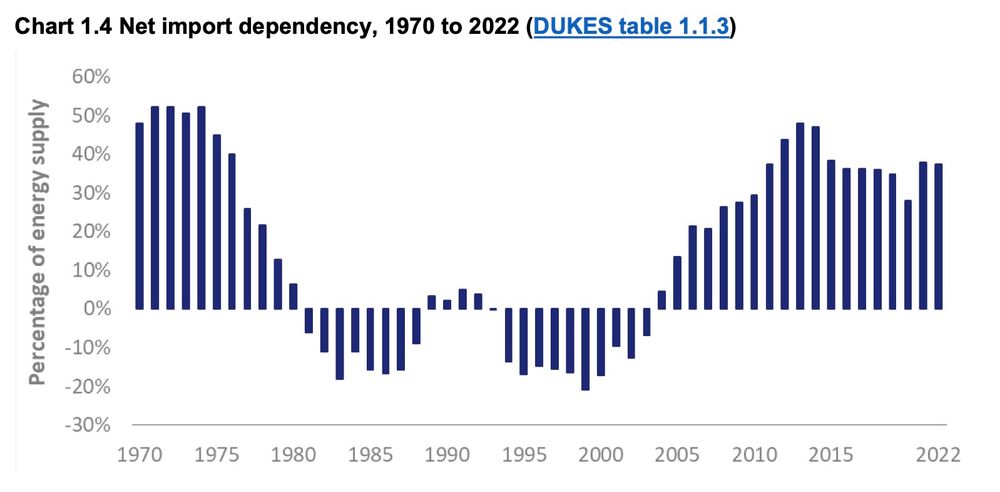

I understand the nostalgia for the days when North Sea oil & gas made the UK self-sufficient in energy, but those days are gone.

You can't run a prosperous industrial economy without affordable and secure energy; realism dictates we must adjust to the new reality.

You can't run a prosperous industrial economy without affordable and secure energy; realism dictates we must adjust to the new reality.

August 3, 2025 at 5:30 PM

I understand the nostalgia for the days when North Sea oil & gas made the UK self-sufficient in energy, but those days are gone.

You can't run a prosperous industrial economy without affordable and secure energy; realism dictates we must adjust to the new reality.

You can't run a prosperous industrial economy without affordable and secure energy; realism dictates we must adjust to the new reality.

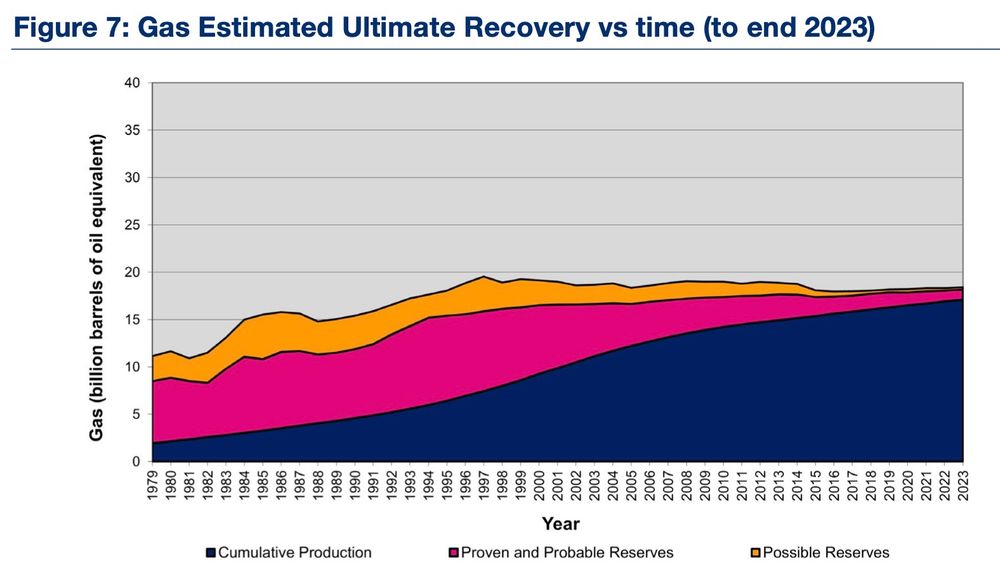

1. We can't be self-sufficient in gas, because we've pretty much used up the North Sea reserves. (Fracking? Might give us 4 or 5 bboe more but good luck with the planning permission).

2. Gas is internationally traded, UK production & consumption is too small to shift the market

2. Gas is internationally traded, UK production & consumption is too small to shift the market

August 3, 2025 at 5:30 PM

1. We can't be self-sufficient in gas, because we've pretty much used up the North Sea reserves. (Fracking? Might give us 4 or 5 bboe more but good luck with the planning permission).

2. Gas is internationally traded, UK production & consumption is too small to shift the market

2. Gas is internationally traded, UK production & consumption is too small to shift the market

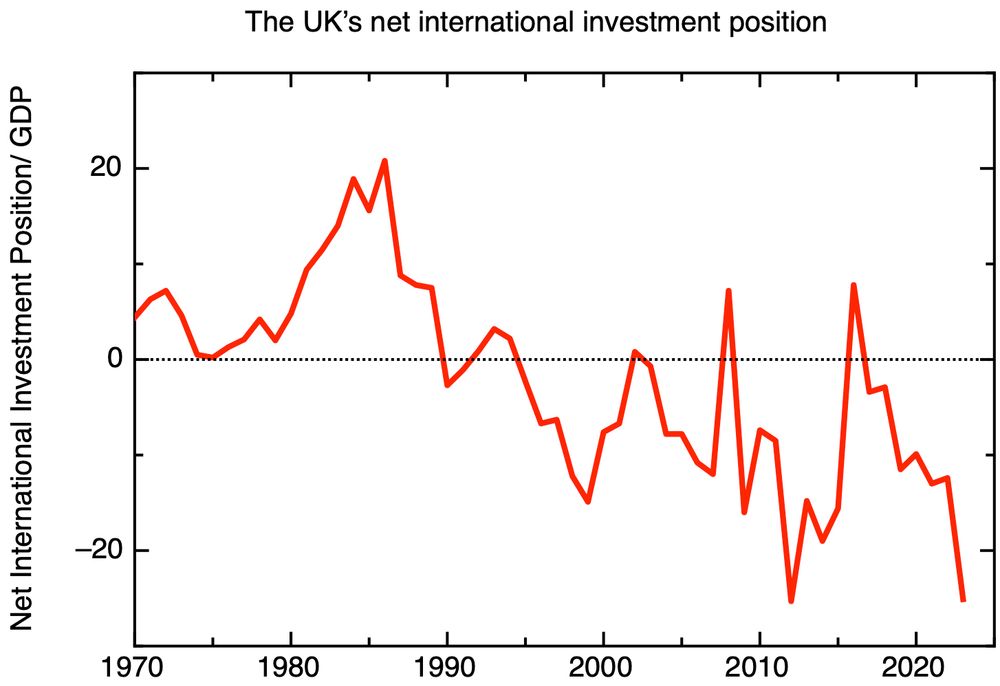

The result is that the UK has moved from being a net creditor nation to a net debtor nation - our net international investment position turned negative in the 90s.

August 1, 2025 at 8:58 AM

The result is that the UK has moved from being a net creditor nation to a net debtor nation - our net international investment position turned negative in the 90s.

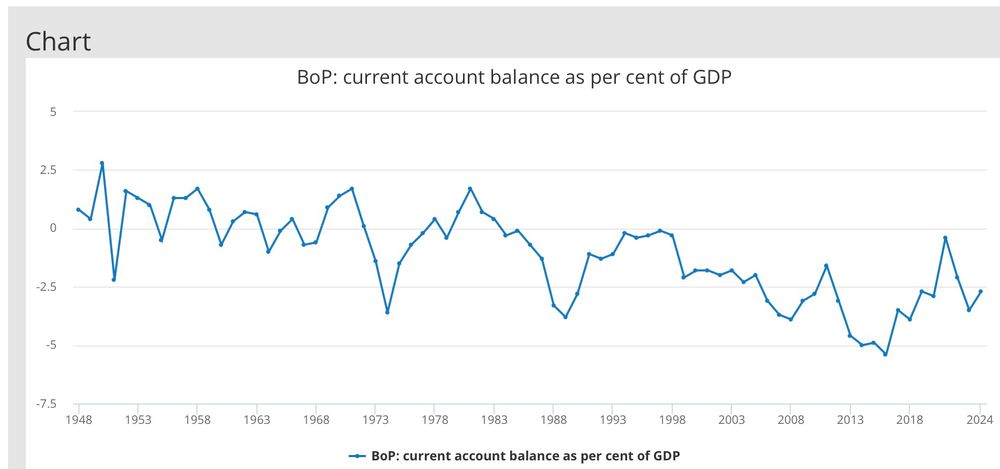

The UK's current account balance has been negative every year since 1983. We buy more from abroad than we sell, paying for the difference by selling assets:

Overseas acquisition of government debt, UK infrastructure & real estate, foreign acquisition of UK firms

Overseas acquisition of government debt, UK infrastructure & real estate, foreign acquisition of UK firms

August 1, 2025 at 8:58 AM

The UK's current account balance has been negative every year since 1983. We buy more from abroad than we sell, paying for the difference by selling assets:

Overseas acquisition of government debt, UK infrastructure & real estate, foreign acquisition of UK firms

Overseas acquisition of government debt, UK infrastructure & real estate, foreign acquisition of UK firms