Ralph Luetticke

@ralphluet.bsky.social

Professor of Economics at University of Tübingen

https://www.ralphluetticke.com/

https://www.ralphluetticke.com/

My stuff is not all open source and as nicely structured. But you can book me... ;)

March 26, 2025 at 3:33 PM

My stuff is not all open source and as nicely structured. But you can book me... ;)

Cosmin Ilut and Martin Schneider recently did a handbook chapter about ambiguity in macro and finance: www.sciencedirect.com/science/arti...

Ambiguity

We survey the literature on ambiguity with an emphasis on recent applications in macroeconomics and finance. Like risk, ambiguity leads to cautious be…

www.sciencedirect.com

January 4, 2025 at 9:09 AM

Cosmin Ilut and Martin Schneider recently did a handbook chapter about ambiguity in macro and finance: www.sciencedirect.com/science/arti...

We further exploit the tractability of ambiguity to study the importance of precautionary pricing of firms. So much to unpack!

Enjoy the holidays. : )

Enjoy the holidays. : )

December 26, 2024 at 3:54 PM

We further exploit the tractability of ambiguity to study the importance of precautionary pricing of firms. So much to unpack!

Enjoy the holidays. : )

Enjoy the holidays. : )

Our model can also explain averages better: Capital premium is 3.2% ambiguity + 2.3% illiquidity. Average wealth inequality is higher as well and there is a larger fraction of HtM households.

December 26, 2024 at 3:54 PM

Our model can also explain averages better: Capital premium is 3.2% ambiguity + 2.3% illiquidity. Average wealth inequality is higher as well and there is a larger fraction of HtM households.

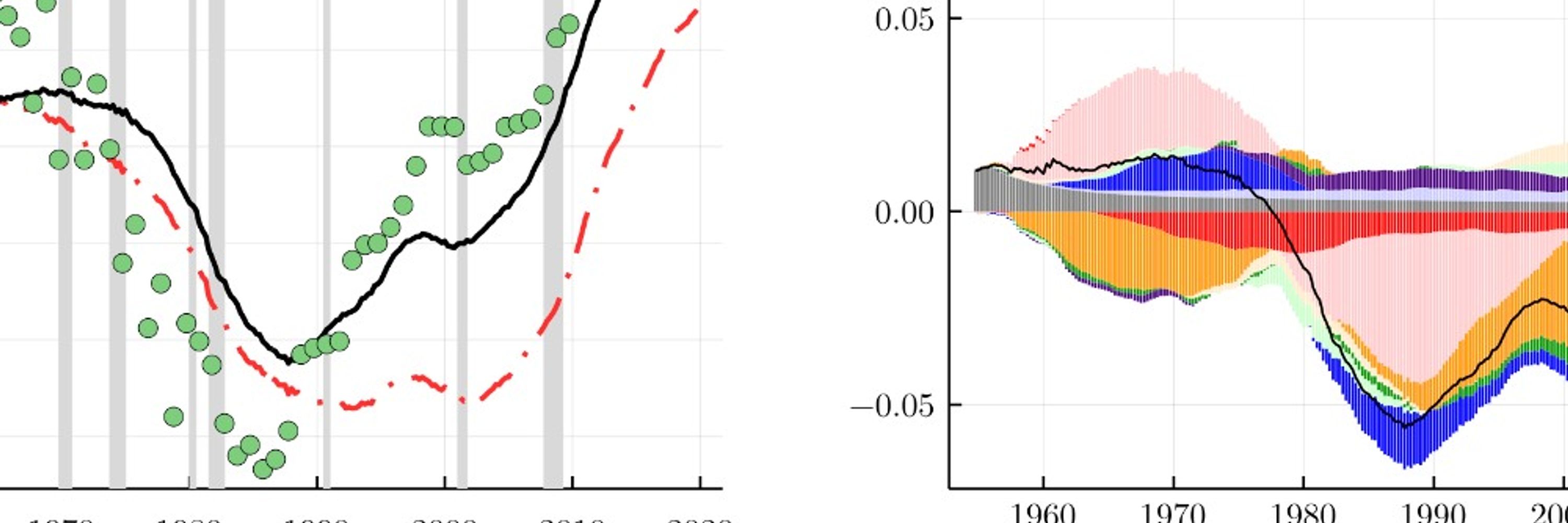

Ambiguity about TFP jointly explains more than 70% of the cyclical variation in key macroeconomic aggregates as well as in the excess return on capital and the real interest rate.

December 26, 2024 at 3:54 PM

Ambiguity about TFP jointly explains more than 70% of the cyclical variation in key macroeconomic aggregates as well as in the excess return on capital and the real interest rate.

Portfolio substitution by rich capital owners is crucial to fit investment and return dynamics. They worry about low dividends + trading frictions, very different from the rep.agent who mostly earns labor income. This leads to a greater fall in investment and asset prices.

December 26, 2024 at 3:54 PM

Portfolio substitution by rich capital owners is crucial to fit investment and return dynamics. They worry about low dividends + trading frictions, very different from the rep.agent who mostly earns labor income. This leads to a greater fall in investment and asset prices.

We exploit the tractability of ambiguity to fully estimate the effects of aggregate uncertainty on the ergodic distribution and dynamics of a 2-asset HANK model, while still using first-order perturbation techniques. We find a strong interaction of ambiguity with heterogeneity!

December 26, 2024 at 3:54 PM

We exploit the tractability of ambiguity to fully estimate the effects of aggregate uncertainty on the ergodic distribution and dynamics of a 2-asset HANK model, while still using first-order perturbation techniques. We find a strong interaction of ambiguity with heterogeneity!

Ana has consistently demonstrated her ability to solve complex models, derive intuitive closed-form expressions, and effectively connect these models with empirical data. That's the perfect skill set for a modern macroeconomist!

November 21, 2024 at 2:01 PM

Ana has consistently demonstrated her ability to solve complex models, derive intuitive closed-form expressions, and effectively connect these models with empirical data. That's the perfect skill set for a modern macroeconomist!

Ana has another completed paper on optimal fiscal policy within the New Keynesian network model, co-authored with my colleague Gernot Müller as well as two papers on precautionary household behavior in response to risk and its significance for the business cycle.

November 21, 2024 at 2:01 PM

Ana has another completed paper on optimal fiscal policy within the New Keynesian network model, co-authored with my colleague Gernot Müller as well as two papers on precautionary household behavior in response to risk and its significance for the business cycle.

Her JMP finds cost-push inflation to be twice as high once she introduces state-dep. pricing into NK network models. State-dep. price adjustments occur in 70% of US sectors and account for a substantial portion of price changes. Sectors with low price avg volatility matter most!

November 21, 2024 at 2:01 PM

Her JMP finds cost-push inflation to be twice as high once she introduces state-dep. pricing into NK network models. State-dep. price adjustments occur in 70% of US sectors and account for a substantial portion of price changes. Sectors with low price avg volatility matter most!

Was waiting for this list! Thanks Jonathan. Please add me as well.

November 17, 2024 at 12:10 PM

Was waiting for this list! Thanks Jonathan. Please add me as well.